IR348 FAQs

From 1 April 2019, employers must report employee info to the IRD every payday via payday filing, instead of filing an IR348. The information on this page only applies before 1 April 2019.

IR348 Figures Do Not Reconcile With Other Wage Data

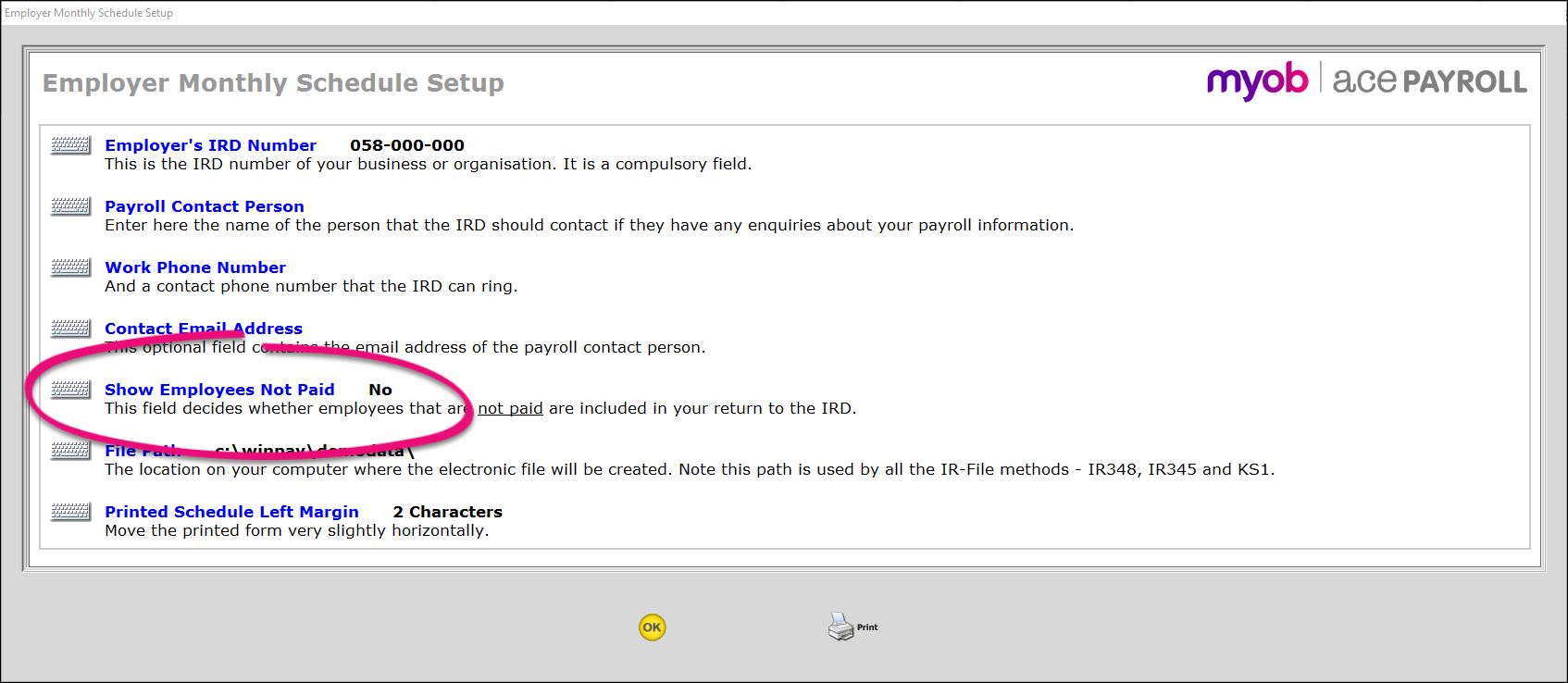

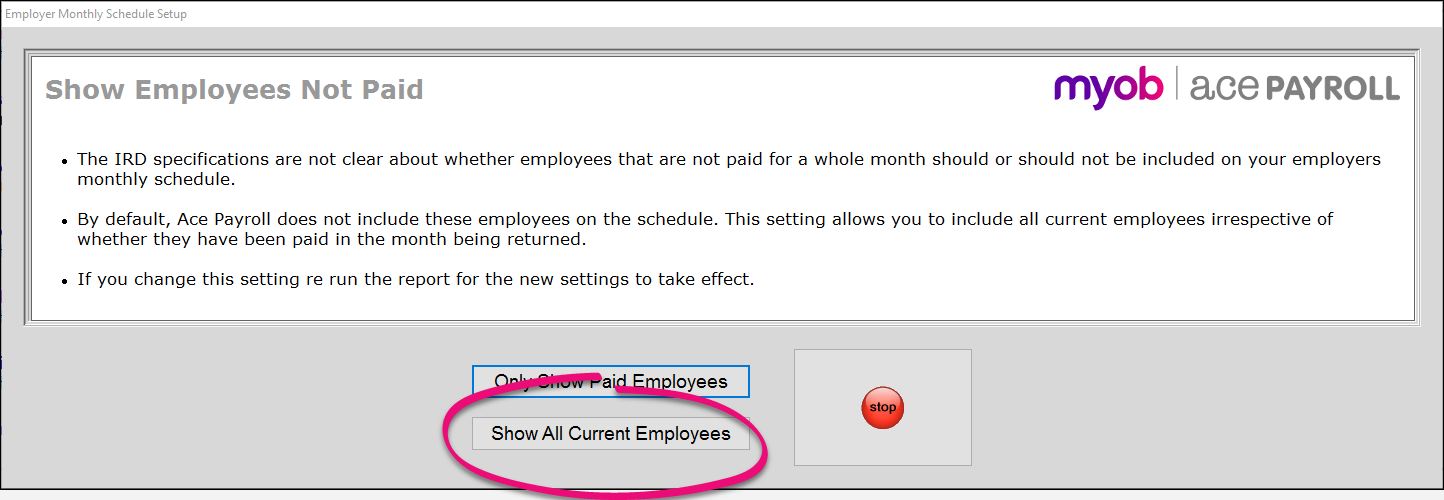

Monthly schedule - employees with no payment

myIR error: Schedule already exists