You can prepare activity statements for your clients if you've set up your tax agent details, and your clients appear in MYOB Practice.

Activity statements can be added manually in MYOB Practice using the Add form button.

-

Check that the client has an ABN and/or TFN in their client details. All these details must match what's in ATO online.

-

An agent is linked to the client and are authorised to lodge activity statements or forms on behalf of your client.

-

If your client has an online AccountRight or Essentials file, you can link your client to their file on the Client files page.

Adding an activity statement

When you add an activity statement, we'll check for any outstanding activity statement obligations that your client has with the ATO. We'll then create and pre-fill the form with the details of the outstanding obligation (where available), including:

form type

branch code

period

lodgment due date

any pre-determined ATO instalments.

The fields that appear in the form will depend on the type of BAS form the ATO has requested. For information about the fields, you'll find in each section, see Data in activity statements - AU.

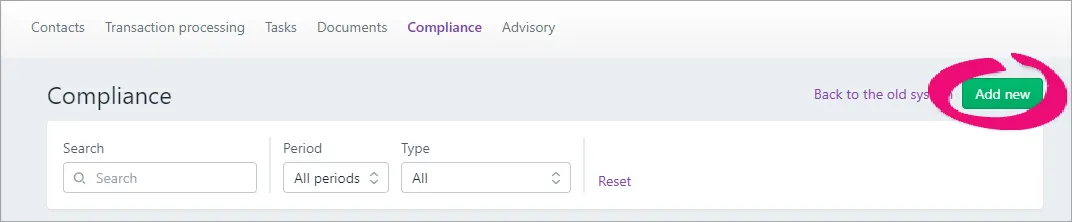

Click Compliance on the menu bar. The Compliance page appears.

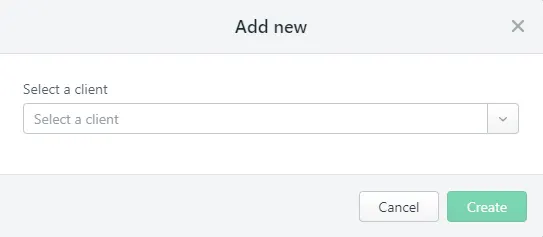

Click Add new on the top right of the page. The Add new window appears.

Select a client from the drop-down.

MYOB Practice checks against the ATO for outstanding activity statements and automatically pre-fills the details of the outstanding activity statement.

If you have multiple activity statements outstanding, select the Branch code and/or Period for the activity statement you want to create.

Click Create. The activity statement appears in the client's Compliance list. To open the activity statement, click it in the Compliance list.

To delete an activity statement (BAS and IAS only)

You can only delete BAS and IAS with the status:

-

Not started

-

In progress

-

In review

-

Fail to load.

On the Compliance page, find the BAS or IAS that you want to delete.

Click the ellipsis icon (...) and choose Delete. The message "Are you sure you want to delete this form and all its content?" appears.

Click Delete.