Not available in AccountRight Basics

If you receive items from a supplier and have not been billed for them, you may not know the actual amount payable to the supplier. However, if you inventory these items, you will need to add them to your on‑hand inventory before you can sell them. But, as you don’t know the amount payable, you shouldn’t record an amount owed to the supplier at this time.

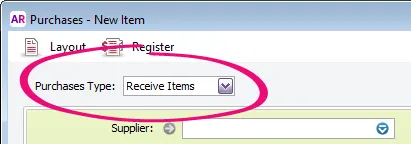

Instead, you can record the receipt of these items using a purchase transaction with a Receive Item type (Purchases command centre > Enter Purchases).

When you record a purchase with a Receive Item type, you enter an estimated purchase amount, which is then allocated to the accounts payable accrual account. Your accounts payable is not affected at this time and an order is created reflecting the receive items transaction.

Later, when your supplier bills you for the items, you can convert the order with the actual purchase amount. When you record the purchase, the actual purchase amount is allocated to your accounts payable and the estimated amount is removed from the accrual account.

Once you set up the accrual account for them you can record items received without a supplier bill.