- Created by StevenR, last modified by RonT on Dec 13, 2022

https://help.myob.com/wiki/x/XABy

How satisfied are you with our online help?*

Just these help pages, not phone support or the product itself

Why did you give this rating?

Anything else you want to tell us about the help?

AccountRight Plus and Premier, Australia only

If you're registered for Single Touch Payroll (STP), there's no need to prepare payment summaries so we've removed that option from the Payroll command centre. If an employee needs a copy of their income statement (payment summary), they can access these details through myGov. Visit the ATO for more information.

Stay compliant by using the latest AccountRight version, and see how we've simplifed your end of payroll year.

If you're registered for STP but you need to complete a payment summary (confirm with the ATO if you're not sure), you'll need to complete a manual payment summary for the employee using forms available from the ATO.

Payment summaries go to your employees, and the Payment Summary Annual Report (known as the EMPDUPE file) needs to be lodged with the ATO.

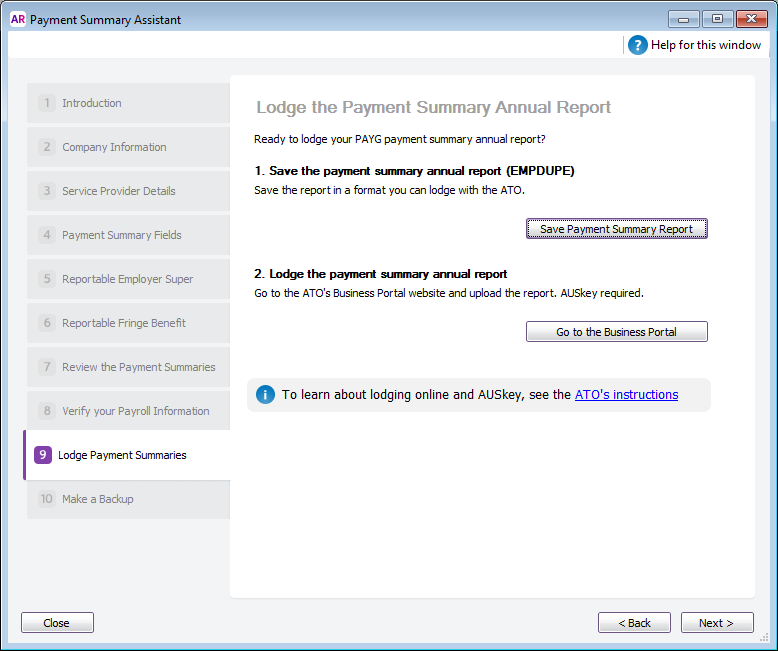

Assuming you've checked your payroll information in the Verify your Payroll Information step of the Payment Summary Assistant, you’re now ready to lodge the Payment Summary Annual Report with the ATO. The report is saved as a text file that’s known as the EMPDUPE file.

Click Save Payment Summary Report and select the location where you want to save the EMPDUPE file.

To submit your EMPDUPE file, use the ATO’s Business Portal website.

Log in to the Business Portal and then go to the Lodge file page (you'll see it in the menu), select Lodge > Browse and then find and select your EMPDUPE file in the window that appears.

To access the Business Portal you need to use Google Chrome or Mozilla Firefox. Internet Explorer and Microsoft Edge browsers are not currently supported. To access the business portal, open Google Chrome or Mozilla Firefox and enter the following address into the address bar: https://bp.ato.gov.au

After you've saved the EMPDUPE file, make a backup.

Payment summary lodgement FAQs

Why does the ATO Business Portal advise there are more records being uploaded in my EMPDUPE file than I was expecting?

When you prepare your payment summaries and run the Verification Report, the number of records being created will be shown. However, when you upload the EMPDUPE file to the ATO, it will advise there are approximately 6 more records than what you expected. These 6 additional records in the file are not employee Payment Summary records, but are required in the file to allow it to successfully upload.

Why am I receiving a warning about WM02 when I lodge my payment summary?

After lodging your payment summary annual report (EMPDUPE) via the ATO business portal, a confirmation report is generated.

If your confirmation report displays a WM02 warning about "street address line 2", you can ignore this warning. It's simply advising that the second line of your business address is blank. For most addresses this is normal.

This warning will not prevent your EMPDUPE file from lodging successfully. Check your confirmation report to ensure your EMPDUPE file lodgement was successful.

Do I also send the ATO the payment summaries?

No, you only lodge the Payment Summary Annual Report (EMPDUPE file) with the ATO . The payment summaries are for your employees.

Why am I getting the message "The file name is not valid" when saving the EMPDUPE file?

This message occurs if your company file name contains special characters, such as \ / : * ? " < > |

Simply remove all special characters from the EMPDUPE file name then click Save.

How do I find my saved EMPDUPE file?

By default, your EMPDUPE file is saved here:

PC Edition: C:\Users\<user.name>\Documents\MYOB\AccountRight\201x.x

Server Edition: C:\Users\Public\Documents\MYOB\AccountRight\201x.x

You can also use the Windows search tool to find it.

- Simultaneously press the Windows

and E keys on your keyboard (the Windows

and E keys on your keyboard (the Windows key is between the Ctrl and Alt keys). The File Explorer appears.

key is between the Ctrl and Alt keys). The File Explorer appears. - In the left panel, click Local Disk (C:).

- In the search box (in the top-right corner) type .A01. This will show all files with a .A01 file extension, including the EMPDUPE file.

How do I recreate the EMPDUPE file?

If you need to create (or recreate) the EMPDUPE file after you've provided your employees their payment summaries, providing you haven't closed the payroll year you can run through the Payment Summary Assistant again to create and save the file.

If you have closed the payroll year, you'll need to restore the backup you made before closing your payroll year, then run through the Payment Summary Assistant again to create and save the EMPDUPE file.

Yes

Yes

No

No

Thanks for your feedback.

Thanks for your feedback.