https://help.myob.com/wiki/x/fgpNAQ

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

You can make changes to most sales (invoices, quotes and orders) in a few quick steps...except for these:

- sales recorded in a closed financial year. There might be times when you need to enter adjustments for the last financial year. If you've already closed that year, you can still make changes by rolling back the financial year.

- sales recorded in a locked period. To change a sale in a locked period, you first need to unlock the period. However, before making a change, consider how it will affect your accounts and tax reports (such as the GST you have reported).

If you need to change how a sale looks when printed or emailed, see Personalising invoices.

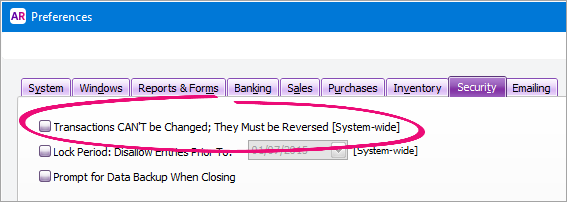

Before you can change a sale, set the AccountRight security preference which controls if transactions can be changed.

Need to convert a quote to an order or invoice? See Changing a sale's type.

To set your security preference

If a sale transaction has a white zoom arrow  next to it, it means it can't be changed. To make it changeable (so it has a blue zoom arrow

next to it, it means it can't be changed. To make it changeable (so it has a blue zoom arrow  ), set the following security preference. If your user role allows you to change preferences, you can change this option at any time.

), set the following security preference. If your user role allows you to change preferences, you can change this option at any time.

- Go to the Setup menu and choose Preferences.

- Click the Security tab.

- Deselect the option Transactions CAN'T be Changed; They Must be reversed.

- Click OK.

To change a sale

- Go to the Sales command centre and click Sales Register.

- Click the applicable tab depending on the transaction you want to change.

- (Optional) Set the Search By and Dated From and To fields to narrow down your search.

- Click the zoom arrow to open the transaction you want to change.

- Make the necessary changes.

- Click OK.

You can also add and delete lines on an invoice you've recorded.

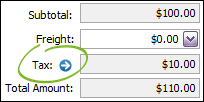

Avoid changing the calculated Tax/GST

If you change a sale's calculated tax/GST using the zoom arrow next to the Tax/GST field, BAS and GST Return calculations could be affected.

To change the customer on a recorded sale

If you need to change the customer on a recorded invoice, here's the fastest way to do it:

- Find and open the invoice to be modified and save it as a recurring transaction.

- Delete the original invoice (open the invoice, go to the Edit menu and choose Delete Sale. Learn more about deleting invoices.)

- Go to Lists > Recurring Transactions, select the recurring transaction you just created and click Use Recurring. A new sale transaction is displayed.

- Select the correct customer for the transaction.

- If this message appears, click Cancel.

- Ensure all details of the invoice are correct then click Record.

- Go to Lists > Recurring Transactions, select the recurring transaction then click Delete.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.