When paying a bill, sometimes you may accidentally overpay or record the payment twice. Mistakes can happen, but there are a number of ways you can easily handle the overpaid amount:

apply it to another unpaid bill

create a debit and refund the amount

create a debit and apply it to a future bill

It's a good idea to first check with your supplier on their preferred option; but no matter what route you choose, you'll be back to doing business in no time.

To create a debit for the overpaid amount

How you create a debit depends on how the overpayment was made. After creating the debit, you can settle it by receiving a refund or applying it to a future bill. For more information, see Settling supplier debits.

Did you.. Overpay the bill amount?

Here's what to do

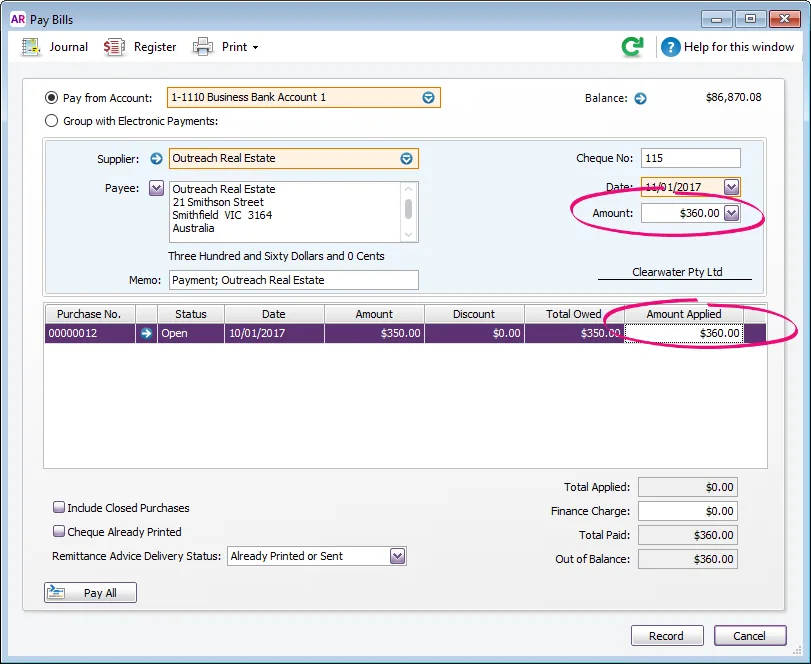

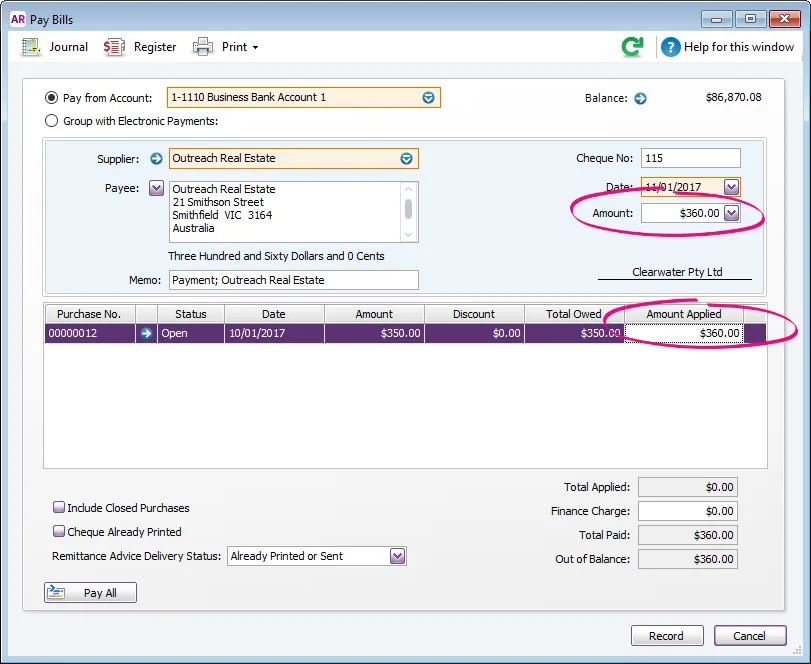

When recording the payment in the Pay Bills window, enter the full payment in the Amount field and in the Amount Applied column in the scrolling list. A debit for the overpaid amount will be automatically created.

