Cashing out annual leave is where an employee is paid the value of annual leave instead of taking the time off work.

First, you'll need to set up a new pay item to include cashed out annual leave in an employee's pay. This ensures the cashed out annual leave is clearly displayed on the employee's pay slip and it'll be reported correctly to the ATO. It also ensures the employee's annual leave balance is reduced accordingly.

You can then pay the employee for the leave they're cashing out. To keep things simple, we recommend paying the cashed out annual leave in a separate pay (instead of adding it to their regular pay).

Check the rules

-

Superannuation Guarantee contributions are typically paid on cashed out annual leave.

-

Leave entitlements are typically not accrued on cashed out annual leave.

-

Check with the appropriate regulatory body about the cashing out leave rules that affect your business. A good place to start is the Fair Work Ombudsman or your accounting advisor.

1. Set up a pay item for cashed out annual leave

MYOB uses pay items to handle the different components of an employee's pay. Tell me more about pay items.

Here's how to set up a pay item for cashing out annual leave.

Go to the Payroll menu > Pay items.

On the Wages and salary tab, click Create wage pay item.

Name the new category "Cashed Out Annual Leave" (or similar).

If you'd like a different, more personalised, name to show on pay slips for this pay item, enter a Name for pay slip. If you leave this blank, the pay item Name will display instead.

Choose the applicable ATO reporting category. Typically this would be set to Cash out of leave in service. If you're still reporting via STP Phase 1, this would typically be set to Gross payments. But if you're not sure, check with your accounting advisor or the ATO. How do I move to STP Phase 2?

Set the Pay basis to Hourly.

For the Pay rate, choose Regular rate multiplied by and leave the rate set to 1.0000.

If you have a separate account you want to use to track the amounts you've paid as cashed out annual leave, select the option Override employees' wage expense account and choose that account. Need a refresher on how to create accounts?

Under Employees using this pay item, choose the employee(s) who are cashing out annual leave.

Click Save to save the new pay item.

You now need to ensure that when an employee cashes out annual leave, their leave balance is reduced.

Here's now:

Go to the Payroll menu > Pay items.

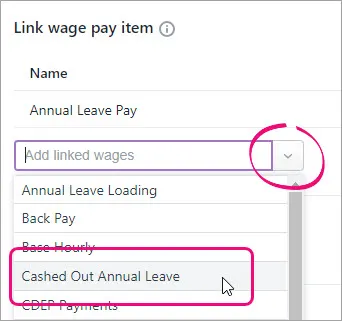

Click the Leave tab.

Click to open the Annual Leave Accrual pay item.

Click the dropdown arrow under Link wage pay item and choose the Cashed Out Annual Leave wage pay item you created earlier.

Click Save to save your changes.

2. Pay the employee for their cashed out annual leave

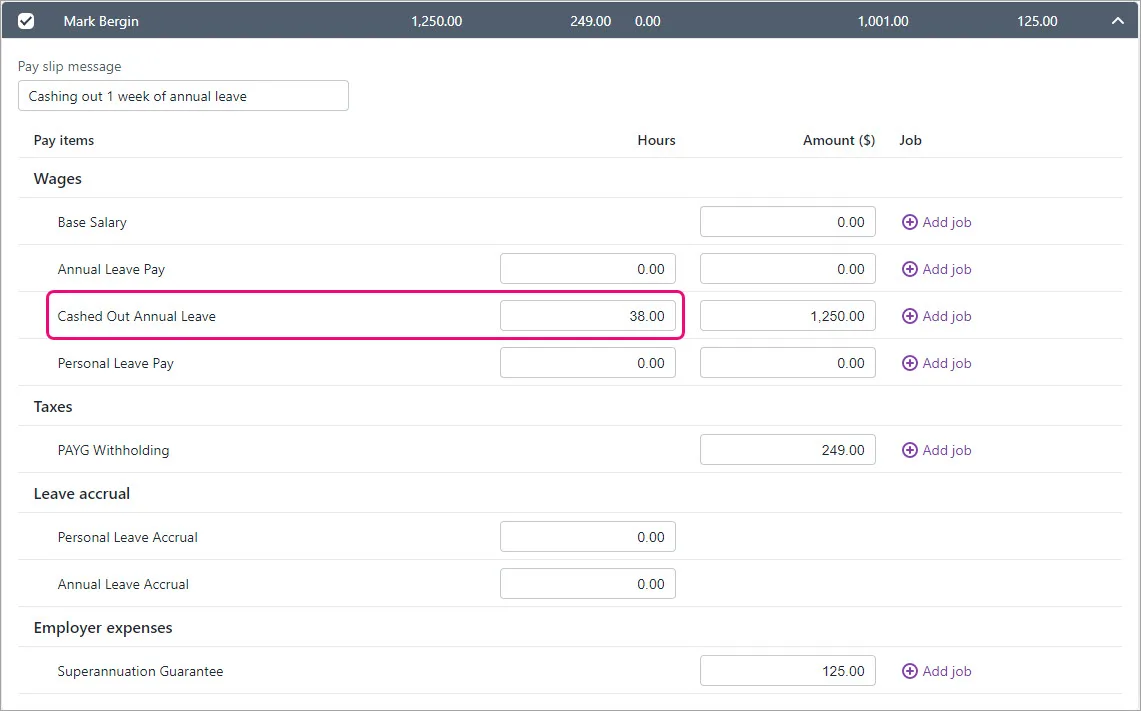

By paying the cashed out leave in a separate pay, you can ensure no leave accrues on the pay and the employee can see exactly what they're being paid for.

Start a new pay run for the employee.

Click the dropdown arrow to edit the employee's pay.

Enter a Pay slip message to describe the pay.

Enter the number of annual leave hours being cashed out against the Cashed Out Annual Leave wage category.

Leave the calculated PAYG Withholding and Superannuation Guarantee contribution amounts, but remove all other hours and amounts. This includes removing any accrued entitlements.

Here's our example of cashing out 1 week (38 hours) of annual leave.

Finish processing the pay as normal.