We're regularly updating this page with the validation errors that have been reported to us. For the full list, see the ATO list of PLS/SBR issues.

Error messages

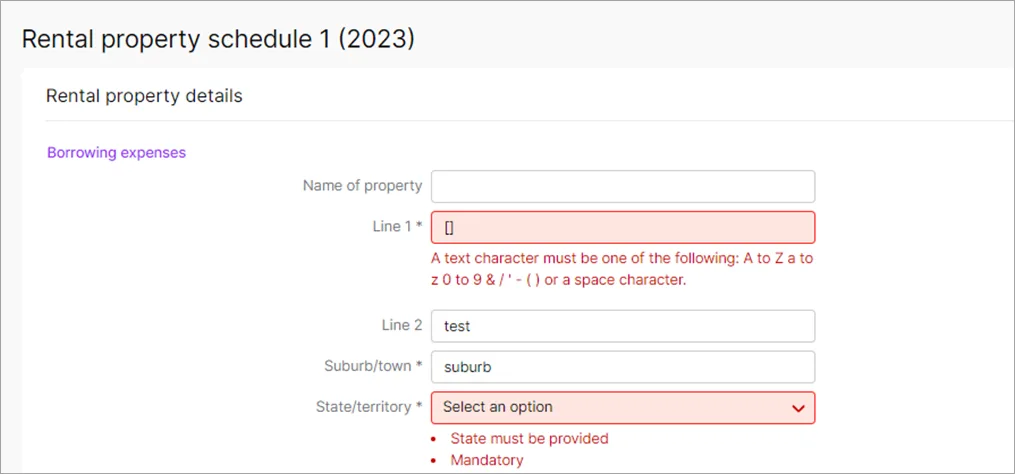

While entering data into certain fields, we'll check for any errors and display a message in red below the field so you can fix it straight away.

After you've fixed any data errors, validate the tax return to clear any ATO validation errors to avoid rejection.

Click the error and it will automatically take you to the field that is missing data.

For example

PLS errors

CMN.ATO.AUTH

Description | Fix |

|---|---|

CMN.ATO.AUTH.006 The software provider has not been nominated to secure your online (cloud) transmissions. If the Agent ABN or the Practice ABN in Tax and the ABN registered in the ATO access Manager for the Software ID aren't the same. Or if there are multiple agents or you used the company or business ABN in Tax. | Make sure that both the ATO Access Manager and MYOB Tax have the same ABN. Once the ABN has been confirmed in ATO Access Manager and MYOB Tax, you can continue lodging. |

CMN.ATO.AUTH.007 You do not have the correct permissions to submit this request or retrieve this file. If you don't have permission to lodge forms on behalf of the client. | Check the following: Are the ABN and TFN correct? In ATO Access manager under Access/Permissions, check if the agent number is added, and has full permissions to Prepare and Lodge returns of that type. Check if your client's ABN is active on abr.business.gov.au. If it's no longer active, remove the ABN from the tax return. Check on the ATO Tax Agent Portal that the client is listed under the tax obligations subsection. If it's missing, add it. ABN, TFN and Client Activity Center (ABN Branch Number) are the same as those entered in MYOB Tax. Enter the ABN Branch Number. Check that the tax return is assigned to the correct agent. If it's still an issue, delete and re-add the client on the ATO tax agent portal. |

CMN.ATO.AUTH.008 Your nomination with the online (cloud) software provider does not contain the correct Software ID. Your nomination with the software provider might not have the correct Software ID in Access Manager. To resolve, log on to Access Manager (AUSkey required), select ? my nominated software provider? and update the nomination, or call the ATO. | Provide the following details: Software provider name and/or their ABN ,Software ID. |

CMN.ATO.AUTH.011 The client you transmitted is not associated with the agent number you supplied and cannot be authorised. A link between your client and your agent number does not exist for the selected task. You'll get this error if the details in the tax return don't match the ATO record | Check that you've added this client to your registered agent number, client identifier, and registered agent number. Edit the details in the tax return to match the details in the ATO records. Remember that text is case-sensitive. If you're still getting the error, contact the ATO. |

CMN.ATO. GEN

Description | Fix |

|---|---|

CMN.ATO.GEN.XBRL01 Text": "The message did not pass XBRL validation. Please contact your software provider | This error happens when the data is not completed correctly in the tax return. For example, If the address details are not entered in the correct field. |

CMN.ATO.GEN.XBRL03 A field contains invalid data (such as letters in numeric or date field).", | This error happens if the data is not cleared from a field. |

CMN.ATO.GEN.200001 You'll see this error if the Practice ABN and/or the Tax Agent ABN do not match with the registered name | Check if the practice ABN is registered and active on abr.business.gov.au Check the TAN is present and valid on tbp.gov.au If the TAN is registered, check the name used for the TAN matches the name listed against the practice ABN on abr.business.gov.au If all of the above is correct, check that the ABN entered in the return is also correct. If this is still an issue contact the ATO. |

Form errors

Individual tax return

Description | Fix |

|---|---|

CMN.ATO.IITR.730355 | Known issue - While we're working on a fix, use the workaround below: Open the Income Details schedule (INCLDTS) schedule. Enter 0 in the following fields: - Deductible expenses, - Undeducted purchase price, Foreign tax paid |

CMN.ATO.IITR.730407 Share of net income from trusts must be provided Where any Total primary production income from managed fund, Your share of primary production income from managed fund or Primary production net income from trusts amounts are present in the attached Income Details schedule, the Share of net income from trusts must be provided | Known issue |

CMN.ATO.IITR.730475 Distribution from partnerships relating to financial investments, less foreign income must be provided | Known issue |

The value should be greater than 0. This error can be found in the Dist from Trusts This error happens when there is a Distribution from trusts workpaper and the Net Primary production amount is incorrect on the main return. | While we're fixing this error, you can still lodge the return sucessfully. |

Income details schedule

Description | Fix |

|---|---|

CMN.ATO.INCDTLS.000381 Non-primary production net income from trusts amount details are incomplete Where Non-primary production net income from trusts (less capital gains, foreign income and franked distributions) is present, both the Non-primary production managed investment scheme amount and the Non-primary production remaining trust amount must be provided | Known issue |