A lump sum E is an amount of back payment that accrued, or was payable, more than 12 months before the date of payment and is $1200 or more. If you're not sure if a back payment should be reported to the ATO as a gross payment or lump sum E, speak to your accounting advisor or the ATO.

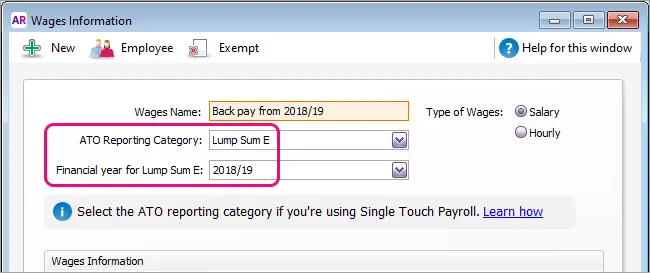

For Single Touch Payroll (STP) Phase 2, if you assign Lump Sum E as the ATO reporting category, you'll need to choose the Financial year for Lump Sum E. For example, it might be for back pay that accrued in the 2018/19 financial year. Learn more about STP Phase 2 on the ATO website.

Lump sum E payments which span multiple years

If a lump sum E payment spans multiple financial years, such as back pay for 2017, 2018 and 2019, you'll need to create separate payroll categories for each financial year the payment relates to.

Before moving from STP Phase 1 to STP Phase 2

Before you can start reporting to the ATO for STP Phase 2, you'll need to do something about any lump sum E payments you've already paid.

For each lump sum E payment you've already paid, you'll need to work out if:

the payment related to one financial year

Example

You paid an employee a lump sum E payment of $3300 in July 2021 and reported it to the ATO via STP. This payment related to back pay which accrued over the 2019/20 financial year.the payment related to multiple financial years

Example

You paid an employee a lump sum E payment of $3300 in July 2021 and reported it to the ATO via STP. This payment related to back pay which accrued over two financial years: 2018/19 and 2019/20. You work out how much of the $3300 accrued over each financial year:$1300 accrued in 2018/19 (between 01/7/2018 and 30/06/2019)

$2000 accrued in 2019/20 (between 01/7/2019 and 30/06/2020)

you've created multiple payroll categories for lump sum payments that relate to the same financial year

Example

You created a lump sum E payroll category for Mary to pay her $3300 for back pay which accrued in the 2019/20 financial year. You also created a separate lump sum E payroll category for Peter to pay him $2500 for back pay which also accrued in the 2019/20 financial year.

Here's how to handle each scenario.

Lump sum E related to one financial year

When you move from STP Phase 1 to STP Phase 2, you'll be prompted to enter a financial year against your Lump Sum E wage categories.

If you're not sure if a back payment should be reported to the ATO as a gross payment or lump sum E, speak to your accounting advisor or the ATO.

As you won't be able to use this payroll category again, you should remove it from your employees.

To remove the lump sum E wage category from all employees

Go to the Payroll command centre and click Payroll Categories.

On the Wages tab, click the blue zoom arrow > to open the lump sum E wage category.

Click Employee.

Deselect all employees and click OK.

Click OK to save your changes.

Lump sum E related to multiple financial years

To advise the ATO of the financial years relating to the lump sum E payments you've made, you'll need to:

create a wage category for each financial year a payment relates to

enter a correction pay to reallocate the original lump sum payment to the new wage category, then

remove the original lump sum E wage category from all employees as you won't be using it again.

Did you pay the lump sum E payment in a previous payroll year?

You only need to complete task 3 below to remove the lump sum E wage category from all employees.

1. Create lump sum E payroll categories for each financial year

You'll need to create a payroll category for each financial

year that your lump sum E payments relate to. Using our example above,

we'd need to create two payroll categories.

Go to the Payroll command centre and click Payroll Categories.

On the Wages tab, click New.

Give the wage category a meaningful Name, like like 'Lump Sum E 2018/19'.

For the ATO Reporting Category, choose Lump Sum E.

For the ATO Reporting Category (Phase 2), choose Lump Sum E.

Choose the Financial Year the lump sum E relates to.

