Some employees want to pay their student loans off more quickly by increasing their repayments above the minimum requirement. You can set up a regular voluntary deduction for your employees wages, which will fall under the SLBOR tax code.

No communication with the IRD is required for an employee to pay back more student loan than the minimum required.

Set up voluntary extra repayments to student loans

- From the front screen click Calculate Pays, select the correct employee then click Options. If the employee has a student loan tax code the option to make additional voluntary repayments is shown.

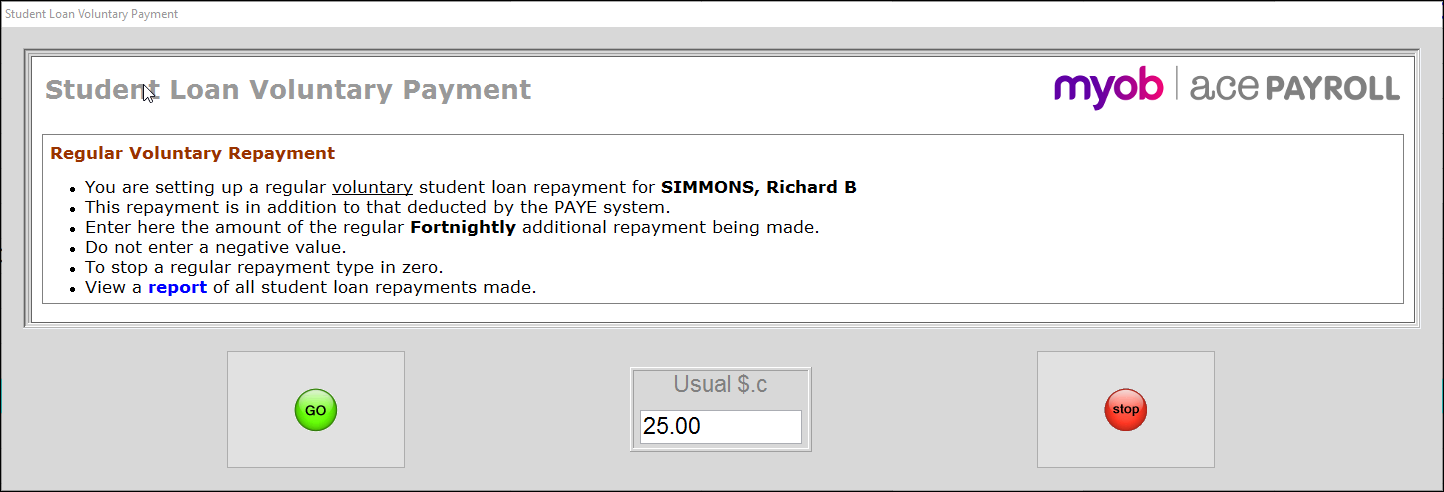

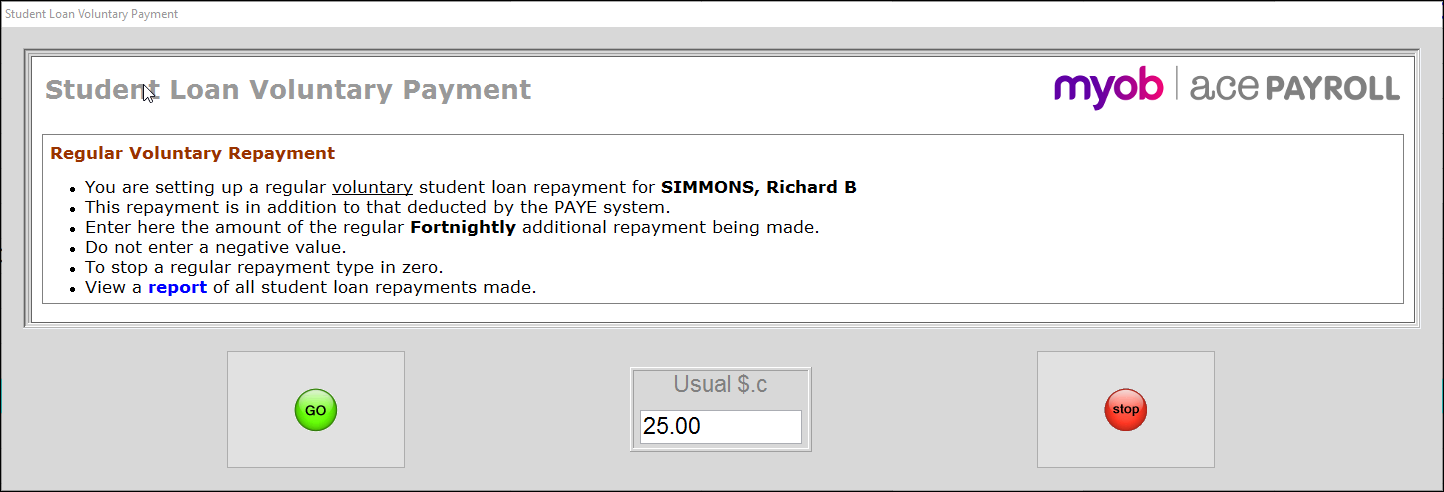

Click Voluntary, then enter the additional repayment amount your employee has requested.

Click Go.

The regular voluntary deduction is now set, and will be processed automatically each pay. The voluntary student loan deduction is itemised in relevant IRD returns, so your employee will receive any benefit they are entitled to from early repayment.