You may need to amend your tax return if you have made a mistake, forgotten to add items like a deduction or an offset, or if something has changed after you've lodged your tax return.

You can amend an individual tax return from 2022 onwards. Creating an amendment for other return types is coming soon.

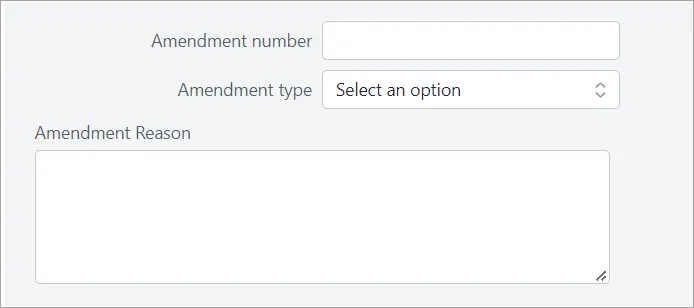

Amending a tax return allows you to describe the reasons for the amendment, and the amendment type (ATO error or Tax Payer error) and indicates the amendment number (1-9). A maximum of nine amendments may be lodged electronically in any tax year for each tax return i.e. the first amendment, and up to eight subsequent amendments

To amend a tax return

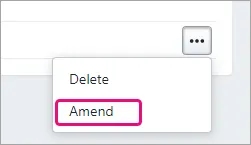

At the end of the tax return that you want to amend, click the ellipses and select Amend.

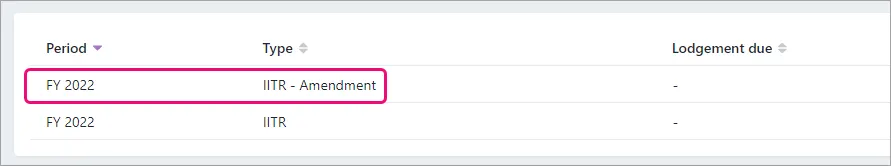

This will create another return (IITR - Amendment) in the Compliance page and the Individual tax return – Amendment opens.

We'll copy the data from the previously lodged return into the amendment. For example, if you're amending for the first time, we'll copy the data from the original return if in Lodged status.

Go to the question Is this an amendment? and select Yes. You can find this question below the Date of Birth field.

Enter an Amendment number. You can only enter between 1-9 as a maximum of only 9 amendments are allowed in a tax return.

Select ATO error or Tax payer error at Amendment type.

Enter a reason for the amendment.

Drag the right side corner to make the box bigger.

FAQs

How do I amend a tax return that was not lodged by me?

Create a tax return using the Add new button in MYOB Practice and, optionally, enter the details of the original return that was lodged to the ATO.You can't manually change the status of the original return to Lodged. While we're working on editing the status manually, you can create an amendment on a return that has an In progress status. You're also able to delete an In progress original return.

If you amend a tax return in practice, will the status show in AE/AO?

We're working on integrating the status back into AE/AO.