Holiday pay that attracts the extra pay tax rate

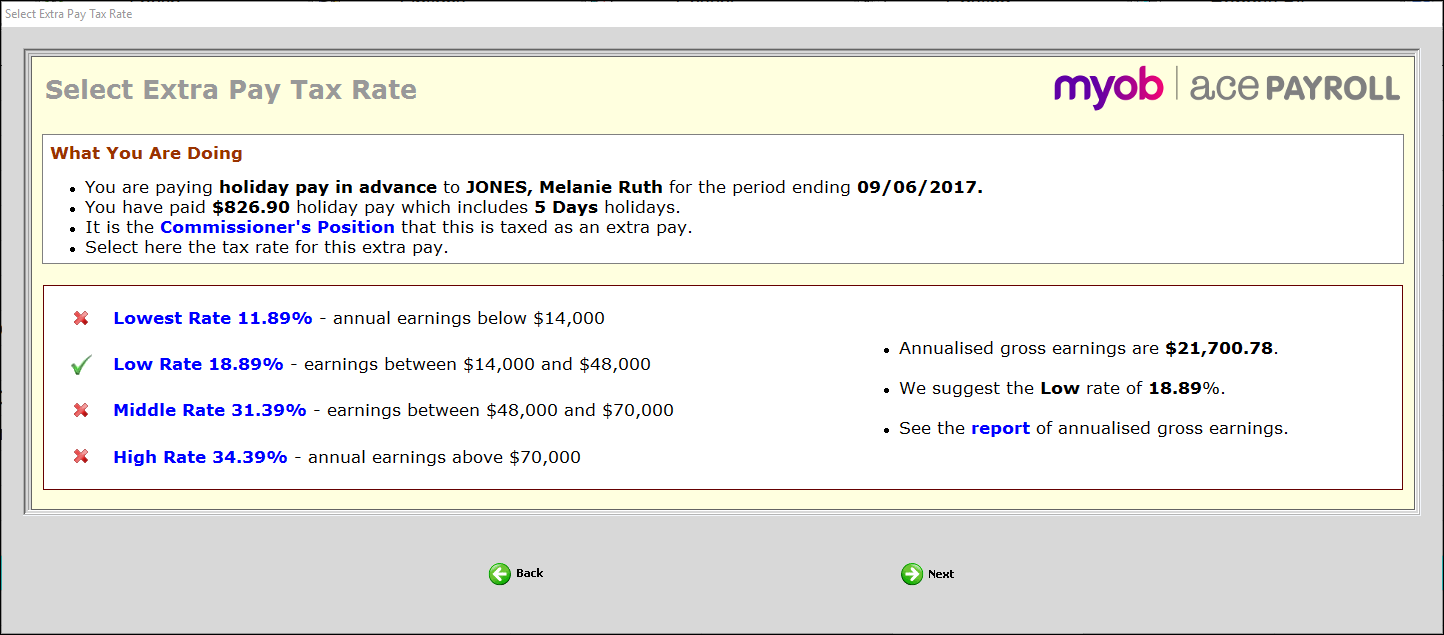

As of March 2016, Inland Revenue has ruled that certain types of holiday pay must be considered extra pay and taxed at a higher PAYE rate than the regular salary or wages rate.

The PAYE rate deducted depends on when the holiday pay is paid to the employee. In general:

