If you're using MYOB AccountRight, you can set up Ace Payroll to post journals to the general ledger of your company file. This will help you or your accountant prepare accurate monthly, quarterly or annual reports by ensuring the right expenses and liabilities are recorded in the correct accounting period.

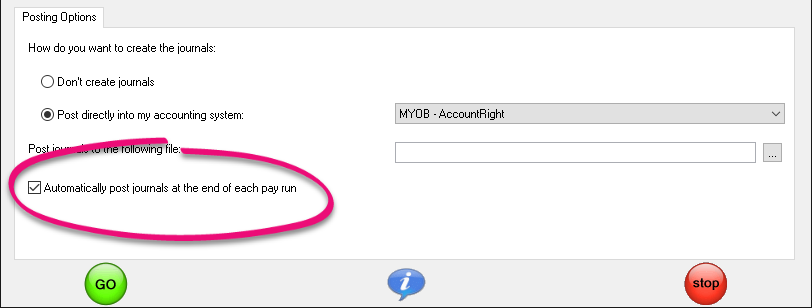

Select the Automatically post journals at the end of each pay run option and you'll be able to:

- Post journals automatically at the end of each pay run (as part of the file regular pay process).

- Post journals when creating extra pays for employees (as part of the one off payment process). A separate journal will be posted automatically for each extra pay.

Don't want to select the Automatically post journals at the end of each pay run option? You can still post journals to your MYOB accounting software by creating a summary journal from Utilities > Export Data at, say, the end of the quarter or financial year (or whatever period you prepare accounts for). Just select a date range of pays to include.

If you're not sure whether you should select the Automatically post journals at the end of each pay run option or not, check with your accountant.

If you post a journal in error, you can always delete it in your MYOB accounting software.

