What's Single Touch Payroll?

You must be reporting to the ATO via STP Phase 2

The ability to report payroll via STP Phase 1 in MYOB will end soon. If you've been using STP Phase 1 reporting in MYOB, we encourage you to move to STP Phase 2 to ensure that you are compliant and can continue to report Single Touch Payroll to the ATO – see how easy it is to move.

Report your payroll to the ATO each time you do a pay run. Your employees' information in myGov is always up to date so they can check it any time and easily complete their tax returns.

Once you're set up, you'll send a report to the ATO with each pay, then finalise things at the end of the payroll year.

1. Set up Single Touch Payroll

There are two things you need to do before you're ready to send STP reports. First, make sure your employee, company and payroll data is in the right format. Then, let the ATO know that you're ready to go.

Don't worry, we'll guide you through the whole process.

Go to Set up Single Touch Payroll reporting >>

2. Report employees' pay to the ATO

Once you've set up Single Touch Payroll, you'll be prompted to send your employees' payroll totals to the ATO after each pay run.

Employee year-to-date totals are sent to the ATO. So if you adjust a previous pay, the next time you process a pay run, the latest year-to-date totals will be sent.

Go to View Single Touch Payroll reports >>

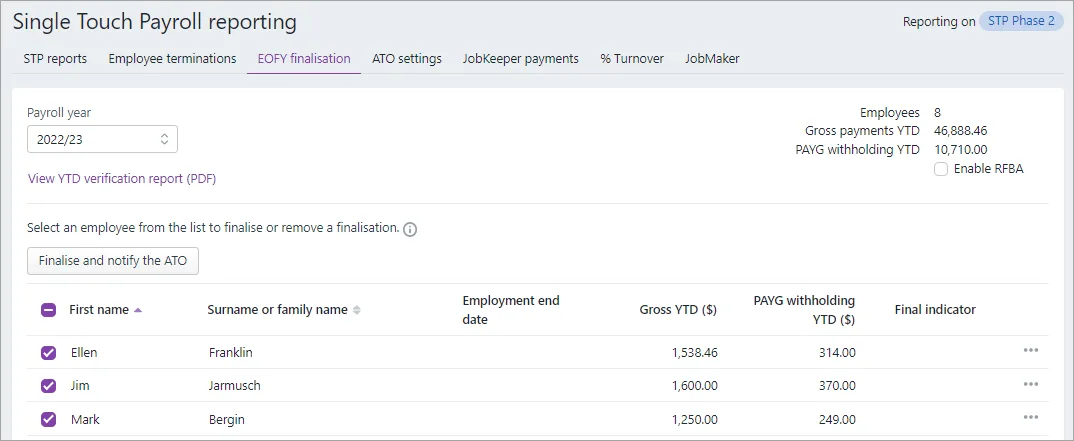

3. End-of-year finalisation

Now you're using Single Touch Payroll, end-of-year is much easier. Instead of payment summaries, you just need to confirm that the data you've already sent is final and correct. You can also enter reportable fringe benefits amounts (RFBA) at this step.

Once you've finalised your Single Touch Payroll information, your employees will be able to pre-fill and lodge their tax returns in myGov.

Go to End of year finalisation with Single Touch Payroll reporting >>

4. Need more help?

Check out MYOB Academy for heaps of free online learning, like End of Financial Year with MYOB AccountRight.

Or if you need a helping hand, contact our support team.