You can add 2 types of pools in Assets: low-value pool and small business entity (SBE).

Low value pool

You can add depreciating assets that have GST credits or adjustment costs, or have an adjustable opening value / written down value of less than $20,000 to a low-value pool and depreciate them at the relevant pool rate.

When first adding assets to the low-value pool, they depreciate at a rate of 18.75% for the current year. For subsequent years it's 37.5%

We'll use these rates regardless of when you allocate the asset to the pool during the year.

We'll calculate the decline in value of an asset that you hold jointly with others. It's based on the cost of your interest in the asset.

This means that you can allocate your interest in the asset to your low-value pool if:

you hold an asset jointly

the cost of your interest in the asset or the opening adjustable value of your interest is below $20,000.

When allocating an asset to the pool, estimate the private use percentage for:

its effective life (for a low-cost asset)

its effective remaining life at the start of the income year (for a low-value asset).

This percentage is for tax purposes to write-off the asset.

If you create a low-value pool and allocate a low-cost asset to it, you must pool all other low-cost assets that start in that income year and later years. This rule doesn't apply to low-value assets.

Small business entity (SBE)

Simplified depreciation rules

You can choose to use the simplified depreciation rules if you're a small business entity with an aggregated turnover of less than:

$10 million from 1 July 2016 onwards

$2 million for previous income years.

See Simpler depreciation for small business on the ATO website for more information.

The simplified depreciation rules are an alternative way to the uniform capital allowances method of calculating depreciation.

If you use the simplified depreciation rules, you can add certain assets to a small business pool.

If you choose to use the simplified depreciation rules, you must apply them to all the assets that the rules apply to.

On 6 October 2020, as part of the 2020–21 Budget, under the JobMaker Plan, the Government announced it will support businesses and encourage new investment, through a Temporary Full Expensing (TFE) incentive. This measure is now law.

TFE is available for new assets and the Small Business Pool. TFE will be applied for the SBE pool, as is mandatory, when the upcoming year-end is between 7:30pm AEDT 6 October 2020 and 30 June 2022.

Accelerated depreciation rules

In March 2020, the ATO introduced an option for you to deduct the cost of depreciating assets at an accelerated rate. This is an incentive to businesses with an aggregated turnover of less than $500 million for the 2019–20 and 2020–21 income years.

This applies to taxation only, not accounting.

The accelerated rate isn't applied automatically; you need to decide if you're eligible for the rate and apply it yourself.

If you choose to use the accelerated depreciation rate, the following rules will apply to the asset:

The asset will be added to the general small business pool.

In the year that you add the asset to the pool, depreciation will be deducted at 57.5%, rather than 15% of the business portion of the new asset.

In later years, the asset will be depreciated as part of the general small business pool rules, at 30%.

These changes are part of the ATO's Covid-19 response. To ensure you see the latest rules and details about eligibility criteria, check Backing business investment – accelerated depreciation on the ATO website.

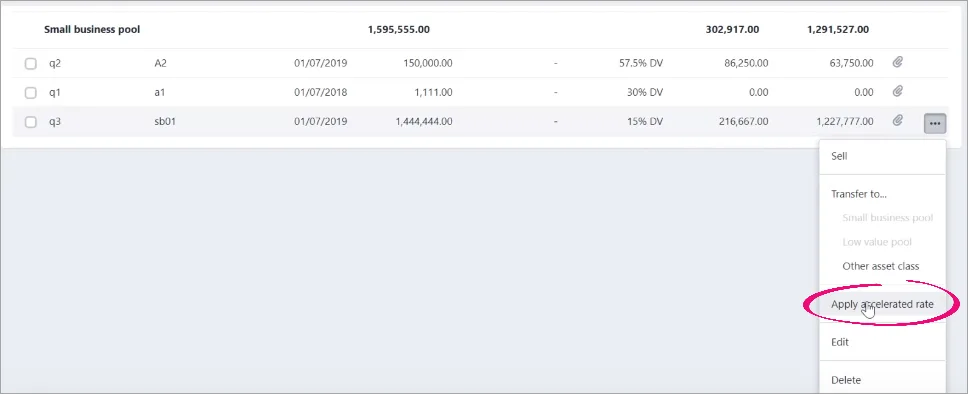

To apply an accelerated depreciation rate

On the Assets page, click Taxation on the top right.

