Latest tax tables

If you have an AccountRight subscription and you're using the latest version, the new tax tables will be used in your software for pays with a payment date of July 1 and later.

The ATO release updated tax tables, also called the tax scales, each year. They contain the rates of tax to be applied to your employees' pays so the correct amount of tax is withheld.

If you're using the latest AccountRight version and you're connected to the internet, you'll always have access to the most up to date tax tables.

When you add an employee to AccountRight, you'll specify which tax table applies to them, such as Tax Free Threshold, Foreign Resident, etc. Learn more about assigning tax tables to your employees.

Tax table automation

When you process a pay, AccountRight looks at the Payment Date and checks if you have the required tax tables in your file. If you don't, AccountRight will download them.

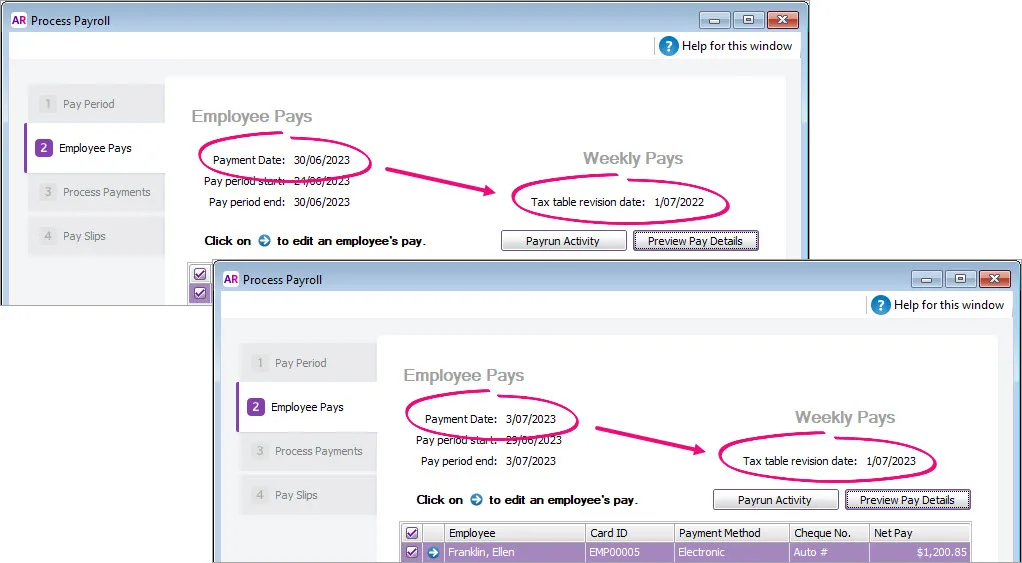

This means if the Payment Date is 30 June or earlier, the 2022 tax tables will be used. But if the Payment Date is 1 July or later, the 2023 tax tables will be used.

You'll see which tax tables are being used during the payroll process.

In a nutshell—you choose the Payment Date and AccountRight chooses which tax tables to use. This keeps you in the good books with the ATO—and your employees.

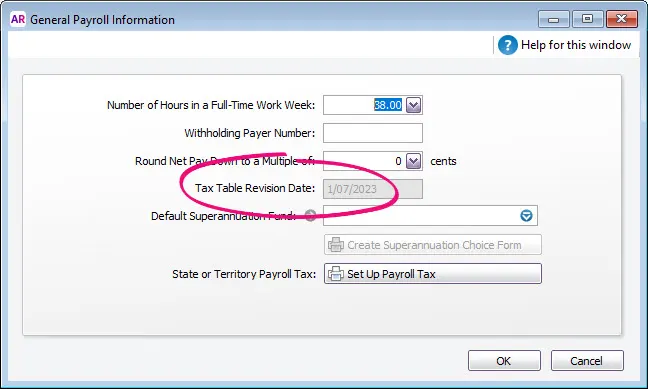

The Tax Table Revision Date shown in AccountRight (Setup menu > General Payroll Information) is based on your last recorded pay.

So once you've processed a pay with a Payment Date of 1 July 2023 or later, the Tax Table Revision Date will be updated:

Not connected to the internet?

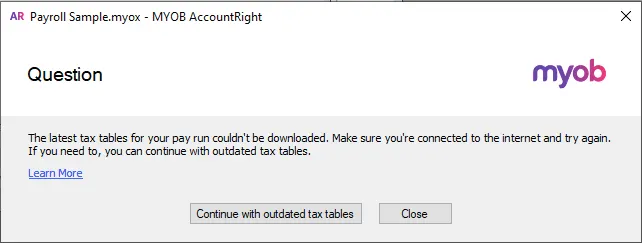

For AccountRight to access to the most up to date tax tables, you'll need to be connected to the internet. If you're not, AccountRight won't be able to download the latest tax tables.

