The Undeposited Funds account is used to track all the payments you receive by cash, cheque and credit card, before they are deposited to your bank account. When you visit your bank to deposit the receipts (or your credit card company deposits the funds), you can record that deposit by transferring the payments from the Undeposited Funds account to your AccountRight bank account.

This makes reconciling your bank account easy, because you'll be able to match up the bank statement deposit amount with the amounts you've recorded in AccountRight.

Example:

Say you receive five credit card payments in one day. You expect those funds to be deposited into your bank account the next day as one lump sum.

If you were to record those individual payments in AccountRight straight to your bank account, it could be difficult to match up the five payments to the lump sum figure that'll be shown on your bank statement.

A better way would be to first record the five credit card payments using the Undeposited Funds account, and the next day, transfer the total value of those payments from the Undeposited Funds account to your bank account. It would then be easier to reconcile the bank statement with your AccountRight records.

How to get started

1. Set up the linked account

When you created your company file, an Undeposited Funds account was set up for you. You can check the account that'll be used, by going to the Setup menu and choosing Linked Accounts > Accounts & Banking Accounts. You shouldn't need to change this account, unless it's already being used for other purposes.

2. Record transactions using the Undeposited Funds account

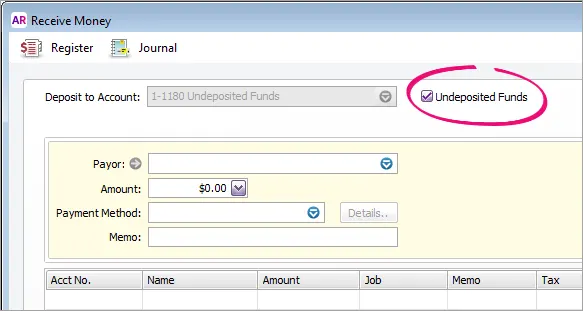

Whenever you receive a payment that isn't directly deposited into your bank account, allocate it to the Undeposited Funds account as shown below.

Note that if you record receipts using the Bank Register window, you will need to select the Undeposited Funds account yourself.

If most of the payments you receive are not deposited directly into your bank account, you can choose to make the Undeposited Funds account your default account when recording receipts.

To do this, go to the Setup menu and choose Preferences. In the Banking tab, select the When I Receive Money I Prefer To Group It With Other Undeposited Funds preference. Note that this will not apply to the Bank Register window.

3. Prepare a bank deposit

When receipts that you have recorded to the Undeposited Funds account are actually deposited to your bank account, you need to record the bank deposit in AccountRight. This clears the funds from the Undeposited Funds account.

For information about this step, see Preparing a bank deposit.