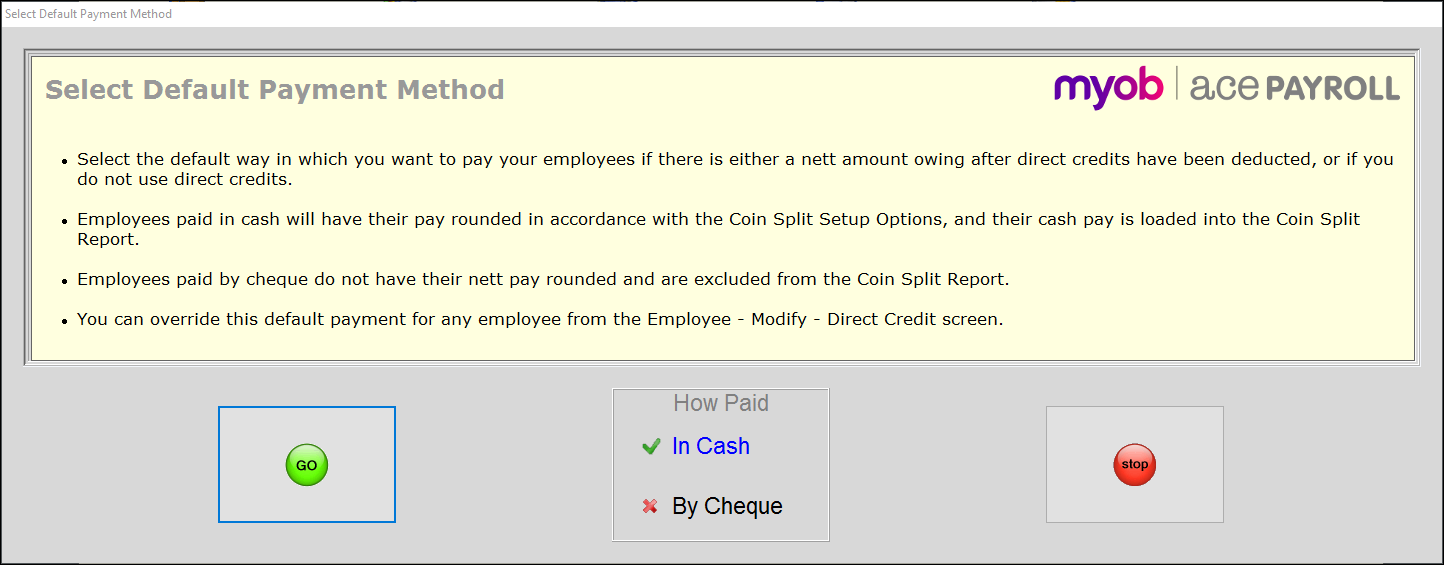

When Ace Payroll rounds a cash payment, it always advances a very small amount to the employee and the amount advanced is stored internally. The amount advanced is then taken into account when rounding the next cash payment.

For this reason, a balance of how much the employee has been overpaid due to rounding is kept in the system. When you change from "cash" to "cheque" the system reduces this balance to zero by deducting from the employee the amount advanced to them.

Once the rounding balance is reduced to zero Ace Payroll no longer makes any rounding adjustments unless the employee is again set to "cash".