AccountRight Plus and Premier only

Do you pay or give your employees benefits that the ATO considers 'fringe benefits'? These fringe benefits are reportable if the total taxable value exceeds the threshold set by the ATO.

To tell the ATO about Reportable fringe benefits amounts (RFBA), enter the grossed-up taxable value of those benefits when finalising your employees at the end of the financial year.

Am I reporting via STP Phase 2?

You can check in the STP reporting centre (Payroll command centre > Payroll reporting > Payroll Reporting Centre). If you don't see this label, you're on STP Phase 1. How do I get ready for STP Phase 2

How you notify the ATO of an employee's RFBA depends on whether you're set up for STP Phase 1 or 2.

I'm set up for STP Phase 1

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

Click the EOFY Finalisation tab.

For each employee with fringe benefit amounts:

Click the ellipsis button for the employee and choose Enter RFBA.

Enter in both the:

Reportable fringe benefits amount $

Reportable fringe benefits amount exempt from FBT under section 57A $. The combined value of these must be above the thresholds set by the ATO.

Click Add amounts.

Select each employee you want to finalise, then click Set as Final.

Enter your name and click Send.

An employee's reportable fringe benefit amounts will display on the YTD verification report after you've completed the finalisation.

I'm set up for STP Phase 2

Go to the Payroll command centre and click Payroll Reporting.

Click Payroll Reporting Centre.

If prompted, sign in using your MYOB account details (email address and password).

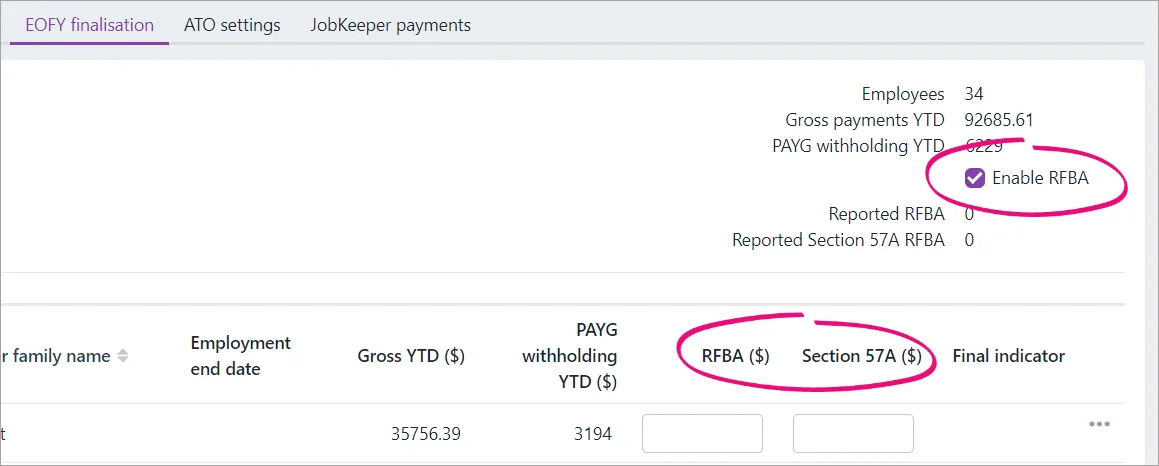

Click the EOFY finalisation tab.

Select the option Enable RFBA. Columns for RFBA ($) and Section 57A ($) appear.

For each employee with fringe benefit amounts, enter the reportable values. The combined value of these must be above the thresholds set by the ATO.

RFBA ($) - these are reportable fringe benefit amounts

Section 57A ($) - these are fringe benefit amounts exempt from FBT under section 57A (see the FAQ below for details).

Note that the entered values won't display at the top of the screen (under the Enable RFBA option) until you've completed the finalisation.

Select each employee you want to finalise, then click Finalise and notify the ATO.

When prompted to send your payroll information to the ATO, enter your details and click Send.

FAQs

How do I enter reportable benefits covered by Section 57A of the FBTAA 1986?

If Section 57A of the Fringe Benefits Tax Assessment Act 1986 applies to you, you can report this to the ATO via Single Touch Payroll reporting.

Affected businesses are mainly not-for-profit organisations, such as public benevolent institutions, health promotion charities, some hospitals and public ambulance services.

If Section 57A applies, you need to report the benefits that fall under that section in the Reportable fringe benefits amount exempt from FBT under section 57A field, and show other reportable fringe benefits provided to the employees in the Reportable fringe benefits amount field.

These don't need to be reported separately.

My employee has a fringe benefit amount, but zero income. Why aren't they listed in the EOFY Finalisation list?

If an employee has no income for the financial year, they won't appear in the EOFY Finalisation list. To get them to appear, you'll need to process a $0 payrun. To do this:

Start a new pay run for the employee.

Enter the pay Memo as "Report FBT" or similar. The date should be within the relevant financial year.

Enter wage amounts as zero.

Zero out all sick leave and holiday pay accrual amounts.

When you process the pay, the software will automatically calculate the amount of superannuation needed to adjust your employee's super to the new correct amount providing it is for the current month. Should the adjustments relate to prior months the figures will need to be entered manually in the Pay Employee window. These pays will appear as VOID in your accounts.

The employee will now be listed and you can enter their RFBA and finalise them.

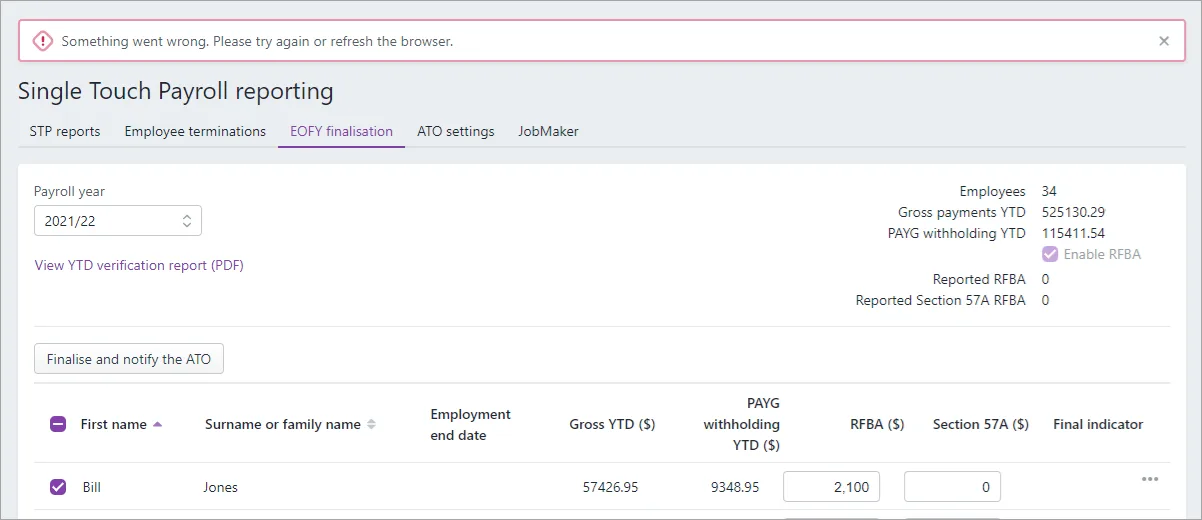

Why am I getting the error "Something went wrong" when entering RFBA amounts?

This error can occur if the RFBA amount you're reporting is below the ATO's threshold. Make sure the combined value of an employee's RFBA is above the thresholds set by the ATO.

If unsure what to report, check with your accounting advisor or the ATO.