AccountRight Plus and Premier only

If you need to track benefits (other than superannuation) that you pay on behalf of your employees, set them up as Employer Expense categories.

To use the Pay Super feature, you must assign Superannuation-type payroll categories to your employees, not Employer Expense categories.

Set up an employer expense category

Go to the Payroll command centre and click Payroll Categories. The Payroll Category List window appears.

Click the Expenses tab.

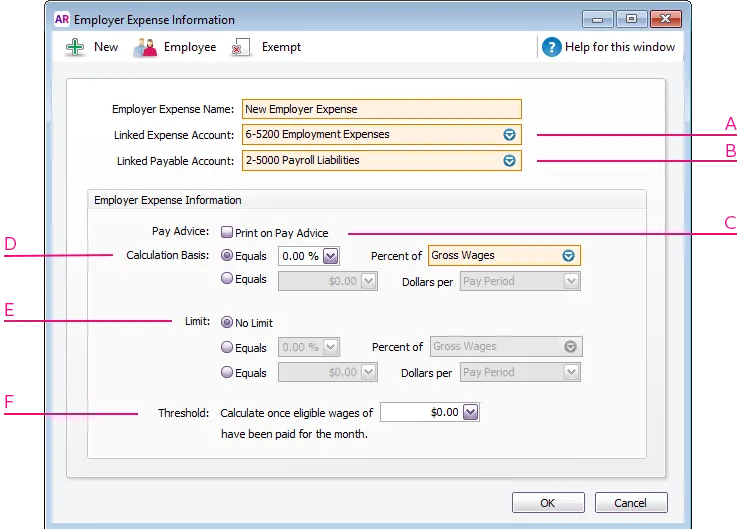

Click New. The Employer Expense Information window appears.

Type a name for the expense.

Make the required selections for the payroll category.

A - Linked Expense Account is the account to which you are charging this expense.

The Default Employer Expense Account you specified when setting up payroll appears as the default.

B - Linked Payable Account is the liability account to which your expense will accrue. The Default Tax/Deductions Payable Account you specified when setting up payroll appears as the default.

C - If you want employer expense amounts to appear on employees’ pay advice, select the Print on Pay Advice option.

D - Calculation Basis can be one of the following choices:

Equals x Percent of allows you to enter a percentage of any of the wage or deduction categories, or a percentage of all the wage categories (by choosing Gross Wages). This expense will be charged until the expense limit is reached.

Equals x Dollars per allows you to enter the specified amount per pay period, per month or per year until the limit is reached.

E - Limits can be used to place a ceiling on the expense. For example, for an expense of $30 per pay period and a limit of 2% of gross wages, a pay with gross wages of $1,000 yields an expense of only $20 (i.e. 2%). Limit may be one of the following choices:

No Limit signifies no limit to the expense for this category.

Equals x Percent of results in the maximum expense being a percentage of a wage or deduction category or of all wage categories. For example, an expense may be $20 per pay period up to a maximum of 20% of the employee’s salary.

Equals x Dollars per results in the maximum expense being a fixed dollar amount per pay period, per month or per year. For example, an expense might be 5% of the employee’s gross wages up to $1,000 per year.

F - If an employer expense is only payable if wages exceed a specified amount per month. Enter this amount in the Threshold field. When determining if the gross wages on a pay exceed the minimum wage threshold per month, other pays processed in that month are included.

Click Employee. The Linked Employees window appears.

Select the employees whose pay will include this category, then click OK.

Click Exempt. The Exemptions window appears for the payroll category you are creating. If the Exempt button is inactive it means the expense category is not set up to calculate on a percentage basis (see D in the table above).

Select the taxes and deductions that do not apply to the new category.

Click OK.

Click OK to return to the Payroll Category List window.