Process a final pay

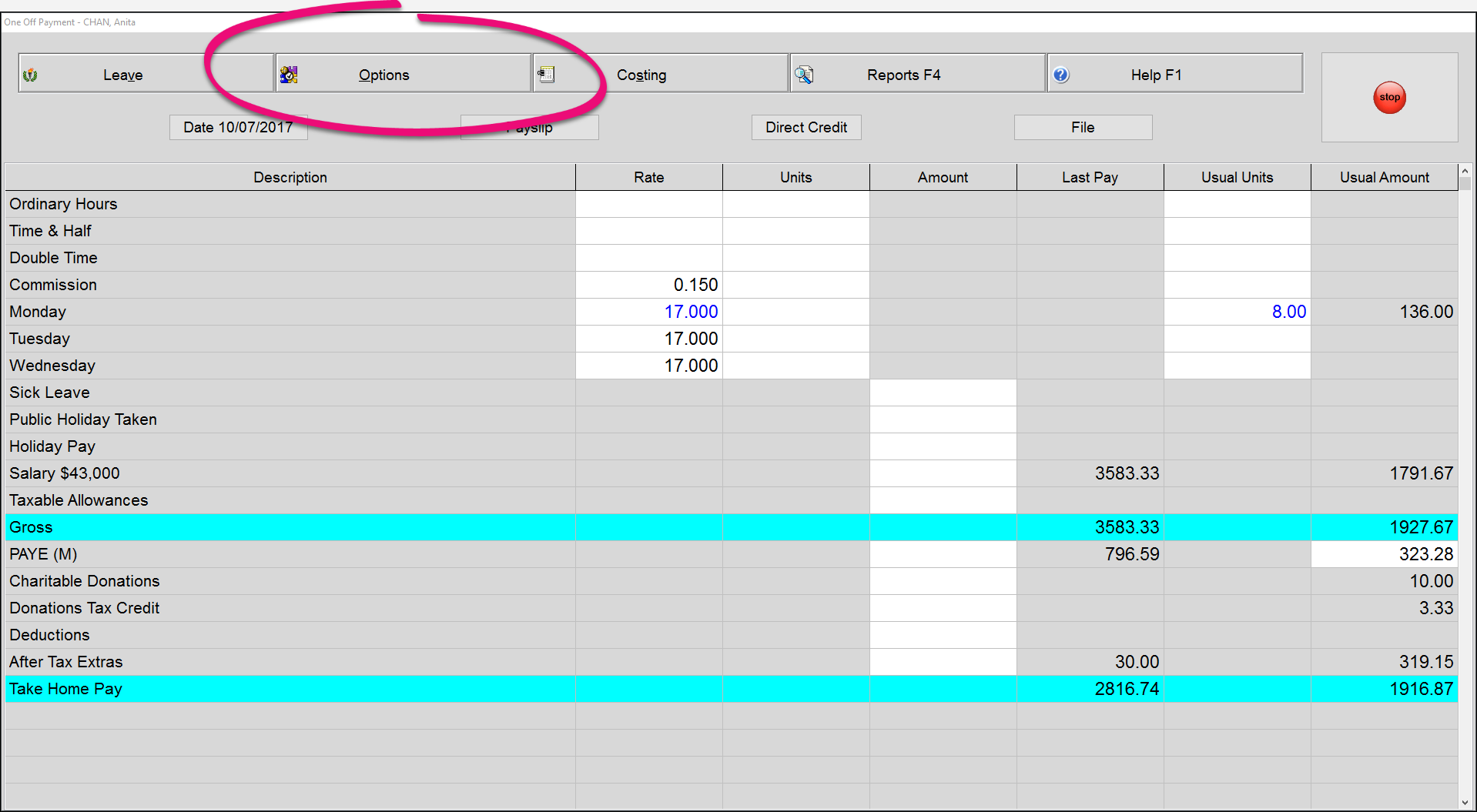

To finish an employee all you need to do is process a termination pay. This pay should include any unpaid amounts for time worked, plus any leave they are owed.