For the Type of Wages, select Salary.

Click Employee.

Choose the employees who were paid a lump sum E payment for the specified financial year and click OK.

Click OK to save the new wage category.

Repeat these steps to create additional payroll categories for other financial years.

2. Enter a correction pay

You can advise the ATO about the

financial years related to your lump sum E payments using a correction

pay. This is similar to a regular pay, but instead of paying the

employee you'll be removing the lump sum payment from the original wage

category and adding it to the new wage category you've created.

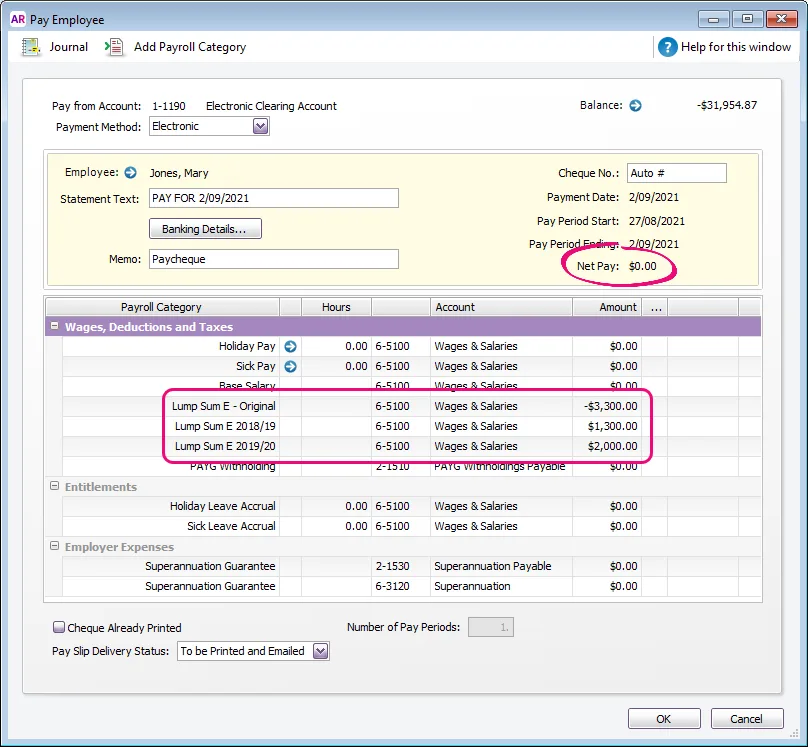

This will result in a $0 net pay and the lump sum E financial year information will be sent to the ATO.

Start a new pay run for the employee (Payroll > Process Payroll).

Choose the pay run details:

Select the option Process individual employee and choose the employee who received the original lump sum E payment.

Choose the same Payment Date, Pay period start and Pay period end as the original lump sum E payment.

Click Next.

Click the blue zoom arrow > to edit the employee's pay.

Enter the amount of the lump sum E payment as a negative amount against the original wage category you used. In our example this is -3,300.00

Enter the respective amounts of the lump sum E payment for each financial year as positive amounts against the new wage categories. In our example this is 1,300.00 and 2,000.00

Clear all other hours and amounts from the pay to ensure they're zero.

Here's our example - notice the net value of the pay is $0.00

Finish processing the pay as normal, which includes confirming that you're voiding the pay and sending it to the ATO for STP reporting.

3. Remove the original lump sum E wage category from all employees

You won't be using the original lump sum E wage category any longer, so it's a good idea to remove it from all your employees.

Go to the Payroll command centre and click Payroll Categories.

On the Wages tab, click the blue zoom arrow > to open the original lump sum E wage category.

Click Employee.

Deselect all employees and click OK.

Click OK to save your changes.

Multiple lump sum E payroll categories which relate to the same financial year

Because you can't specify the same financial year in multiple lump sum E payroll categories, to advise the ATO of these lump sum E payments you've made, you'll need to:

create a new wage category for the financial year the payments related to

enter a correction pay to reallocate the original lump sum payments to the new wage category, then

remove the original lump sum E wage categories from all employees as you won't be using them again.