If you are connected to the internet but AccountRight can't download the latest tax tables, there might be a temporary glitch at our end. Either way, make sure you're connected to the internet and try again.

You can choose to continue processing the pay using last year's (outdated) tax tables, but the wrong amount of tax might be calculated.

By using the latest tax tables you'll remain compliant and avoid a possible tax debt for your employees.

FAQs

How do I handle PAYG Withholding Variations?

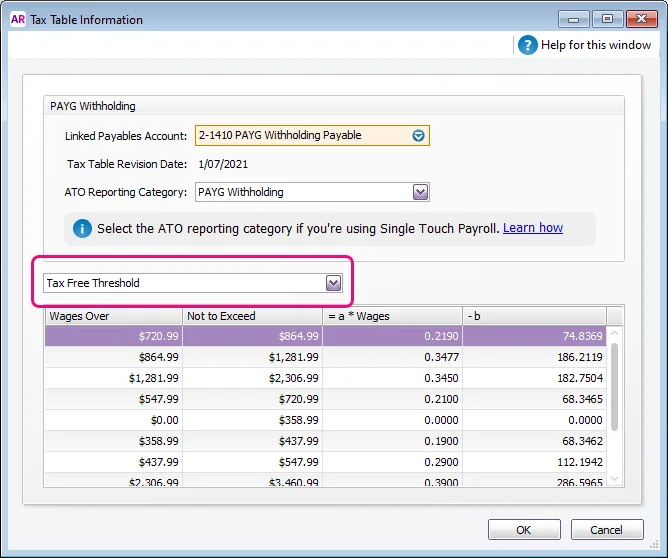

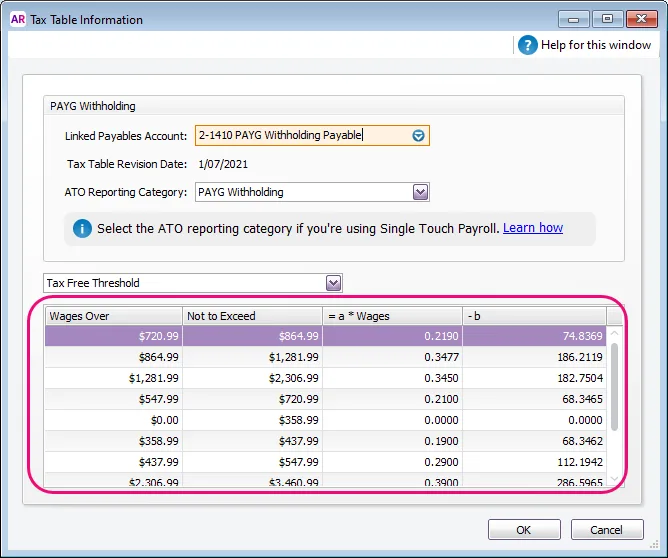

Yes, if you're keen to look under the hood you can see the tax scales in AccountRight which are provided by the ATO.

Go to the Payroll command centre > Payroll Categories > Taxes tab.

Click the blue zoom ( ) arrow to open the PAYG Withholding category.

Use the dropdown arrow to choose a tax table and see the tax scales.

The image above shows the tax scales for 2021 and is not current.

How is PAYG calculated?

You don't need to worry about this bit, but if you're interested, here's how PAYG is calculated using the tax scales in the PAYG Withholding category (Payroll command centre > Payroll Categories > Taxes tab > click the blue zoom arrow to open the PAYG Withholding category).

PAYG withholdings = (Weekly wage amount x a) - b

Using the values shown in the 2021 example above (which isn't using the latest tax tables) for an employee that has been assigned the Tax Free Threshold tax table and a fortnightly wage of $1500.

The calculation would be as follows:

Fortnightly wage = $1500

"a" coefficient = 0.3450

"b" coefficient = 182.7504

so, ($1500 x 0.3450) - 182.7504 = $334.7496

The image and example above use the 2021 tax scales which are not current.

Note that when processing a pay using this example, the PAYG amount will be rounded to $334.75, or it might be different by a few cents if you've chosen to round the net pay (Setup menu > General Payroll Information).

The tax table information is set by the ATO. So, if you have any queries, please ask the ATO (or use their Tax Withheld Calculator).