When you entered the opening balance of your bank account, if this included the value of any uncleared transactions (such as unpresented cheques), you'll need to record these uncleared transactions in such a way that the opening bank account balance is not affected.

To record these uncleared deposits and withdrawals, you need to post a debit and a credit of equal amounts for each transaction against the applicable bank account. This will then allow you to reconcile these transactions when the cheques are eventually presented.

To enter uncleared withdrawals

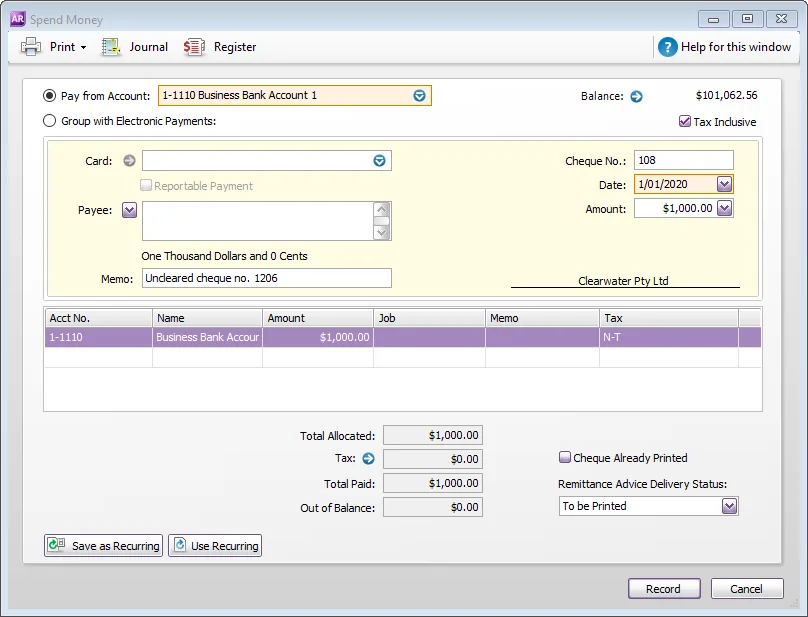

Go to the Banking command centre and click Spend Money. The Spend Money window appears.

In the Pay from Account field, type or select the bank account you want to reconcile.

In the Cheque No. field, enter a reference number for the withdrawal.

In the Date field, type the first day of your conversion month. For example, if your conversion month is January 2020, enter

1/01/2020.In the Amount field, type the amount of the withdrawal.

In the Acct No. field, type or select the bank account you want to reconcile. This must be the same account entered in step 2.

(Australia) In the Tax field, select the N-T tax code.

(New Zealand) In the GST field, select the N-T GST code

Enter details of the withdrawal in the Memo field.

Click Record.

Repeat from step 3 for each uncleared withdrawal.

To enter uncleared deposits

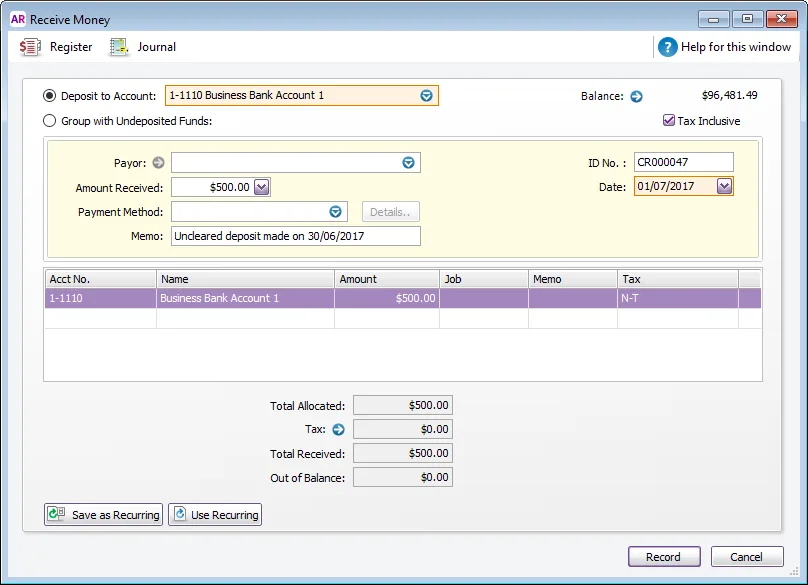

Go to the Banking command centre and click Receive Money. The Receive Money window appears.

In the Deposit to Account field, type or select the bank account you want to reconcile.

In the Date field, type the first day of your conversion month. For example, if your conversion month is January 2017, enter

01/01/17.In the Amount Received field, type the amount of the deposit.

In the Acct No. field, type or select the bank account you want to reconcile. This must be the account entered in step 2.

(Australia) In the Tax field, select the N-T tax code.

(New Zealand) In the GST field, select the N-T GST code

Enter details of the deposit in the Memo field.

Click Record.

Repeat from step 3 for each uncleared deposit.

When you're done, continue with 3. Reconcile.