When you know that a debt will not be recovered, you need to write it off. Your company file should have a ‘Bad Debt’ expense account to which you can allocate these amounts. Or, if you account for bad debts by posting a provision to an asset account, you can use AccountRight's ‘Provision for Bad Debts’ asset account.

You can create new bad debts accounts if you like, but it might be best to first check with your accounting advisor for clarification. Learn how to create detail and header accounts.

To write off a bad debt, you enter a negative dollar value sale to create a credit note that can be used to close the sale you won’t be receiving payment for. This enables you to adjust the customer's balance.

Need to write of debt in a previous financial year? You'll need to roll back the financial year first.

Need to write off some stock? Record an inventory adjustment.

To write off a bad debt

Go to the Sales command centre and click Enter Sales. The Sales window appears.

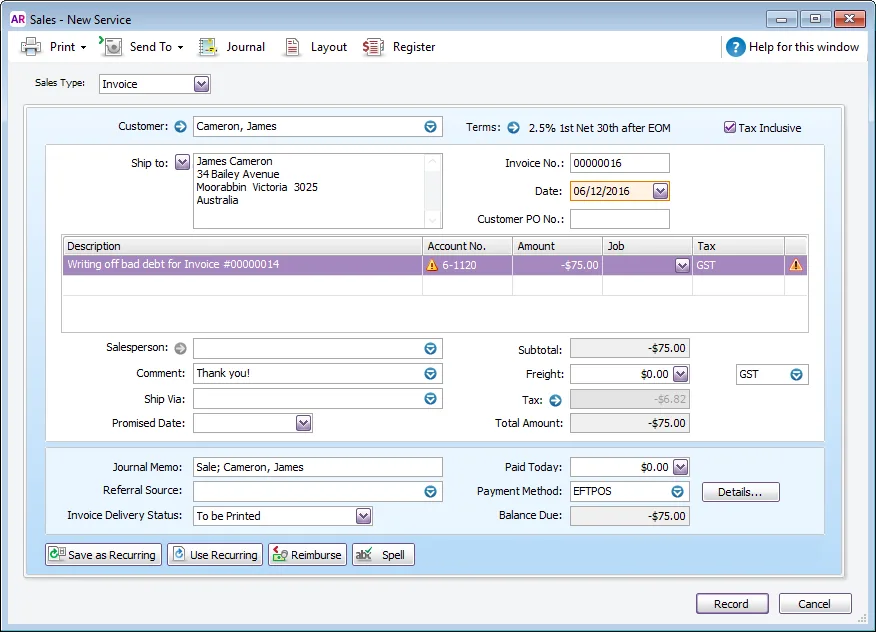

Enter the customer’s details.

Click Layout, choose Service, and then click OK.

In the Description field, type a description of the transaction.

In the Acct No. field, enter the expense account for Bad Debts or the Provision for Bad Debts asset account. If a warning displays about the account you've selected, this is OK to ignore.

In the Amount field, type the bad debt amount as a negative number.

In the Tax (Australia) or GST (New Zealand) field, enter the required tax/GST code. Typically this will be the same tax/GST code as the invoice you're writing off. Here's our example:

Click Record.

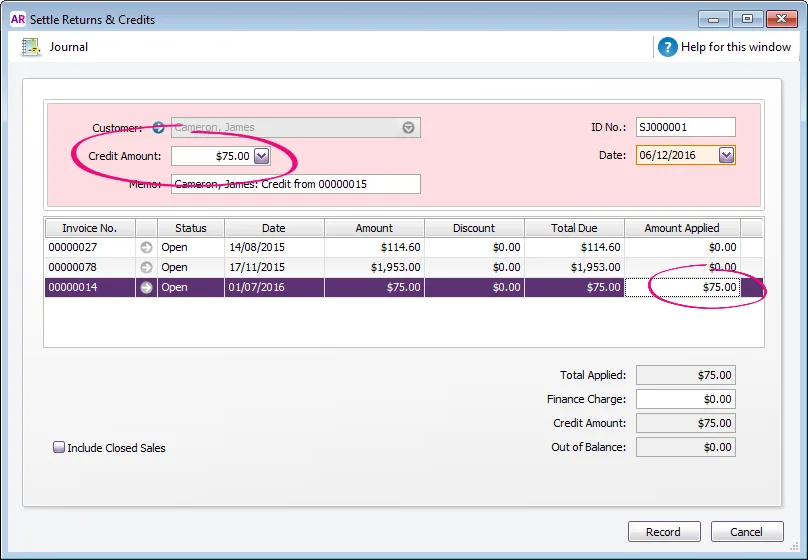

Go to the Sales command centre and click Sales Register.

Click the Returns & Credits tab.

Click to select the credit note created above then click Apply to Sale.

In the Settle Returns and Credits window, apply the credit against the original open invoice and click Record. Here's our example:

Can't see any outstanding invoices?

If you're using categories, make sure the customer credit has the same category allocated as the outstanding invoice. This ensures the bill will display when applying the credit.

For more information, see creating and settling customer credits.