Did you pay the lump sum E payment in a previous payroll year?

You only need to complete task 3 below to remove the lump sum E wage category from all employees.

1. Create a lump sum E payroll category for the financial year the payments related to

You'll need to create a wage payroll category for the financial

year that your lump sum E payments related to — using our example above, this would be the 2019/20 financial year.

Go to the Payroll command centre and click Payroll Categories.

On the Wages tab, click New.

Give the wage category a meaningful Name, like 'Lump Sum E 2019/20'.

For the ATO Reporting Category, choose Lump Sum E.

For the ATO Reporting Category (Phase 2), choose Lump Sum E.

Choose the Financial Year the lump sum E relates to.

For the Type of Wages, select Salary.

Click Employee.

Choose the employees who were paid a lump sum E payment for the specified financial year and click OK.

Click OK to save the new wage category.

2. Enter a correction pay

You can now use a correction pay to advise the ATO about the financial year the lump sum payments related to. This is similar to a regular pay, but instead of paying the employee you'll be removing the lump sum payment from the original wage category and adding it to the new wage category you've created.

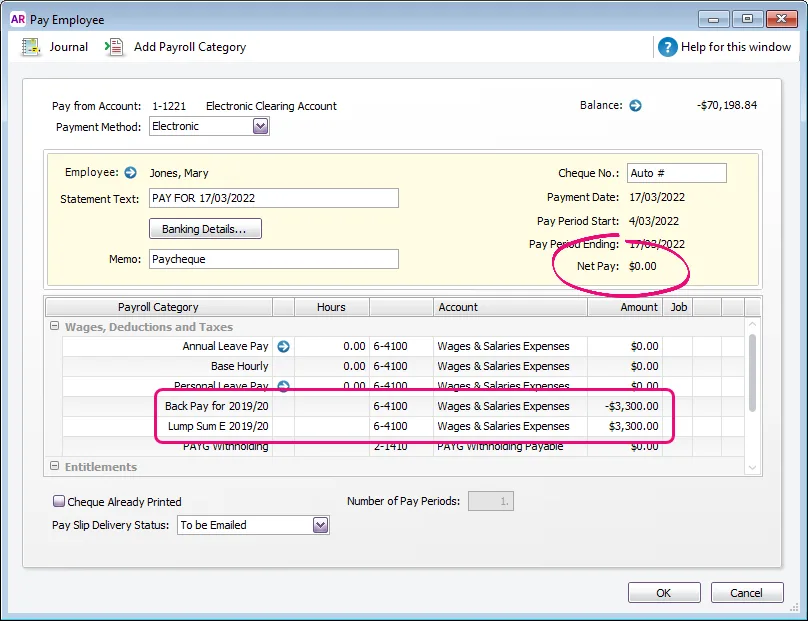

This will result in a $0 net pay and the lump sum E financial year information will be sent to the ATO.

Start a new pay run for the employee (Payroll > Process Payroll).

Choose the pay run details:

Select the option Process individual employee and choose the employee who received the original lump sum E payment.

Choose the same Payment Date, Pay period start and Pay period end as the original lump sum E payment.

Click Next.

Click the blue zoom arrow > to edit the employee's pay.

Enter the amount of the lump sum E payment as a negative amount against the original wage category you used. In our example for Mary, this is -3,300.00

Enter the same value as a positive amount against the new lump sum E wage category. In our example this would be 3,300.00

Clear all other hours and amounts from the pay to ensure they're zero.

Here's our example - notice the net value of the pay is $0.00

Click OK.

Finish processing the pay as normal, which includes confirming that you're voiding pays and sending it to the ATO for STP reporting.

Repeat for the other employees who were paid a lump sum E payment for the specified financial year.

3. Remove the original lump sum E wage categories from all employees

You won't be using the original lump sum E wage categories any

longer, so it's a good idea to remove them from all your employees.

Go to the Payroll command centre and click Payroll Categories.

On the Wages tab, click the blue zoom arrow > to open the original lump sum E wage category.

Click Employee.

Deselect all employees and click OK.

Repeat steps 2-4 for the other original lump sum E wage category.

Click OK to save your changes.