Work together with your clients

The portal in MYOB Practice is a secure online space to collaborate and interact with your clients.

Share documents with your client so they can comment on and approve the documents. (Digital signatures). These can be tax returns or activity statements that might need their approval.

Assign tasks to your client with instructions and they'll receive an email immediately for further action.

Add and restrict users who can have full access or just contributors.

Each client has their own portal in MYOB Practice and you can personalise the web address for each of your clients.

Start setting up portals

If you're new to portal, set up your default portal options for your practice.

Create client portals and select the users.

Start collaborating with your clients.

Examples

The following examples will give you some ideas on how you can set up portals for different types of clients.

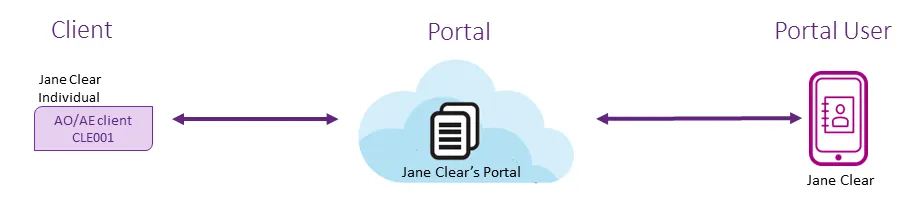

Example 1 - Individual

Jane Clear is an individual for whom you prepare an annual tax return and provide some financial planning advice.

In MYOB Practice, you would create a portal with Jane as the sole user.

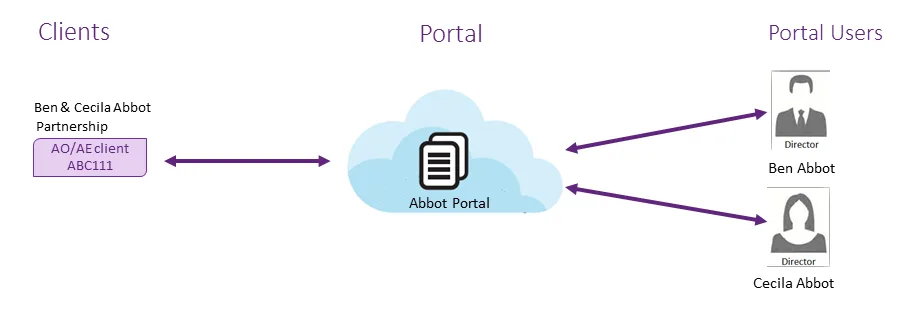

Example 2 - Partnership

Ben and Cecila Abbot, a married couple, operate a business as a partnership.

Each are familiar with the financial situation of the partnership and each other's financial details.

As their accountant, you would set up a client portal for their partnership, Abbot Portal, with both Ben and Cecila as portal users.

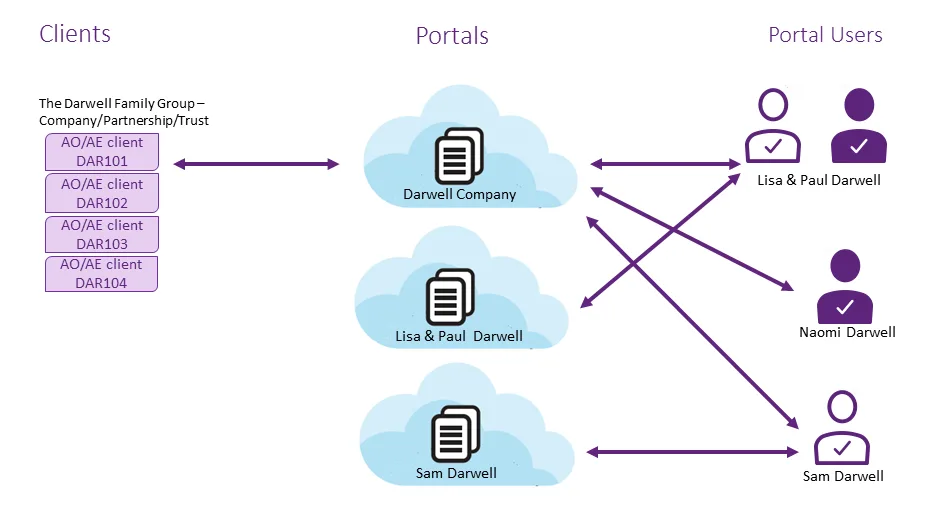

Example 3 - Family group

The Darwell Family Group consists of 4 members - Lisa (Mum), Paul (Dad) and 2 children, Sam and Naomi.

All in the family group are part of the Darwell Company.

Sam generates an independent income and has other assets apart from the company.

Naomi is still a minor and has no independent income.

When you're thinking about setting up portals for the Darwell Family, you could set up:

a client portal with all the members of the family group for the company

a separate portal for mum and dad, for their tax and accounting needs

a portal for Sam so that his tax and accounting requirements are kept separate from the rest of the family group.

Therefore, for the Darwell Family Group, 3 client portals could be created.

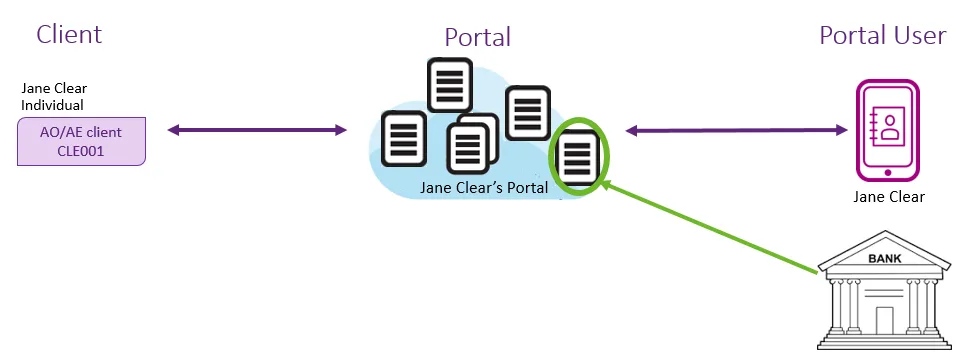

Example 4 - Contributors

Jane is refinancing her business loan and her bank has requested that she provide them with a number of documents in order to secure the loan.

As her accountant, you're able to add the bank as a contributor to Jane's portal so that they can access the documents that they need. The bank won't have access to the whole portal, only to the documents that you share with them.

This will save you time and resources in photocopying the documents and mailing them to the bank; and the bank can access the documents immediately speeding up the loan process.

Helping your clients with portal

To help your clients understand and use the portal see Help for your clients or Watch this video.