Journals

For taxation assets, the report lists all the journals and the associated amounts that are mapped to assets in an asset class.

The report is divided into:General and immediate deductible assets

(Australia) Small business pool assets

(Australia) Low-value pool assets.

For accounting assets, assets and asset transactions included in the report must belong to an asset register set up for accounting depreciation. In Australia, none of these assets can belong to a pool. The report distinguishes between general and immediate deductible assets.

For each account with a non-zero balance the report lists:Account code (listed in ascending order)

Description (the name of the account)

Debits

Credits.

Account balances for each account are derived as:

Debits (positive amounts) | Credits (negative amounts) |

|---|---|

Depreciation | Accumulated depreciation |

Private use balance sheet a/c | Private use profit & loss a/c |

Realisation | Profit on sale |

Loss on sale | Cost for all the sold assets |

Tax schedule

The tax schedule lists all taxation assets in an asset register that are Taxation only or Accounting and taxation. (Australia) There's a summary of all assets in the small business pool and the low-value pool.

Accounting schedule

The accounting schedule lists all accounting assets in the asset register.

For each asset the report lists:

Asset code

Asset description

Acquisition date

Private use %

Original cost

Depreciation %

Disposal value

Method

Original cost

Opening w.d.v

Profit (loss on sale)

Closing written down value

(Australia) YTD

(New Zealand) YTD Depn.

The report lists totals for:

Original cost

Opening written down value

Assessable

Deductible

Closing written down value

(Australia) YTD

(New Zealand) YTD Depn.

The report lists the assessable (profit) or deductible (loss):

If the termination value is more than the closing asset value (CAV) the assessable (profit) = termination value – CAV

If the termination value is less than the closing asset value (CAV) the deductible (loss) = CAV – termination value.

Additions and disposals

This report lists assets that were acquired and/or disposed of during the current financial year by the asset class. It provides:

Asset code

Accounting acquisition date

Disposal date

Termination value.

The data displayed depends on the asset register settings. If the setting is:

Accounting and taxation, both sections are displayed and the information is based on the accounting acquisition date

Accounting only, only accounting details are displayed and the information is based on the accounting acquisition date

Taxation only, only taxation details are displayed and the information is based on the taxation acquisition date.

For accounting assets:

Original cost: the amount is only displayed where the accounting acquisition date is not in the current year, otherwise you'll see a nil amount

Profit or loss on sale: If there's a loss on a sale, the amount displays with brackets. If there's a profit on a sale, the amount displays without brackets.

For taxation assets:

(Australia) The taxation details are left blank for assets in a low-value pool or small business pools.

Original cost: displays the taxation original cost and any additional expenditure. The amount only displays if the accounting acquisition date is not in the current year, otherwise, you'll see a nil amount.

Profit or loss on sale: If there's a loss on a sale, the amount displays with brackets. If there's a profit on a sale, the amount displays without brackets.

Low value pool schedule

The low-value pool schedule report lists all assets in the low-value pool.

To print a simplified version of this report for clients, select Is client summary?

Small business pool schedule

The small business pool schedule report lists all assets in the small business pool.

To print a simplified version of this report for clients, select Is client summary?

Full schedule

The Full schedule report lists the depreciation details for both accounting and taxation purposes for all assets by asset control groups and (Australia) pools.

It includes:

Asset code:

Followed by any applicable indicators (*) as described in the report.Asset description.

Private use percentage.

Acquisition/disposal date:

If integration is for accounting, it displays the accounting acquisition date.

If not, it either displays the taxation acquisition date or the disposal date for assets disposed of in the current year.Original cost.

Additions or disposals:

For an asset disposed of in the current year, this is the difference between the Accounting original cost and the consideration amount if the asset's Accounting acquisition date is in the current year. if not it displays the consideration amount.

Accounting

Opening written-down value.

Depreciation method.

Year-to-date depreciation.

Closing written-down value.

Taxation

Opening adjustable value.

Decline in value method or effective life.

Year-to-date decline (this is the taxation depreciation amount).

Closing adjustable value.

(Australia) Pool details

We'll only display the details of the pool if one of the balances is not zero. In other words, we won't display details of a specific pool if it's not set up, or if all the balances are zero.

Details of a pool are always shown for the whole of the year.

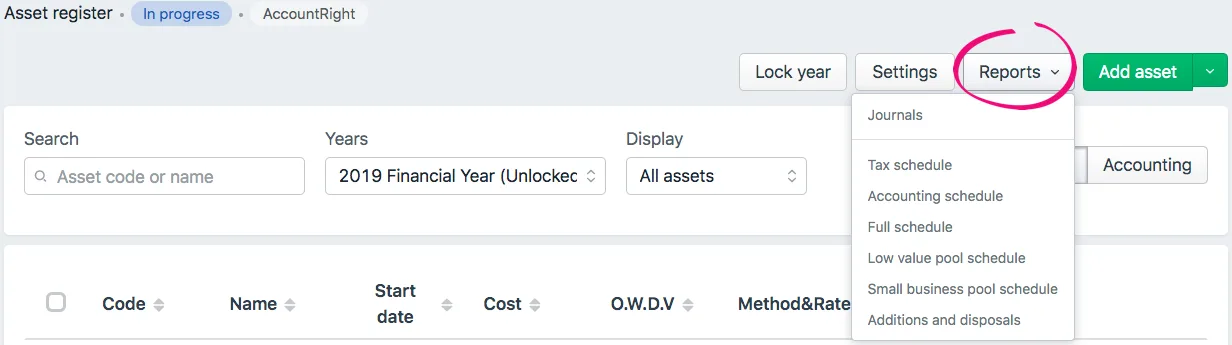

Open the Assets Listing page. See Opening an asset year.

To generate a report

Click Reports on the toolbar.

Select the report that you want to view.

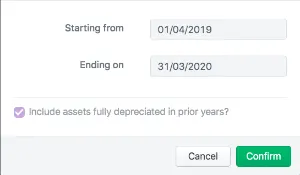

Enter the date range for the report.

Click Confirm.