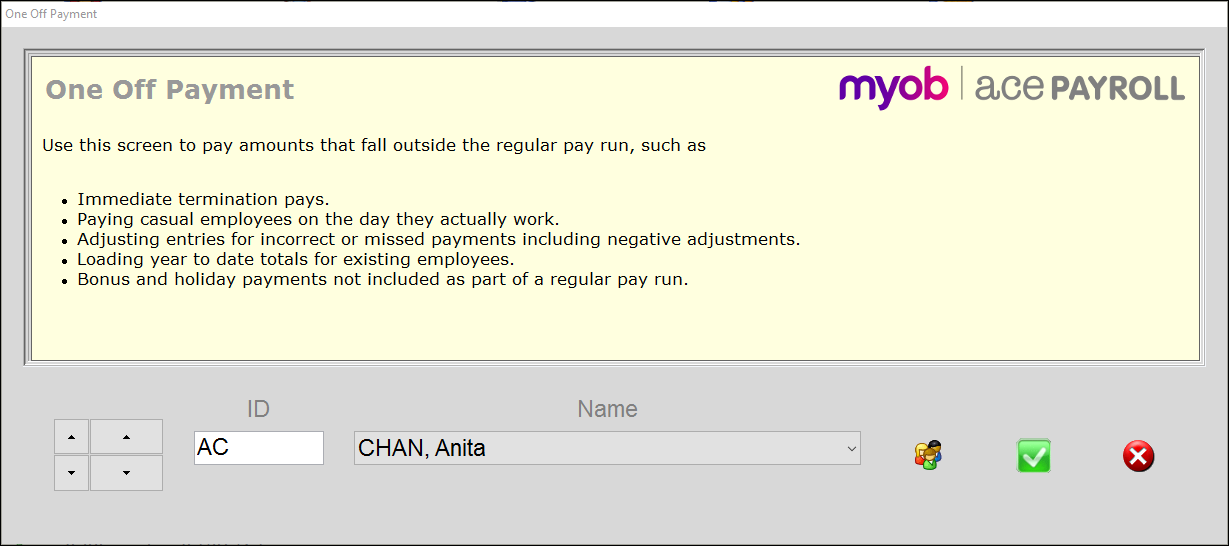

Make a one off payment

Use the One Off Payment method for paying amounts that fall outside of the regular pay run.

Common uses for one off payments are:

Immediate termination pays

Bonus Payments

Holiday Pay

Paying casual employees on the day they actually work

Loading year to date totals for existing employees.

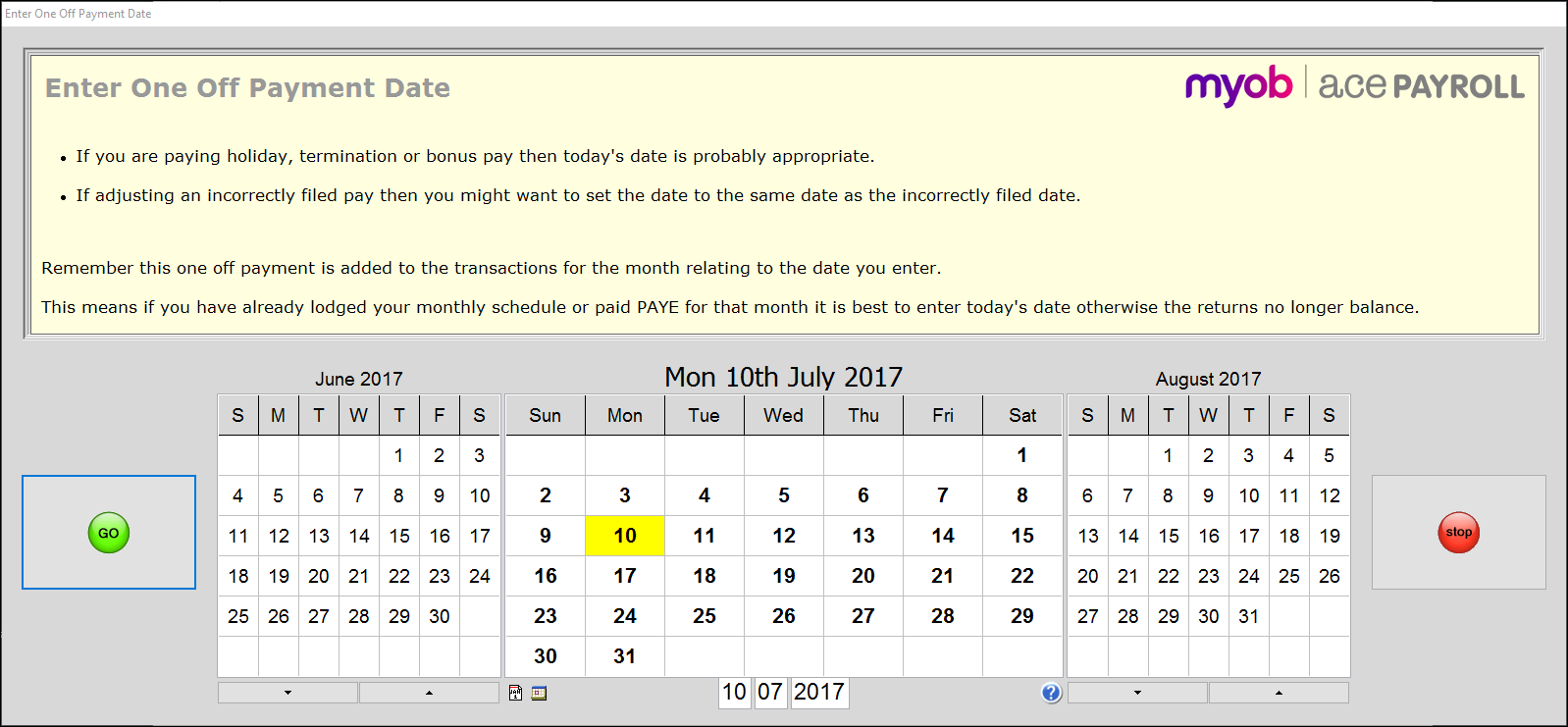

Date Entry

When selecting a date there are some things to consider.

If you are paying holiday, termination, or bonus pay, then today's date is probably appropriate.

If you are adjusting an incorrectly filed pay then you might want to set the date to the same date as the incorrectly filed pay.

However, once it is filed the payment will be added to the transactions for the month of the date you enter. This means that if you have already paid your PAYE for that month your reconciliation will not balance at the end of the year, and you may be liable for penalty tax. In this case, it is best to enter today's date.