Child support is deducted from employees' pay each pay period. Sometimes you will need to manually adjust the child support payment. When you manually adjust the child support payment the variation code is included on your employer's monthly schedule, so you do not need to inform the IRD. All you need to do is update the details in Ace Payroll.

By law, child support deductions cannot be more than 40% of an employee's nett pay, not counting any student loan deductions. The remaining pay is called the employee's "protected earnings". Ace Payroll manages protected earnings automatically, and will never deduct an amount of child support that would reduce an employee's protected earnings. If Ace Payroll adjusts a child support payment because of an employee’s protected earnings, it also automatically adds the correct variation code to the employer monthly schedule.

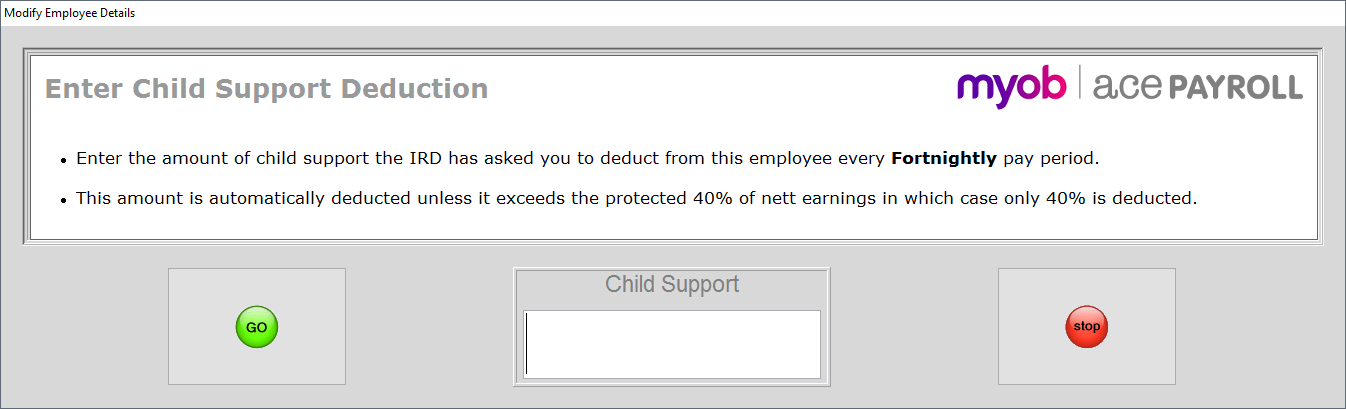

To set a child support payment

From the front screen click Employee > Modify Employee Details and select the employee.

Click the Taxation tab.

Click Child Support and enter the amount of child support the IRD has asked you to deduct from this employee every weekly pay period.

Click Go.

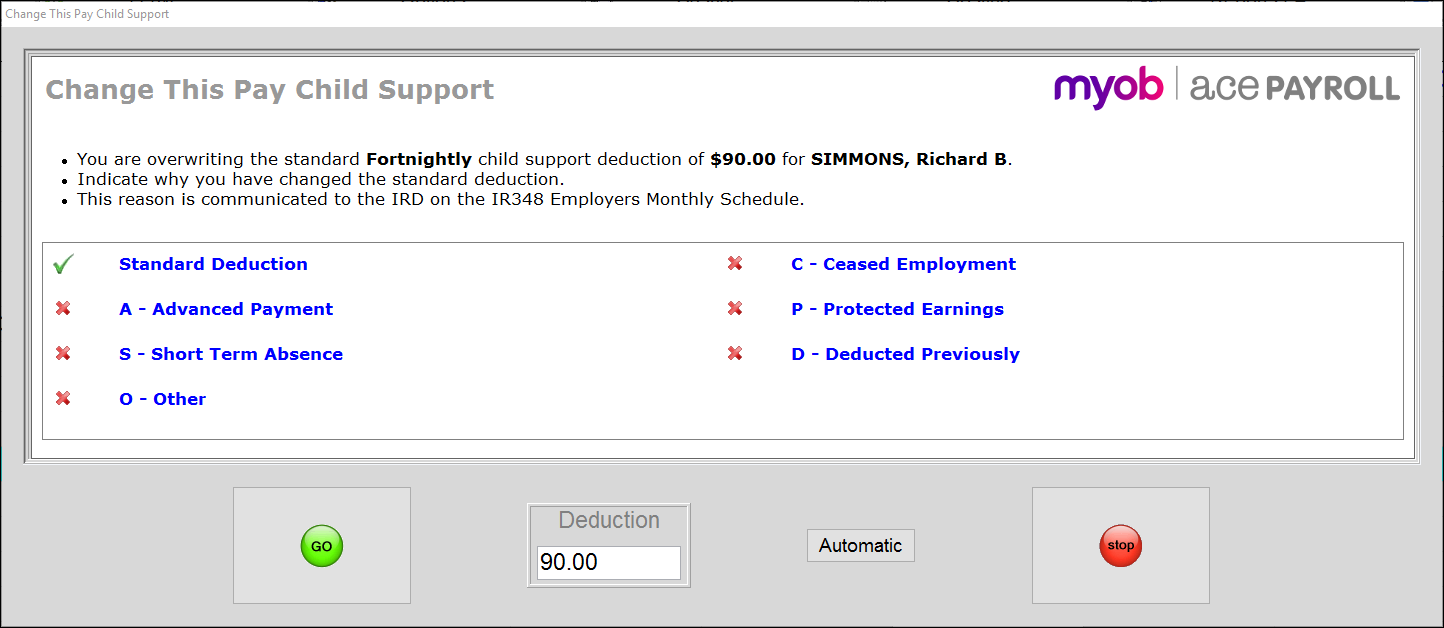

To manually adjust a child support payment

- From the front screen click Calculate Pays. The pay calculation window opens.

- Select an employee from the drop-down menu at the top of the window.

- Click the white cell in the child support deduction field. The Change This Pay Child Support window opens.

- In the Deduction field enter the amount you want to deduct for the current pay period.

- Click the reason for the change. A green tick appears next to it.

- If you have previously entered a changed deduction and want to reset the child support to its usual deduction, click the Automatic button.

Click Ok and you’re done!

Any changes made are for the current pay period only, and are reset to default values when the payroll is filed.