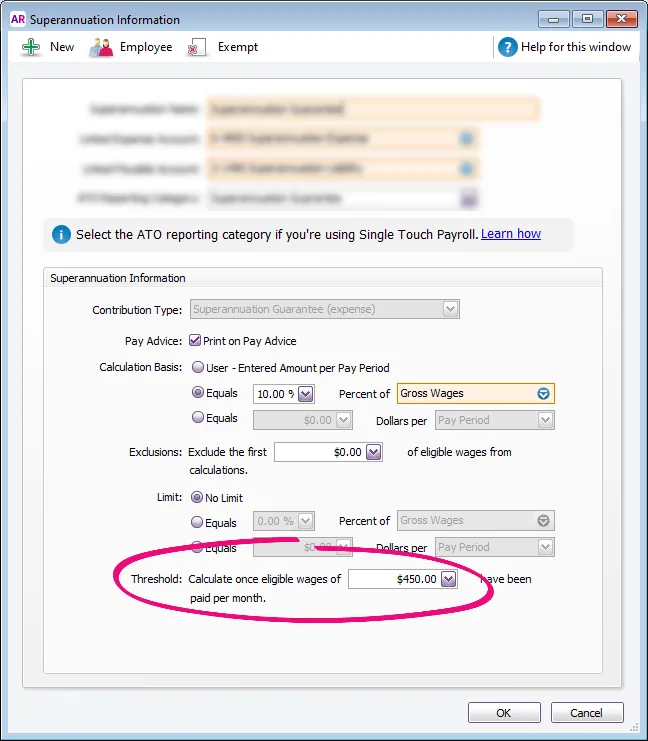

From 1 July 2022, the Australian Government has removed the $450 per month threshold for super guarantee eligibility (that's the amount an employee can earn in a calendar month before you have to pay them super). This means you need to pay super guarantee contributions on all ordinary time earnings for pays dated 1 July 2022 or later.

As such, we've removed the Threshold field from superannuation payroll categories where the Contribution Type is set to Superannuation Guarantee (expense).

Here's what it used to look like:

What do I need to do?

Nothing.

The right amount of super will be calculated each pay.

Do you employ under 18s? If they work 30 hours or less in a week you don't need to pay them super for that week. Learn more about paying super for employees aged under 18.