To enter data into the deduction labels in an Individual tax return, you need to complete the Deduction schedule. The deduction schedule allows you to provide more information on deductions being claimed by your clients. See Claiming deductions on the ATO website.

After you've entered data into the Deduction schedule, this will integrate into the respective deductions labels in the tax return.

To complete the Deductions schedule

From the Tax workpapers and schedules drop-down, type Deduction or select Deduction schedule from the list. The deductions schedule opens in a new browser tab

Enter the details in the deductions labels. The Deductions amount will appear on the main label of the tax return.

Click the purple amount to open the deductions schedule in a new browser tab.

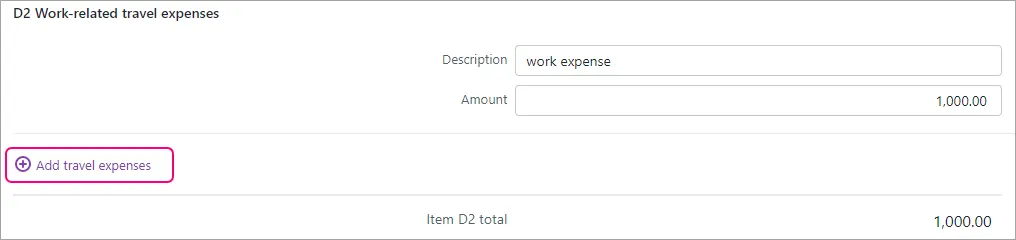

To add a new record, select Add.

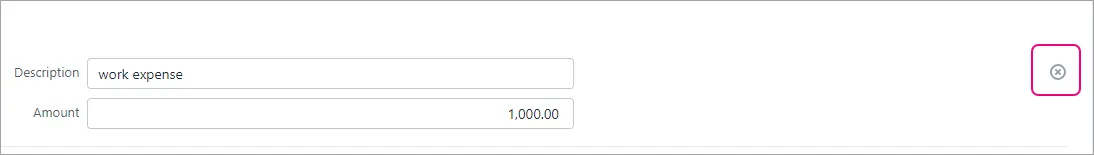

To delete a record, select the grey cross at the end of the record.

The Deductions amount will appear on the main label of the tax return.

The motor vehicle expenses schedule and integrate it into the relevant Deductions labels such as D1, D2, D5, etc.

To complete a motor vehicle schedule (mve)

Open the tax return.

From the Tax workpapers and schedules drop-down, type Motor vehicle expenses or select Motor vehicle expenses from the list. The Motor vehicle expenses worksheet opens in a new browser tab.

Enter the details in:

the motor vehicle details

Method 1 - cents per kilometer method

Method 2 - logbook method

Fuel costs estimator.

Motor vehicle expenses. Enter the depreciation amount from the Assets tile.

In the Calculation method, we'll automatically calculate the Deductible amount.

The Total deductible amount will show higher amount of depreciation, which is best for the taxpayer.

In the Want to override the selected method? question, select Yes if you want to override the default method.

In the Allocation of expenses section, enter the % allocated for the deduction label you want to allocate to.

Once you've allocated the expenses, the amounts will appear in the Deductions schedule.

The motor vehicle expenses schedule doesn't get transmitted to the ATO.