To set up journals with AccountRight

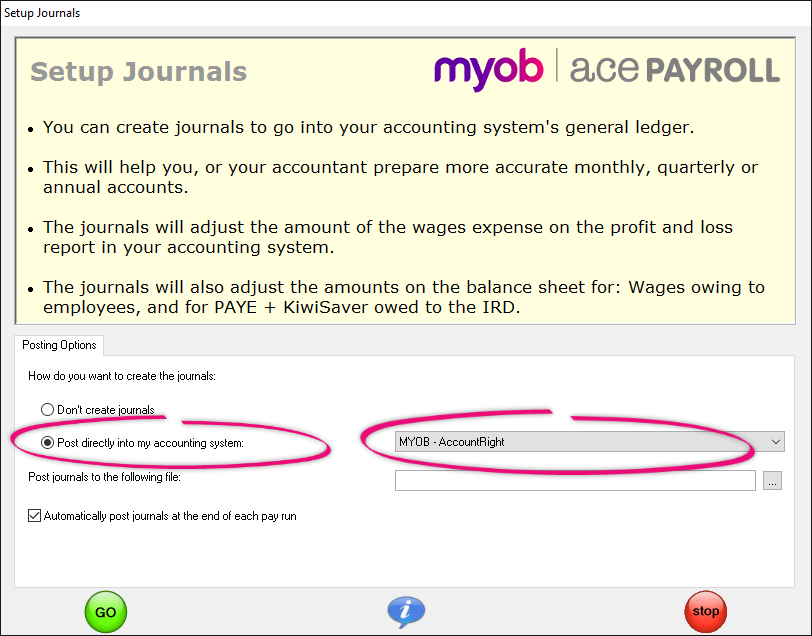

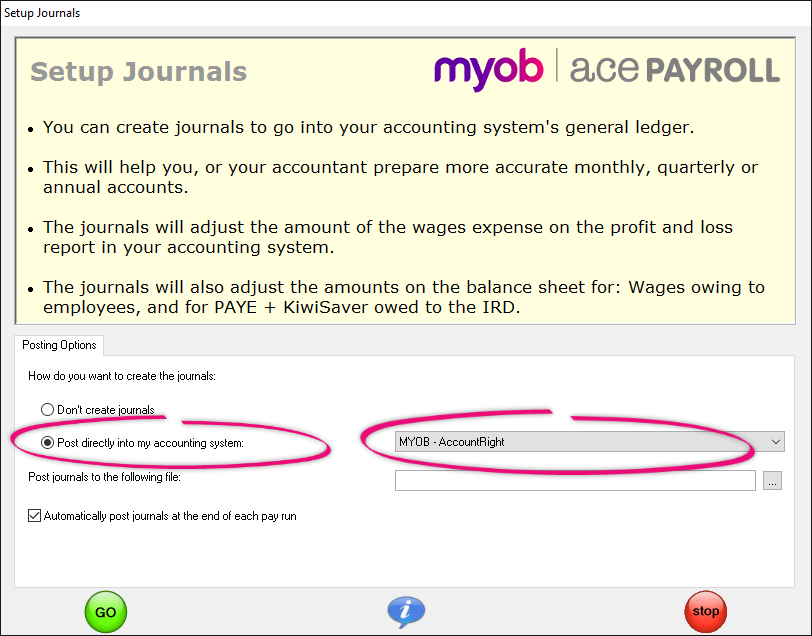

- From the front screen click Setup, then Set up Journals. The Setup Journals window opens.

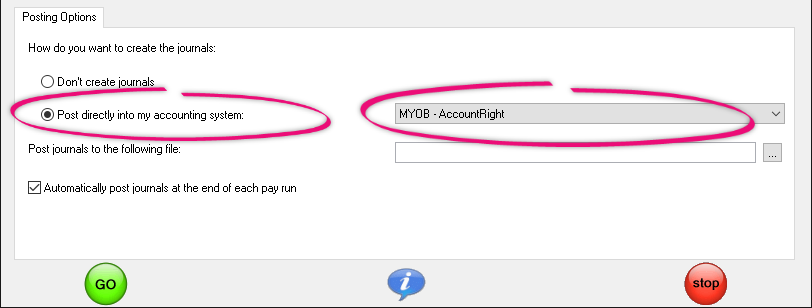

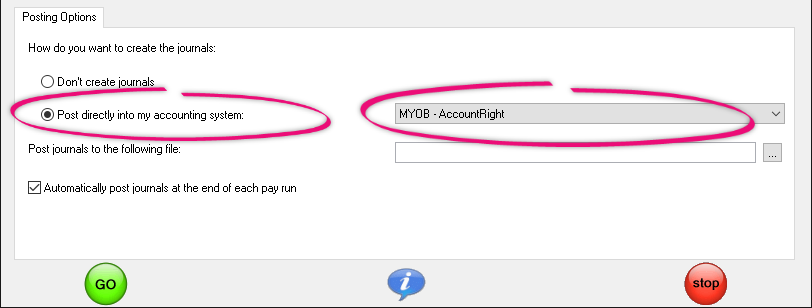

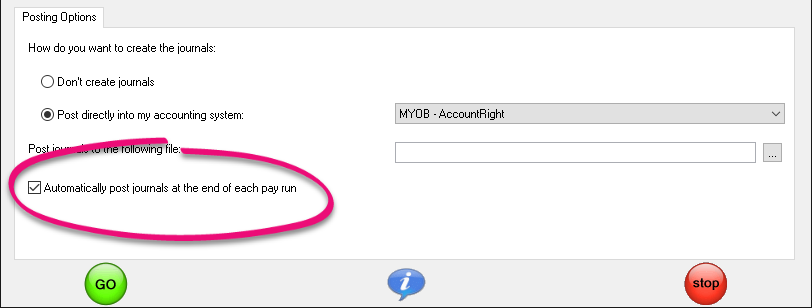

- In the Posting Options tab, select the Post directly to my accounting system option, then choose your MYOB accounting product from the drop-down list next to it.

