Your company’s vehicles and equipment lose value each year. Part of the cost of vehicles and equipment can be allocated as an expense to your company each year you benefit from their use. The allocation of the cost of a piece of equipment over its useful life is called depreciation.

There are several methods of recording depreciation. Consult your accountant to see which method is best for you.

If you depreciate your assets at the end of the financial year, make this step a part of your end-of-year routine. Consult an accounting advisor (such as your accountant) for information about when to depreciate your assets.

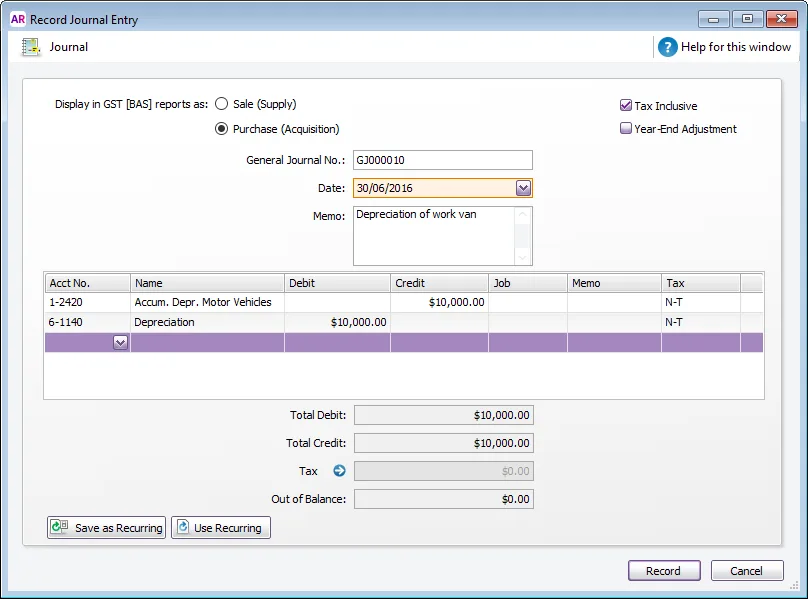

Depreciation isn’t calculated automatically, but you can record your depreciation figures with a journal entry.

To record depreciation

Before you can record depreciation for an asset, you need to create an asset account and an expense account for each type of asset you depreciate. You only need to create these accounts once.

Create a new asset account for each type of asset you depreciate

Add the words ‘Accum. Depr.’ (for Accumulated Depreciation) at the start of each new account name. Give the new account a number that allows it to come after its corresponding asset account in the accounts list. For more information on creating a new account, see Set up accounts.

In the following example, we have a header account, Motor Vehicles numbered 1‑2400, and a detail account Motor Vehicles At Cost numbered 1‑2410. We have created a new asset account called Accum. Depr. Motor Vehicles numbered 1‑2420. Notice that the header account shows the current book value of the vehicles.

Create a new expense account. You may want to call it Depreciation.

Once you’ve determined your depreciation amounts, make journal entries to credit the new accumulated depreciation asset account (for example, the Accum. Depr. Motor Vehicles account) and debit the new depreciation expense account. The accumulated depreciation asset accounts will always have a negative balance to show a reduction in the value of the depreciable assets. Check with your accounting advisor if you're not sure which tax/GST codes to use.