Finishing dates

Do not enter a finishing date for the employee – once the final pay has been filed, Ace Payroll automatically enters a finishing date. In some situation, entering a finishing date can cause problems.

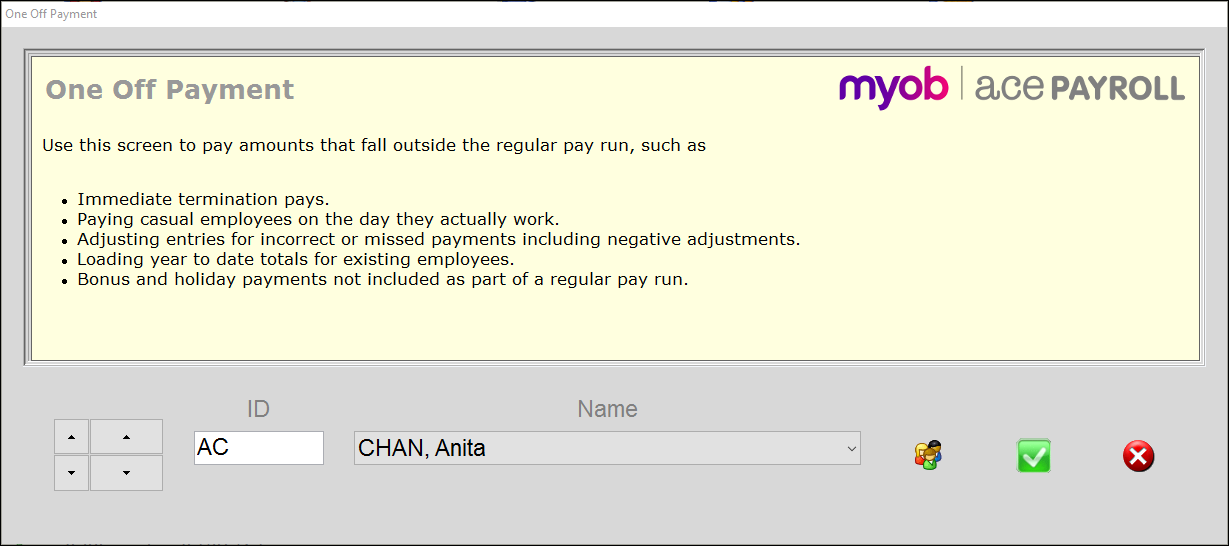

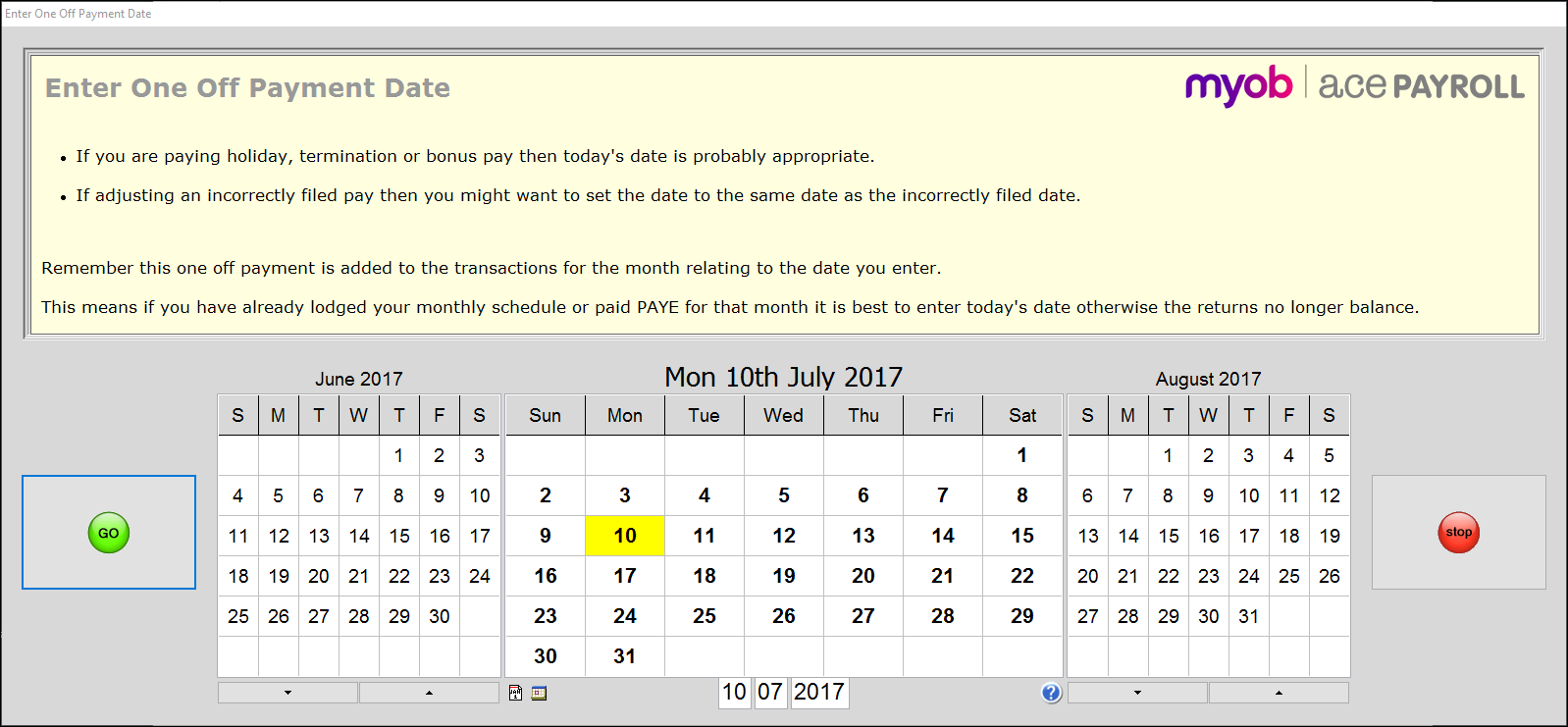

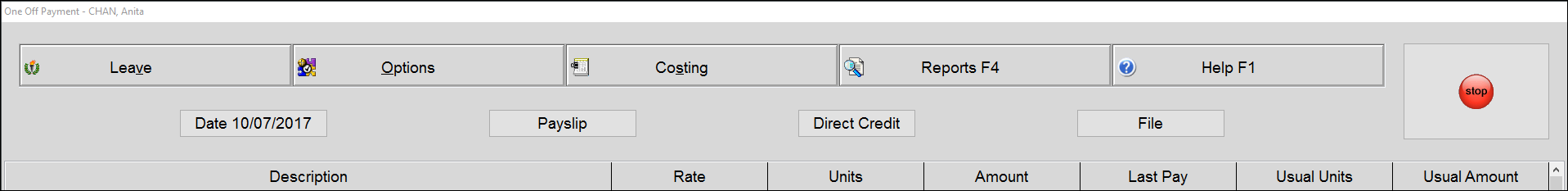

If you enter a finishing date after you calculate pays but before you file your pays, then the payment for the finished employee will be deleted from your reports and from the records you will send to Inland Revenue. If this has happened, you can fix the situation by entering a One Off payment by following the instructions below.

Public holidays

Employees may be entitled to be paid public holidays that fall after their employment ends, if they have unused annual holidays owed. Consider any remaining holidays owed as leave taken immediately after their last day of employment.

Any public holidays that fall within this period that the employee would have normally worked had they still been employed are paid at their relevant daily pay, or average daily pay (if applicable).

If public holidays are owed, add these to the pay first before calculating the final pay amount. For help, see Pay a public holiday.