Reducing balance deductions

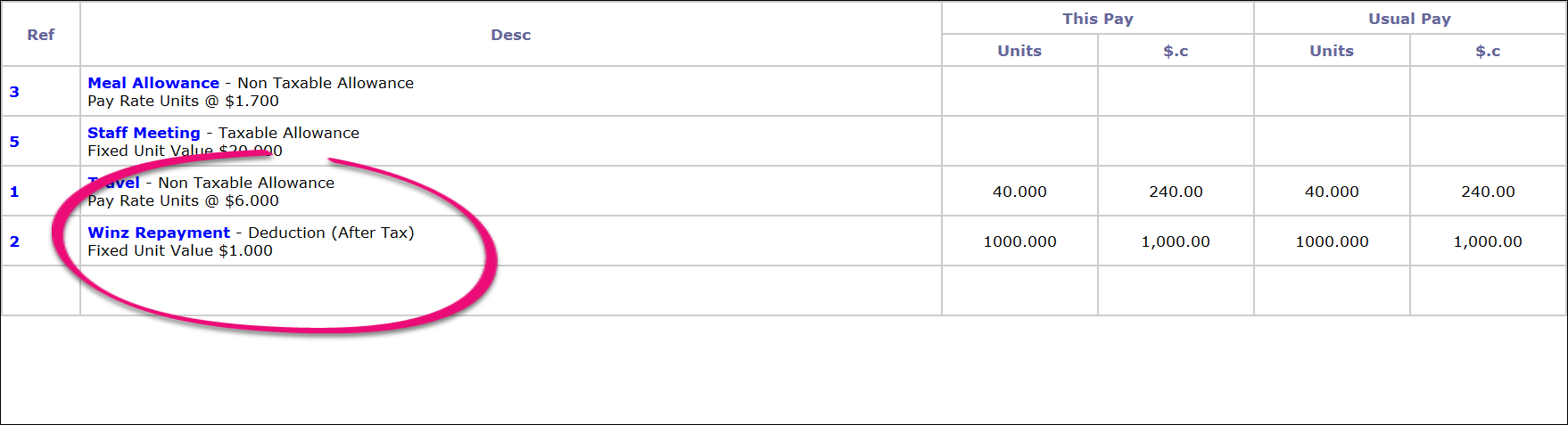

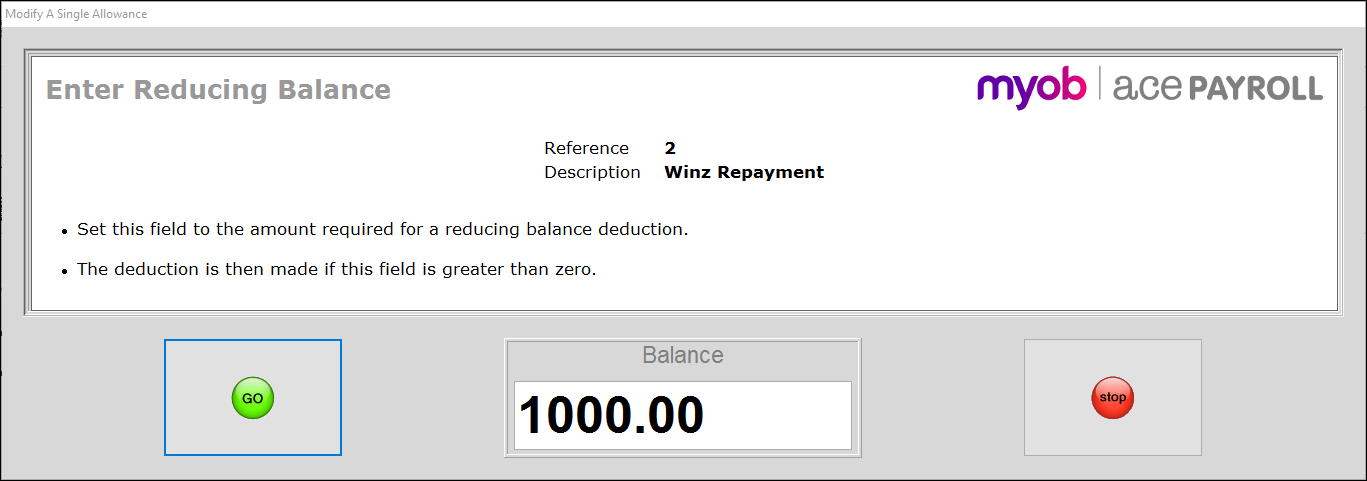

A reducing balance deduction automatically ceases once a set amount has been deducted. They are especially useful when a third party asks an employer to deduct a certain amount from employee wages over a period of time. Examples are IRD Arrears, Court Fines and WINZ Repayments.

