You can delete an activity statement or tax return from MYOB Practice.

For tax returns, deleting in MYOB Practice will make the tax return available in AE/AO, but without any of the data or workpapers. You can either continue working in AE/AO or migrate the return across to MYOB Practice again.

For activity statements, this gives you the option to create a new activity statement in MYOB AE/AO instead, or to create it again in MYOB Practice.

Before deleting a tax return

-

The tax return status must be Not started or In progress.

-

Deleting a tax return deletes all the data in the return, including any workpapers.

-

You can delete a tax return for a client if that client only has one tax return that's been moved online to MYOB Practice.

To delete a tax return

In MYOB Practice, from the client sidebar, select the client for whom you want to delete the tax return.

On the top menu bar, click Compliance.

Click the ellipsis button on the right of the tax return, and select Delete.

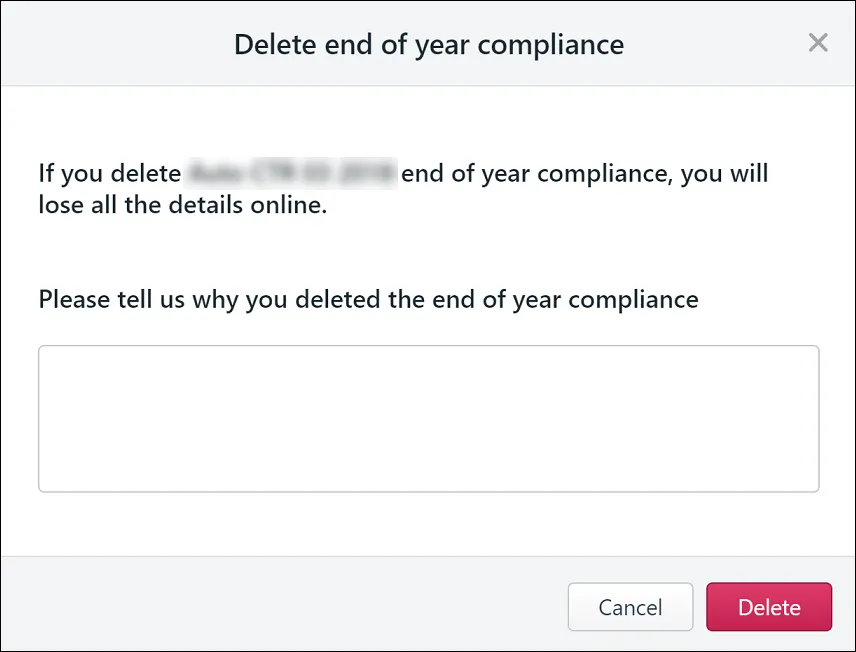

In the Delete end of year compliance window, let us know why you want to rollback the tax return to AE/AO.

We'd like to know why you rolled back your tax return to AE/AO. Tell us; we're listening!

Select Delete.

As shown in the success message window, go to AE/AO and select the refresh button () to start working on the tax return in AE/AO.