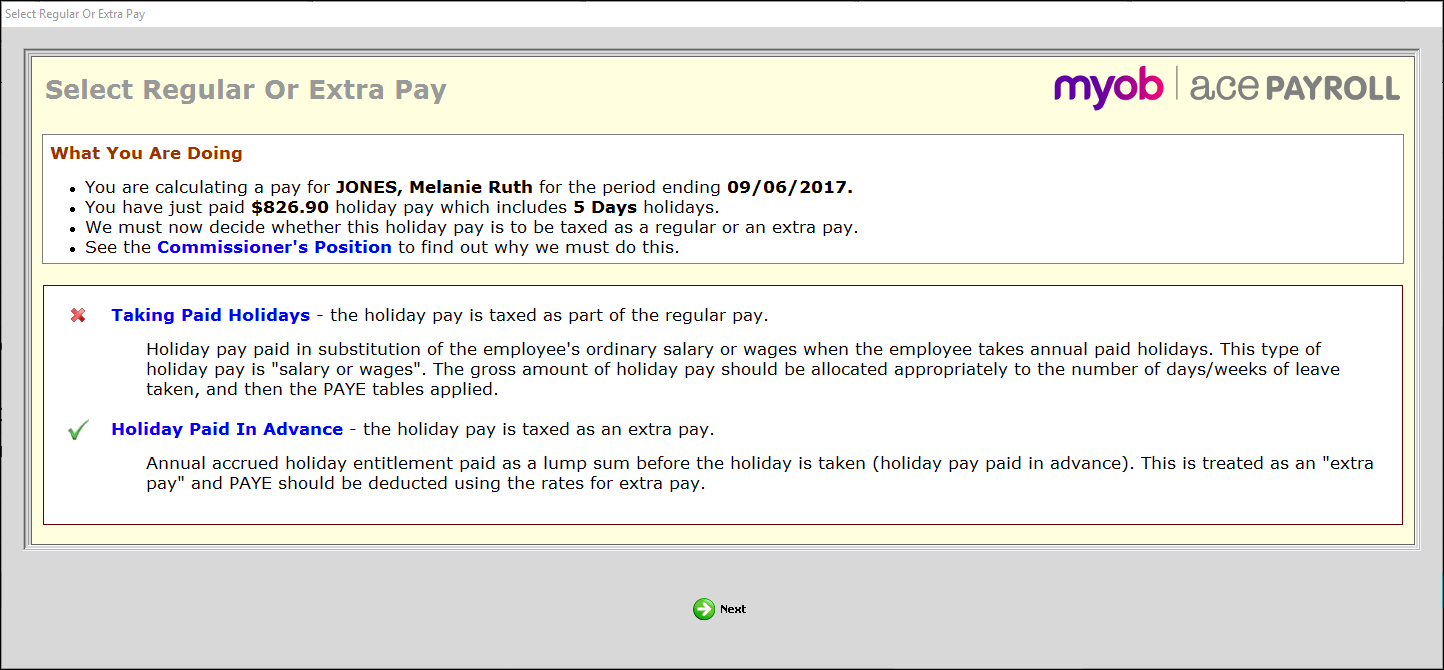

the salary or wages rate will be applied to holiday pay that is linked to the work days within the pay period. This is how the majority of holiday pay is paid to an employee.

the extra pay rate will be applied to holiday pay that is paid in addition to the regular pay for the pay period. These are payments that wouldn’t normally be paid in that pay period.

