Analysing ageing periods can help you monitor how much money your customers owe you, and identify when money is due to come into your business. You can use this information for a number of purposes:

Identify the customers who regularly pay late. You might then send out reminder letters or adjust their credit limits accordingly.

See which customers whose payments are most overdue, or which ones owe you the most.

Check on your cash flow. If a lot of money is overdue now, you might end up with cash flow problems later. By monitoring the ageing of amounts, you can identify potential cash flow problems and try to fix them.

There are many reports and tools in AccountRight that show your aged invoices, this includes customer statements, sales reports (such as Aged Receivables), the To Do List and Business Insights.

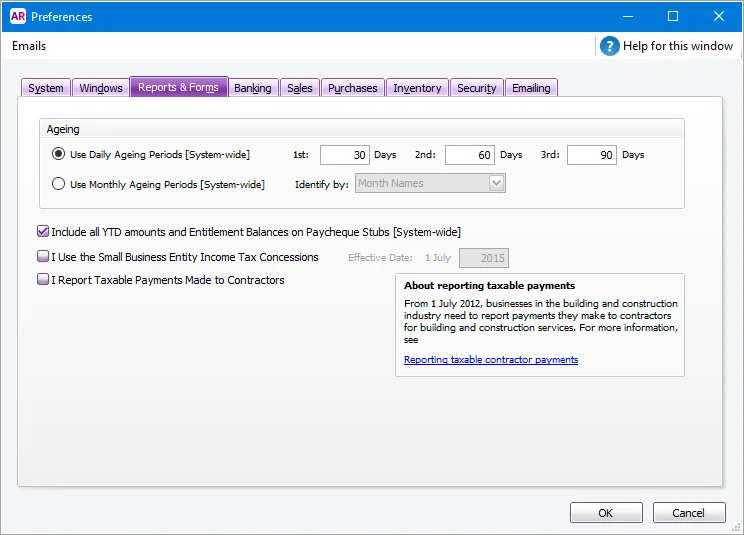

To change between Daily and Monthly ageing

Go to the Setup menu and choose Preferences. The Preferences window appears.

Click the Reports & Forms tab. You can now select your ageing method.

Ageing example

Assume that you want to age the following invoices as at 31 July 2023 (or any other date in July):

Customer | Date | Amount | Terms | Due |

|---|---|---|---|---|

A-Z Stationery | 1 Jul 17 | 123.45 | 21 days from Inv | 22 Jul 23 |

A-Z Stationery | 14 Jul 17 | 200.50 | 21 days from Inv | 4 Aug 23 |

Chelsea Mosset | 2 Jul 23 | 400.24 | C.O.D. | 2 Jul 23 |

Footloose Dance Studio | 30 Apr 23 | 25.00 | 30 days from Inv | 30 May 23 |

Footloose Dance Studio | 12 May 23 | 112.30 | 30 days from Inv | 11 Jun 23 |

Footloose Dance Studio | 29 Jun 23 | 149.30 | 30 days from Inv | 29 Jul 23 |

Footloose Dance Studio | 30 Jun 23 | 20.35 | 30 days from Inv | 30 Jul 23 |

Footloose Dance Studio | 6 Jul 23 | 90.70 | 30 days from Inv | 5 Aug 23 |

Footloose Dance Studio | 21 Jul 23 | 85.12 | 30 days from Inv | 20 Aug 23 |

My Town Realty | 26 May 23 | 210.45 | 7 days from EOM | 7 Jun 23 |

My Town Realty | 10 Jun 23 | 142.40 | 7 days from EOM | 7 Jul 23 |

The examples below show the two ageing methods you can use when reporting aged receivables:

Number of days since invoice date

Days overdue using invoice terms.

Ageing by invoice date using month names

Assume you age invoices monthly and identify your ageing periods by month names.

If you age these invoices by invoice date, the invoices will be aged as follows:

| Total | July | June | May | Pre-May |

|---|---|---|---|---|---|

A-Z Stationery | 323.95 | 323.95 | 0.00 | 0.00 | 0.00 |

Chelsea Mosset | 400.24 | 400.24 | 0.00 | 0.00 | 0.00 |

Footloose Dance Studio | 482.77 | 175.82 | 169.65 | 112.30 | 25.00 |

My Town Realty | 352.85 | 0.00 | 142.40 | 210.45 | 0.00 |

Totals | 1,559.81 | 900.01 | 312.05 | 322.75 | 25.00 |

Ageing Percent | 0.00 | 57.7% | 20.0% | 20.7% | 1.6% |

In this example, each ageing period represents the months when the invoices were generated.

Ageing by invoice date using month numbers

Assume you identify your ageing periods by month numbers.

The results above would be the same as per month names, but with different headings, as follows:

| Total | 1 Month | 2 Months | 3 Months | 3+ Months |

|---|---|---|---|---|---|

A-Z Stationery | 323.95 | 323.95 | 0.00 | 0.00 | 0.00 |

Chelsea Mosset | 400.24 | 400.24 | 0.00 | 0.00 | 0.00 |

Footloose Dance Studio | 482.77 | 175.82 | 169.65 | 112.30 | 25.00 |

My Town Realty | 352.85 | 0.00 | 142.40 | 210.45 | 0.00 |

Totals | 1,559.81 | 900.01 | 312.05 | 322.75 | 25.00 |

Ageing Percent | 0.00 | 57.7% | 20.0% | 20.7% | 1.6% |

In this example, each ageing period represents the number of months since the invoice date.

Ageing by invoice terms using month names

If you were to age the transactions based on their invoice terms, the results would look like this:

| Total | Current | July | June | Pre-June |

|---|---|---|---|---|---|

A-Z Stationery | 323.95 | 200.50 | 123.45 | 0.00 | 0.00 |

Chelsea Mosset | 400.24 | 0.00 | 400.24 | 0.00 | 0.00 |

Footloose Dance Studio | 482.77 | 175.82 | 169.65 | 112.30 | 25.00 |

My Town Realty | 352.85 | 0.00 | 142.40 | 210.45 | 0.00 |

Totals | 1,559.81 | 376.32 | 835.74 | 322.75 | 25.00 |

Ageing Percent | 0.00 | 24.1% | 53.6% | 20.7% | 1.6% |

In this example, each ageing period represents the month in which the invoice falls due.

Ageing by invoice terms using month number

If you were to age the transactions based on their invoice terms and using month numbers, the results would look like this:

| Total | Current | 1 Month | 2 Months | 2+ Months |

|---|---|---|---|---|---|

A-Z Stationery | 323.95 | 200.50 | 123.45 | 0.00 | 0.00 |

Chelsea Mosset | 400.24 | 0.00 | 400.24 | 0.00 | 0.00 |

Footloose Dance Studio | 482.77 | 175.82 | 169.65 | 112.30 | 25.00 |

My Town Realty | 352.85 | 0.00 | 142.40 | 210.45 | 0.00 |

Totals | 1,559.81 | 376.32 | 835.74 | 322.75 | 25.00 |

Ageing Percent | 0.00 | 24.1% | 53.6% | 20.7% | 1.6% |

In this example, each ageing period represents the number of months by which the invoices assigned to the period are overdue.