Select 2020 or 2021 from the Years filter option.

Click the ellipsis to the right of an eligible small business pool asset, and choose Apply accelerated rate.

The rate and calculations displayed are updated.

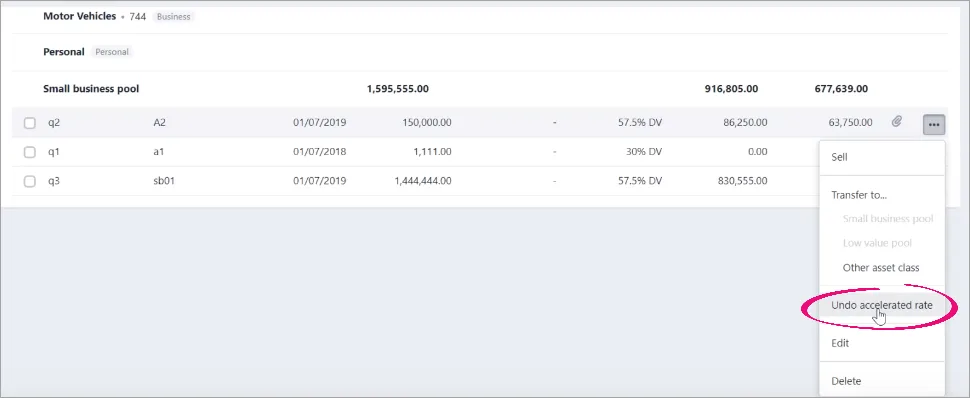

To undo an accelerated depreciation rate

On the Assets page, click Taxation on the top right.

Select 2020 or 2021 from the Years filter option.

Click the ellipsis to the right of the asset, and choose Undo accelerated rate.

The rate and calculations displayed are updated.

To apply Temporary full expensing (TFE)

FE will be applied for the SBE pool, as mandatory, if the asset is installed/used between 7:30 pm AEDT 6 October 2020 and 30 June 2022.

To apply TFE for an eligible new asset:

Add a new asset.

In the Taxation section, select Temporary full expensing.

TFE is mandatory for eligible assets in the Small Business pool.

For new assets that are not in the pool, you can choose the TFE when adding the asset.

For SBE pool assets not eligible for temporary full expensing and instant write-off, eligible businesses can apply for accelerated depreciation. With accelerated depreciation, you can 57.5% (rather than 15%) of the business portion of a new depreciating asset in the year it's added to the pool.

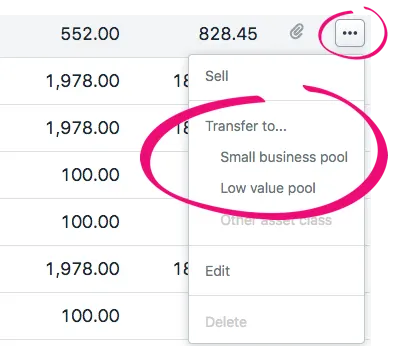

Pooling an asset

In the Assets list, click the ellipsis and select Small business pool or Low value pool.

You can't transfer a personal asset class to a pool.

The only way to achieve this is to change it to a business asset class (by allocating it to an account in your ledger), and then you can transfer it.

You can bulk-transfer multiple assets to another pool by selecting two or more assets in the listing and select Transfer to Small business pool or Transfer to Low value pool.

To undo a transfer to pool

In the Assets list, click the ellipsis and select Original asset class. This transfers the asset back to its original general asset class.

Transfer to... Original asset class appears in the drop-down for a transferred asset created in any previous year.