Asset register in the browser only.

When moving a tax return from AE/AO to Practice, you can import the depreciation assets into the assets register in MYOB Practice.

Asset class is nothing but Group in AE/AO.

Key points

-

This feature is available from 2021 Individual tax returns.

-

You can only do Taxation depreciation and not Accounting depreciation.

-

You'll need to manually enter the depreciation values from assets into the tax return. Automatic integration of values into the tax return is coming soon!

To import the depreciation items into Assets

The Group field in the depreciation worksheet in AE/AO is known as the Asset Class in Assets in Practice. If you have already allocated a Group in AE/AO, the assets will automatically be grouped based on that.

After you've moved your tax return online, the first thing you'll see is the tax return in MYOB Practice.

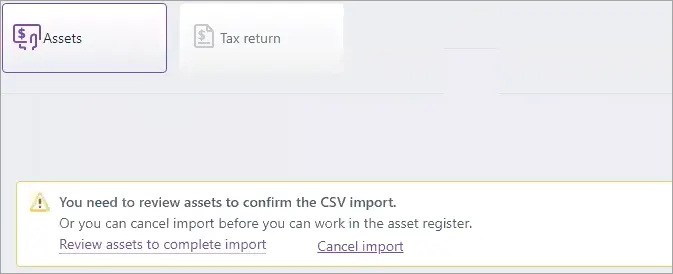

To import the depreciation assets, you'll need to select the Assets tile. You'll see the message:

You need to review assets to confirm the CSV import. or you can cancel the import before you can work on the asset register.

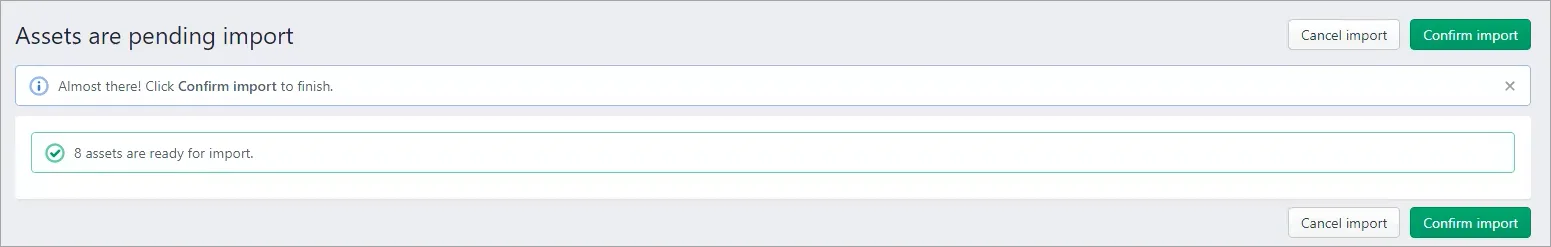

To import the assets, click Review assets to complete import. A new browser tab appears to confirm the import and number of assets being imported.

Select Confirm import. A message appears while the assets are being imported. Close out of that browser tab.

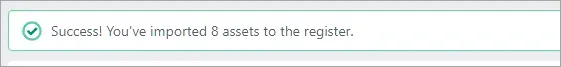

Select the Assets tile, and a Success message appears confirming the number of assets that have been imported.

The assets are automatically grouped into asset classes as per the Group name in AE/AO.

To print the assets register

Click Reports on the toolbar.

Select Tax schedule.

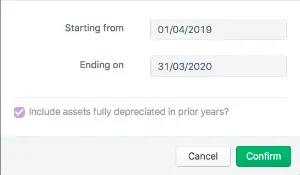

Enter the date range for the report.

Click Confirm.

If you have any assets that don't have a Group in AE/AO, we'll allocate them to a Default asset class.

Later, you can change the name of the Default Asset class or allocate the asset to another asset class.