An ABN Branch (also known as a GST Branch) is used if part of your business needs to account for GST separately from its parent entity.

Even if your business doesn't account for GST this way, if your business has an ABN you'll also have an ABN branch number. If you don't have multiple branches, your ABN branch number will typically be 1 or 2 – but check with the ATO if you're unsure.

Learn more about GST branch eligibility and registration.

To enter your ABN branch in AccountRight

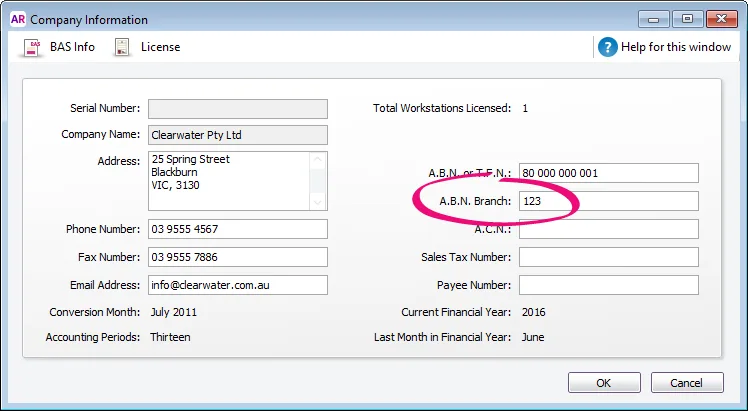

Go to the Setup menu and choose Company Information. The Company Information window appears.

Enter the A.B.N Branch. If you don't need to report on multiple branches enter 1 or 2 as your ABN branch number. If you're still not sure what your ABN branch number is, check with your accounting advisor or contact the ATO.

Click OK.

FAQs

Why am I getting the error CMN.ATO.AS.EM139 when setting up my activity statements?

This error means there's a problem with the ABN Branch number in AccountRight. To check this number, go to the Setup menu, choose Company Information and check the number entered in the A.B.N Branch field.

This number needs to be from 1-999. If you're not sure what your ABN branch number is, check with your accounting advisor or contact the ATO.