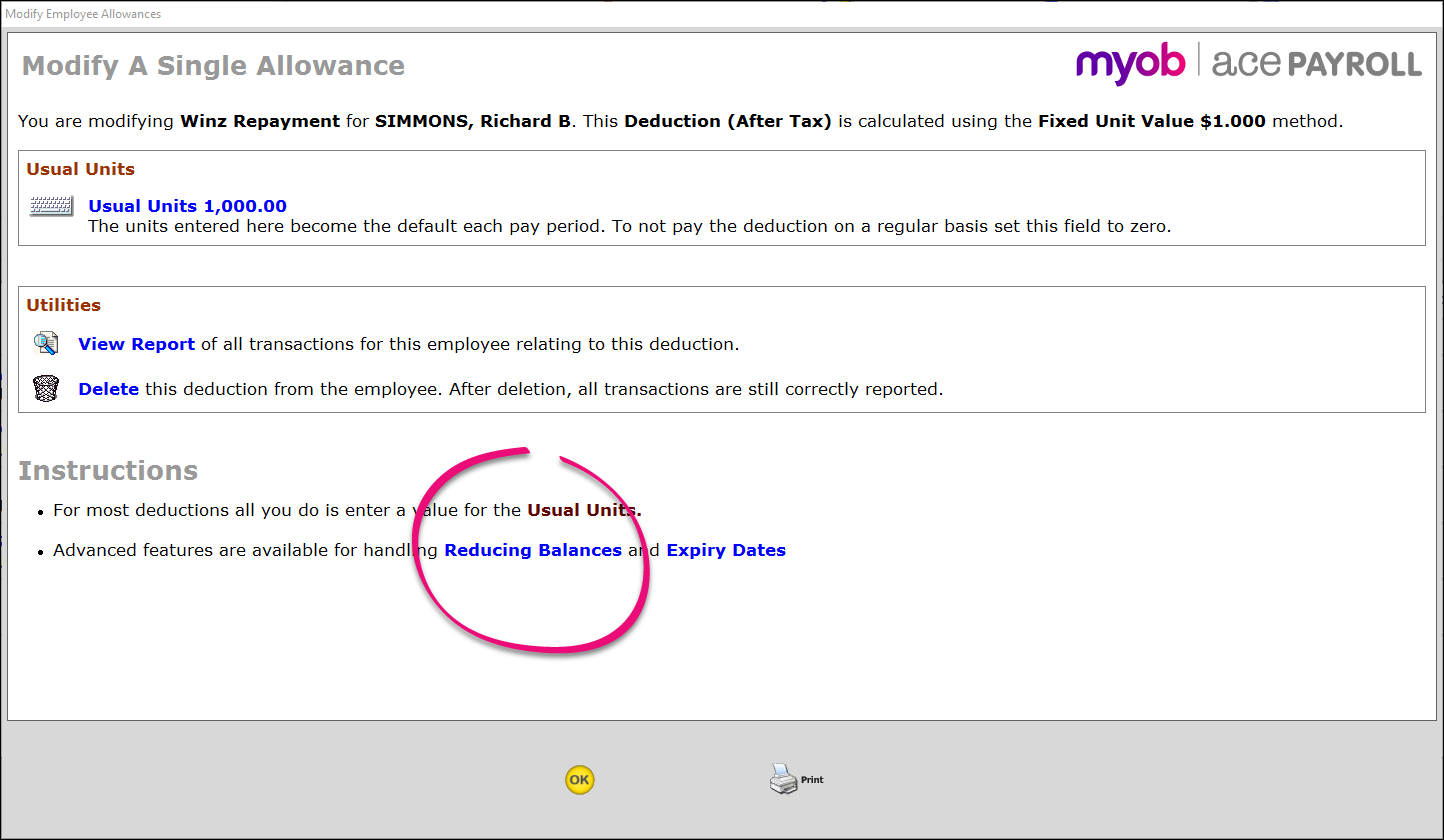

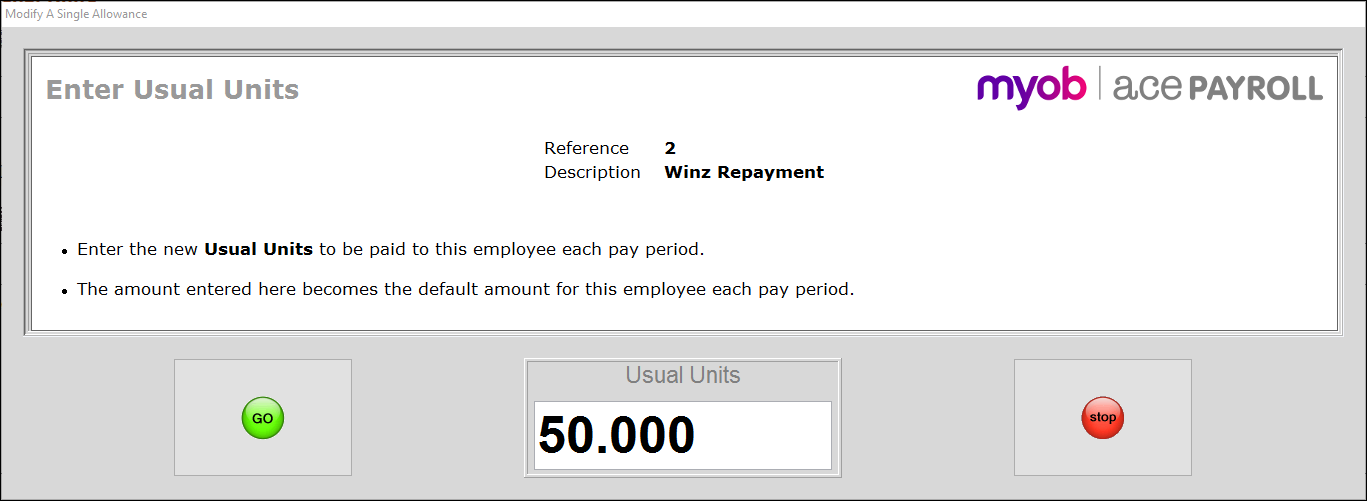

To set a reducing balance deduction for an employee, you first need to add the deduction to your organisation, then link the deduction to the employee.