This information only applies if you have both MYOB Practice and MYOB AE/AO.

MYOB’s new compliance tools are starting to become available online. However, many practices will continue to use desktop software for portions of their work, and in particular, for their document management capabilities.

This article describes the best practice for MYOB Document Manager customers to ensure that the practice can maintain a single source of truth and make the most of their Document Manager features.

Background

Historically, MYOB Practice software was deployed and managed in the practices’ own facilities. This enabled tight integration between the Document Manager software and the AE/AO software but required the practice to manage updates and manage costly infrastructure.

With the move to online compliance, software updates are automatically applied and practices can be the transition away from costly infrastructure.

However, MYOB’s online replacement for the desktop document manager software is not yet available, and the online software does not integrate directly with the desktop Document Manager due to security and technical concerns.

The following is the best practice to make the most of your desktop document manager software and the efficiency of the online compliance tools.

Best practice

For users of the MYOB Document Manager software, we recommend that the desktop software remains as the single source of truth for your documents and the best method for sharing documents with your clients via the Client Portal (retaining the icons in which you can tell if published to portal and signed, etc.)

Workflow for Document Manager sites

Follow the steps below on how to use Document Manager in AE/AO with MYOB Practice.

Downloading the document from MYOB Practice (Compliance, Corp admin)

See To download a document from Corporate Admin, click the ellipses at the end of a line and select Download documents. A PDF copy of the tax statement or tax return save to the default Downloads location.

Sharing the document in MYOB Document Manager. You can share single or multiple documents into MYOB Document Manager.

To share a single document, see Publishing a document to a portal using Share It.

To share multiple documents:

Log in to MYOB AE/AO and go to the client you want to upload the document for.

Select the Documents tab.

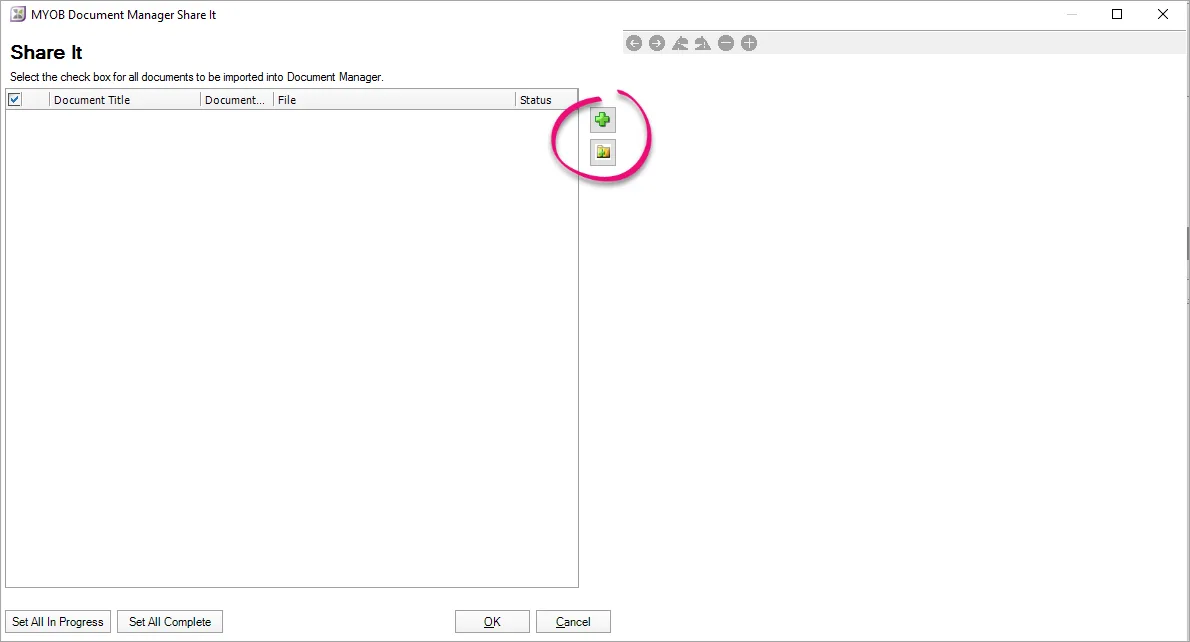

Select Import document on the Tasks bar. The MYOB Document Manager Share It window opens.

To import one or more selected documents:

Select the plus () to import multiple documents. In the Open window, select the documents you want to import and click Open.

To import all documents in a folder, select the folder (). In the Browse For Folder window, select the folder and click OK.

The selected document(s) are listed in the Document Manager Share It window.

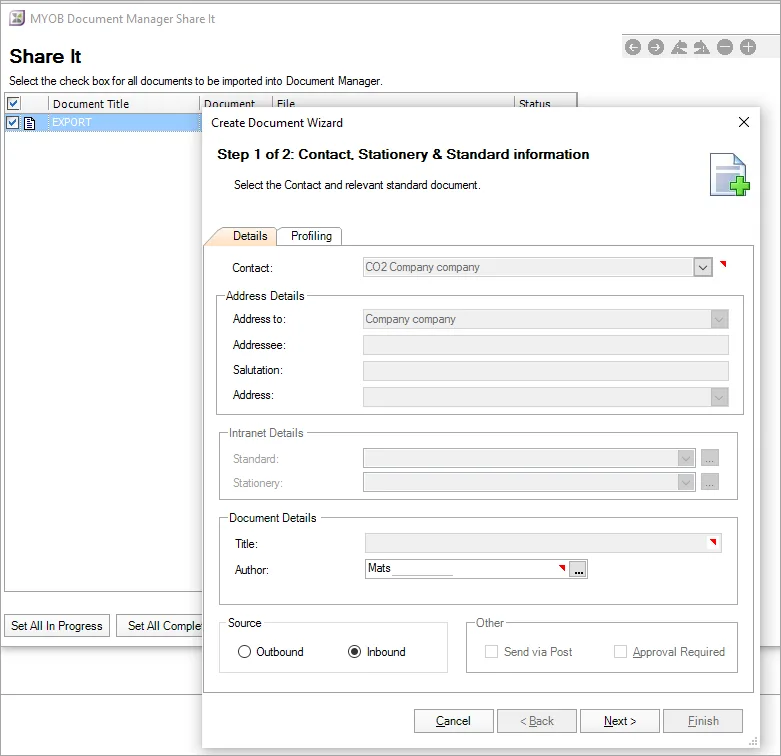

Click OK. The Create Document Wizard opens.

Complete the details for the document(s).

After you've imported the document, you can choose to publish it to the client portal.