Getting a message about a finance charge? Make sure you have entered the over payment in the Amount Applied column (Amount and Amount Applied should match as shown above). If you don't allocate the full amount in the Amount Applied field the difference will be applied to the Finance Charge field.

After creating the debit, you can settle it by receiving a refund or applying it to a future bill. For more information, see Settling supplier debits.

Did you.. Pay a bill twice?

Here's what to do

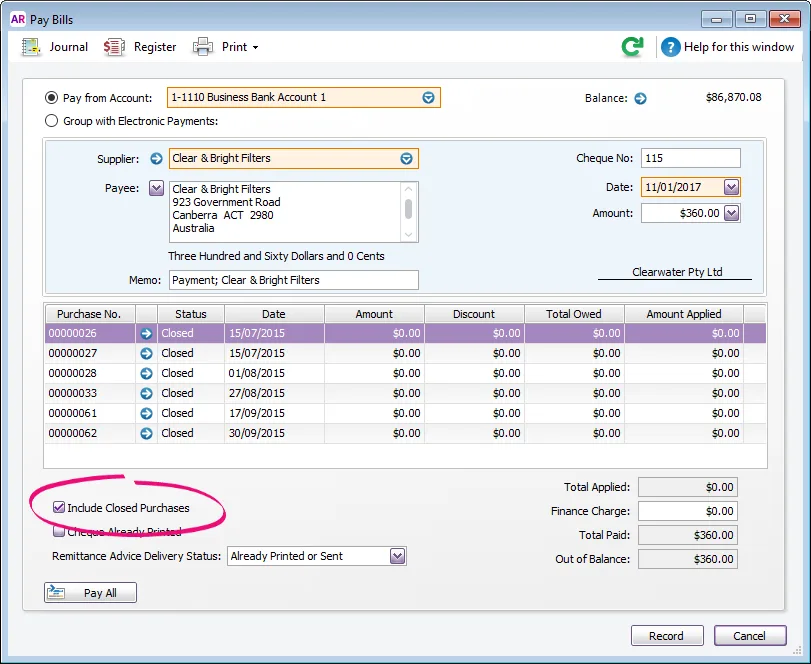

Apply the first payment to the unpaid (open) bill as you normally do and then record another supplier payment and apply the second payment to the same bill. As this bill is now paid (or closed), you'll need to select the Include Closed Purchases option to see it. A debit for the second payment will be automatically created.

You record the payment using the Pay Bills window or by selecting the Pay Bills option in the Band Feeds window.

After creating the debit, you can settle it by receiving a refund or applying it to a future bill. For more information, see Settling supplier debits.

FAQs

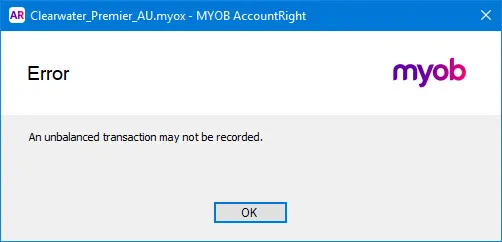

Why am i getting the error "An unbalanced transaction may not be recorded"?

This error will occur when the amount in the Applied column doesn't match the Amount field. When doing an overpayment, remember to enter the full amount paid in the Applied column.

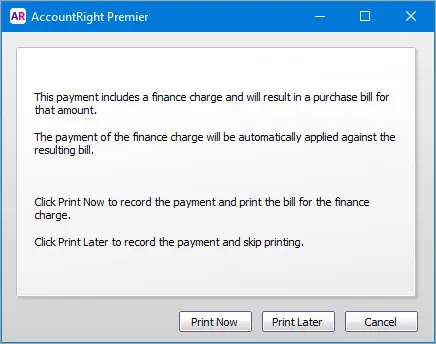

Why am I getting the message 'This payment includes a finance charge'?

If you don't allocate the full amount in the Amount Applied field the difference will be applied to the Finance Charge field. To stop this message remove the amount from the Finance Charge field and enter the overpayment in the Amount Applied column as shown in the instructions above.

Why can't I find the overpayment transaction, or it shows as a different amount to what I actually received?

If you recorded the overpayment using Pay Bills, it's possible a value was entered as a finance charge. For help finding, deleting or reversing finance charges, see Finance charges paid to suppliers.