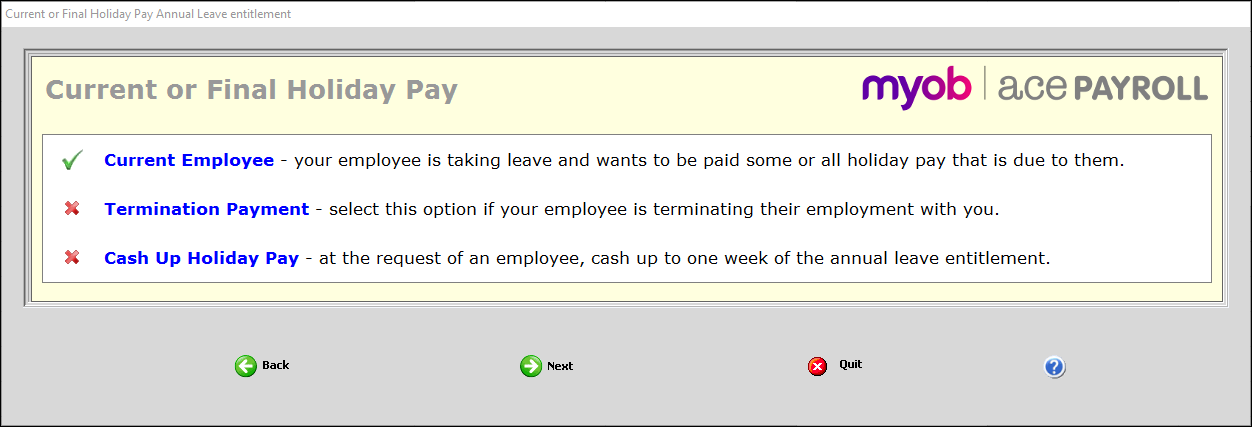

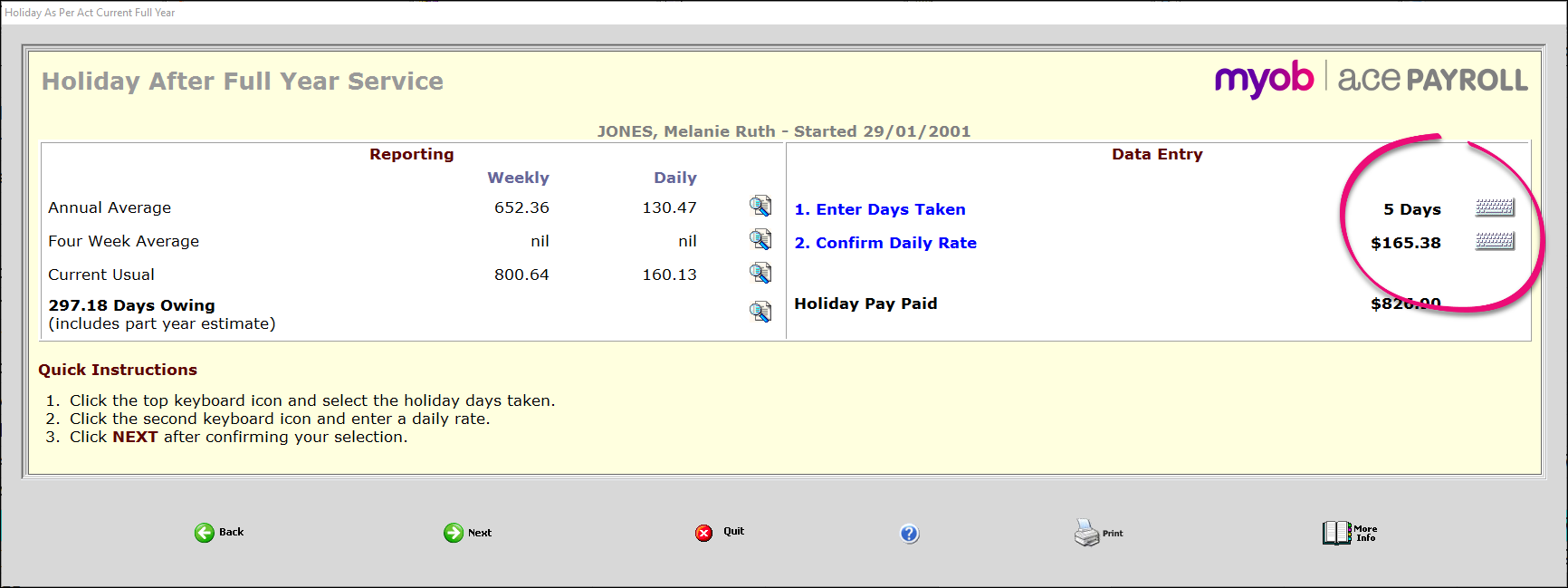

This higher extra pay rate will be applied to holiday pay in advance, cashed up annual leave, and termination payments. As you add holiday pay, Ace Payroll will calculate the correct PAYE rate for you.

For more information, read Taxing holiday pay and Taxing lump sum payments on Inland Revenue's website.

Here’s how it would work if you entered holiday pay in advance for an employee: