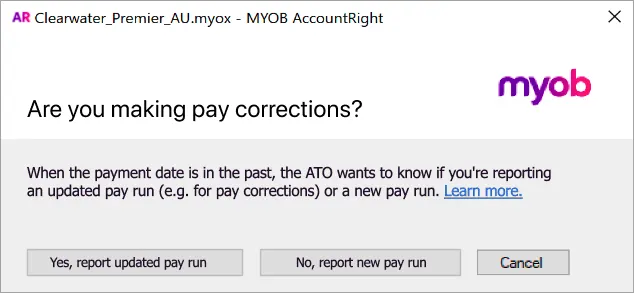

If the Date of payment in a pay run is in the past (but still within the current payroll year), you'll need to specify how to report it to the ATO.

For example, if you're correcting a previous pay the ATO need to ensure you're following their rules for correcting pays.

Here are some examples to help you choose:

Example 1

You recorded a pay last week, but you realised the pay was wrong (maybe it was missing some sick leave), so you reversed it. You record the pay again, with the correct details, and you choose a Date of payment from last week. Because this date is prior to today and you're fixing a previous pay, you'd choose Report as an updated pay run.

Example 2

You normally process your payroll every Thursday, but you don't get to it until Friday. When you process the pays you enter Thursday's date as the Date of payment. This date is prior to today, but because you're not fixing a previous pay you'd choose Report as a new pay run.

Example 3

You were half way through processing a pay run, but something urgent came up, so you saved and closed the pay run. You resume the saved pay run the next day, so the Date of payment is yesterday. This date is prior to today, but because you're not fixing a previous pay you'd choose Report as a new pay run.

Example 4

You recorded a pay yesterday but forgot to pay an employee some overtime or an allowance. You record a new pay, just to pay the overtime or allowance, and you choose yesterday as the Date of payment. Because this date is prior to today and you're fixing a previous pay, you'd choose Report as an updated pay run.

Once you've chosen, you can record and declare the pay run as normal. Need a refresher?