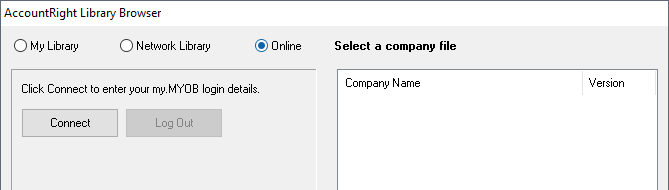

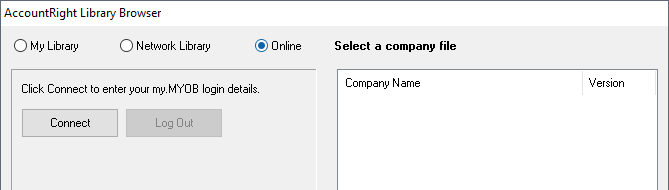

- Click the ellipsis button on the right of the empty field choose your company file. The AccountRight Library Browser window appears.

If your file is stored:

a. Locally, select My Library.

b. On a network, select Network Library.

c. Online, select Online.

Click Connect. You'll be prompted to enter your MYOB software and company file login details.

Select your MYOB company file from the list and click OK. The Posting Options tab of the Set Up Journals window will reappear with your file listed.

If you want journals automatically posted to your MYOB company file at the end of each pay run, select the Automatically post journals at the end of each pay run option. If you prefer to initiate the journal export yourself each time (via Utilities > Export Data), don't select this option.

Check with your accountant if you're not sure whether to select this option or not.

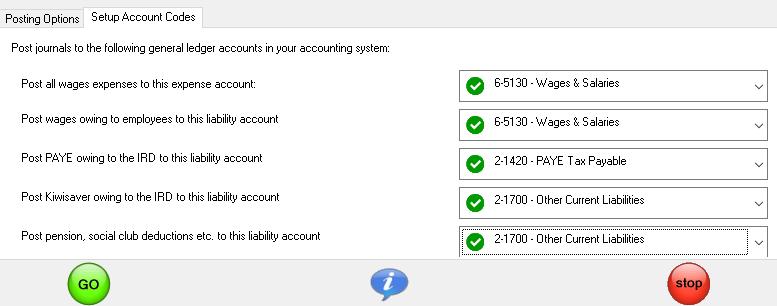

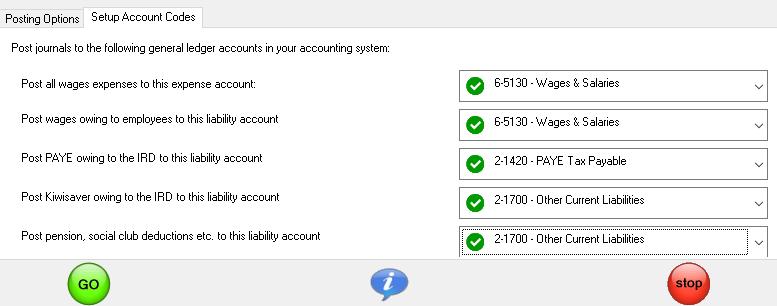

In the Set Up Account codes tab, select the accounts from your MYOB company file's chart of accounts that you want to use for the journal entries in your accounting software.

These accounts are:

- Your expense account for wages expenses.

- Your liability account for wages owing to employees.

- Your liability account for PAYE owing to Inland Revenue.

- Your liability account for KiwiSaver owing to Inland Revenue.

- Your liability account for additional deductions (like pension, social club deductions, etc).

If your chart of accounts only has only one or two liability accounts set up, you may want to post, say, both the PAYE owing to IRD, and the KiwiSaver owing to IRD, into the one liability account (i.e. an account such as 2-1310 - Wages deductions owing to IRD). Check with your accountant if you're not sure which accounts to post into.

You can't post to a heading account or an inactive account.

Click Go, then Go again to save your changes.