Before closing a financial year, make sure you've:

entered any required transactions and adjustments as instructed by your accountant (invite your accountant to your file so they can do this for you)

created a backup of your company file. You'll be prompted to do this when closing the financial year, but you can choose to create a backup whenever you like.

If you've done all of the above, you're now ready to close the financial year.

Also, you don’t need to close your financial year at any particular time. You can continue to use your company file after the last month of your current financial year.

When you close the financial year no transactions are affected, but the following will occur:

The monthly totals for all accounts are changed to last year categories. If last year amounts already existed, those amounts will be replaced.

The balance of your current-year earnings account is transferred to your retained earnings account.

The balances of your income, cost of sales, expense, other income and other expense accounts are returned to zero.

The new financial year will be started in your company file.

To close a financial year

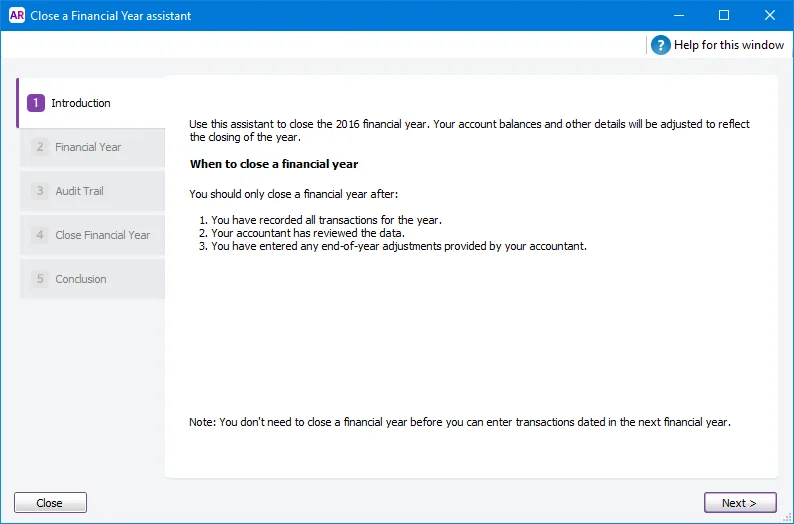

Go to the File menu and choose Close a Year > Close a Financial Year. The Close a Financial Year assistant opens.

Follow the on-screen instructions. You shouldn't need to make any changes, however, note the following:

If required, you can change the last month of your financial year. But, before you do, read the FAQ below.

If you've upgraded from a classic version of AccountRight, you can purge old audit trail entries by selecting the Remove audit trail entries option in step 2 of the Close a Financial Year assistant. If you have a lot of transactions, this will make your file smaller. Note that the new AccountRight doesn't use this feature as it tracks your audit history in a more efficient way.

Make a backup of your company file when prompted to do so.

If you want to prevent any transactions being entered in the closed financial year, you'll need to lock it – for the steps, see Lock a period.

FAQs

How do I change the last month of a financial year?

You can change the last month of your financial year when you close a financial year.

Changing your last month will result in a shorter or longer current financial year (it depends on the month you're moving from and to). Check with your accountant about reporting requirements for a short or long financial year.

When to change your last month

When you change your last month, you shift your 12-month financial year period. As such, you'll need to consider when you can enter transactions in your new financial year. When changing your last month, you'll see a proposed new financial year. Check that you can enter transactions in this year.

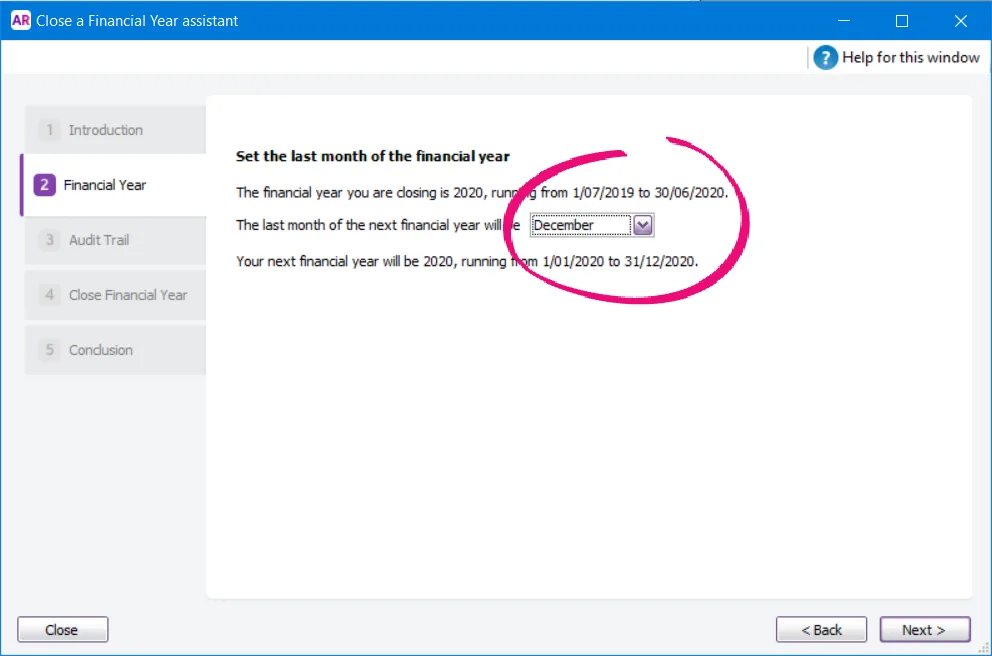

In the following example, changing the last month to December shifts the 12-month financial year from 1 July 2019—30 June 2020, to 1 January 2020—31 December 2020.

As transactions can only be entered from 1 January 2020, you would only change the last month after all transactions have been entered for December 2019.

How to change your last month

Before changing your last month, enter all transactions for your previous financial year and complete your end of financial year tasks.

You can change the last month of your financial year in step 2 of the Close a Financial Year assistant. After changing the last month, check the proposed financial year as it shows you when you can record the first transaction in the new financial year. And don't forget to make a backup before you make this change.

Can I enter transactions in a financial year after I close it?

You sure can. For all the details see Transacting in closed financial years.

Can I close multiple financial years?

If you haven't closed the financial year in a while, you can repeat the above process to close multiple years (doing it one year at a time).