If your turnover is less than $10 million per year, you’re now eligible to report your BAS using the Simpler BAS reporting format.

It means fewer GST fields need to be completed on your form, and even easier transaction data-entry. You can learn about Simpler BAS on the ATO’s website, but here’s a summary of what it can mean for you.

What’s changing

If you report on GST in your activity statements, you now only need to report these GST fields:

G1 - Total sales

1A - GST on sales

1B - GST on purchases

The following GST information no longer needs to be reported separately on your BAS:

G2 - Export sales

G3 - GST-free sales

G10 - Capital purchases

G11 - Non-capital purchases

How to lodge a Simpler BAS

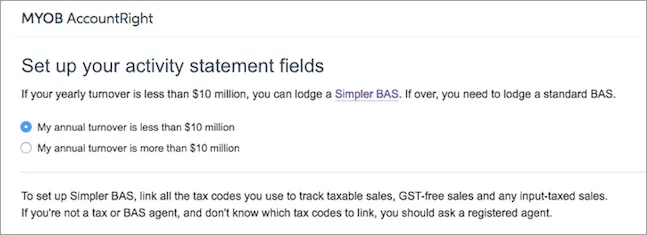

If your company file is online, you can lodge a Simpler BAS online. When setting up your activity statement fields for the first time, you’ll be asked if your annual turnover is less than $10 million. If it’s less, you’ll be shown the Simpler BAS layout to fill out, otherwise all the fields required on the standard BAS will need to be completed.

If you've already set up the online activity statement, we'll automatically show you the Simpler BAS form if the ATO lets us know that you're eligible to use it.

If your company file isn’t online, you can use MYOB BASlink to prepare your Simpler BAS. While BASlink is designed to help you complete a standard BAS form, you can still use the amounts it gives at G1, 1A and 1B fields for your paper or ATO portal forms to lodge your Simpler BAS.

Simpler BAS means simpler record keeping

Because there’s less to report to the ATO, you might not need all the tax codes that are currently set up in your company file.

If you’ve just started using AccountRight for your business, you might want to delete the tax codes you don’t need, if you haven’t used them (speak to your accountant first).

The only tax codes you need so you can complete the GST section of the Simpler BAS are:

GST: Use this code to track GST received and paid on sales and purchases. The GST amounts will be reported at 1A and 1B on the BAS, and the value of the sales will be reported at G1.

FRE: Use this code to track the sales that are GST-free. The value of these sales is included in the amount reported at G1.

N-T (Not reportable): Use this code for transactions that don’t need to be reported at all on your BAS.

If you don’t need the following tax codes for your personal reporting needs, you can delete them, and use the GST, FRE or N-T codes (whichever is appropriate) in their place:

CAP: This code was used to track capital purchases.

EXP: This code was used to track GST-free exports.

To delete unused tax codes

Go to the Lists menu and choose Tax Codes.

Right-click the tax code you don’t need and select Delete Tax Code.

If you’ve used a tax code in a transaction, you can’t delete it, even if you delete the transaction. Note also that if a tax code you want to delete is currently being used as a default code on a card, item or account, recurring transaction template or bank feed rule, you can’t delete it until it’s been changed to another code in those records.

If you have lots of records, you can use AccountRight's importing and exporting feature to update them faster - for an example of how you can do this, see our Bulk update customer and supplier cards help page.