Migrate Ace Payroll to MYOB Essentials

When you move from Ace Payroll to MYOB Essentials you’ll need to set up your employees, and enter their leave balances and pay history.

This document explains how to find this information in Ace Payroll and enter it into MYOB Essentials.

Employee details setup

In Ace Payroll, run the Miscellaneous report and select the options shown below.

To create a new employee in MYOB Essentials, open the Payroll menu and select Employees, then click Add Employee.

Use the Ace Payroll Miscellaneous report to fill in your employee’s information.

The field names vary between Ace Payroll and MYOB Essentials. In each tab you must fill in the yellow fields before you can save the new employee record.

If you’re unsure, use the table below as a reference.

MYOB Essentials Fields | Ace Payroll details from report |

|---|---|

Employee details – Personal | |

First Name | First Names |

Last Name | Surnames |

Date of Birth | Birth Date |

Start Date | Start Date |

Job Title | Occupation |

Postal Address | Postal |

Phone | Phone |

Employee details – Pay details | |

Status | Select one |

Employee is paid: Hourly Rate or Annual Salary If $/hr |

Enter hourly rate (Ordinary Hours rate on report) |

Employee details – Banking | |

| Select “Pay into one account” or “Split pay between 2 accounts” | |

Account Description | Account number |

Tax | |

IRD Number | IRD No |

Tax Code | Tax Code (select from list) |

| Tick the tax code declaration box | |

KiwiSaver | |

KiwiSaver Status | If KiwiSaver “Yes” then select Active If KiwiSaver “No” then select Opted Out or Exempt |

Employee Contribution rate | Employee: % |

Employer Contribution rate | Employer: % |

Employee Annual Salary (select band) | ESCT Rate % |

Holiday pay / annual leave balances

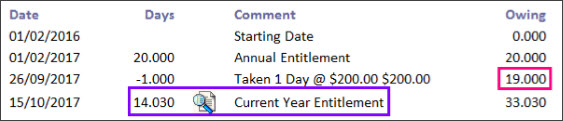

Holiday pay and annual leave balances are handled differently in Ace Payroll and MYOB Essentials. MYOB Essentials splits annual leave into two sections: Leave Available (the total leave they have become entitled to, minus any leave taken) and Leave Accruing over the current year.

Follow the steps below to check the Annual Entitlement (leave available) and Current Year Entitlement (leave accruing over the current year) in Ace Payroll.

Casual Employees are usually paid their holidays as they work, so they will not have leave balances to enter.

Pay history

We recommend loading 52 weeks of pay history so that MYOB Essentials can calculate annual leave rates correctly.

The pay history you enter here is only for reference and will not be included in reports.

Contact us

Can't find what you're looking for? Contact Ace Payroll to talk to our support staff.