A closely held employee is someone who's directly related to the business, company or trust that pays them, such as:

family members of a family business

directors or shareholders of a company

beneficiaries of a trust.

The ATO refers to these as closely held payees, but as we'll explain below you'll set them up in MYOB as employees—so that's how we'll refer to them.

Single Touch Payroll (STP) reporting

The ATO require payments to closely held employees to be reported via STP at least quarterly. So if you're paying a closely held employee on a regular frequency, such as weekly, fortnightly, monthly or quarterly, you can process their payments through payroll like any other employee. This will also take care of the tax and superannuation obligations which are required on those pays. Learn all about setting up an employee and processing your payroll.

However, if a closely held employee isn't paid on a set frequency, you'll still need to report their pays to the ATO via STP at least quarterly.

Here is the recommended way to handle these types of quarterly payments.

Seek expert advice

Quarterly reporting might not suit your business needs, so you should speak to your accounting advisor about what works best for you.

1. Set up a closely held employee

You'll set up a closely held employee in much the same way as any other employee (Payroll menu > Create employee).

There's some mandatory information you'll need to enter in the employee's record to be able to report their payroll information via STP.

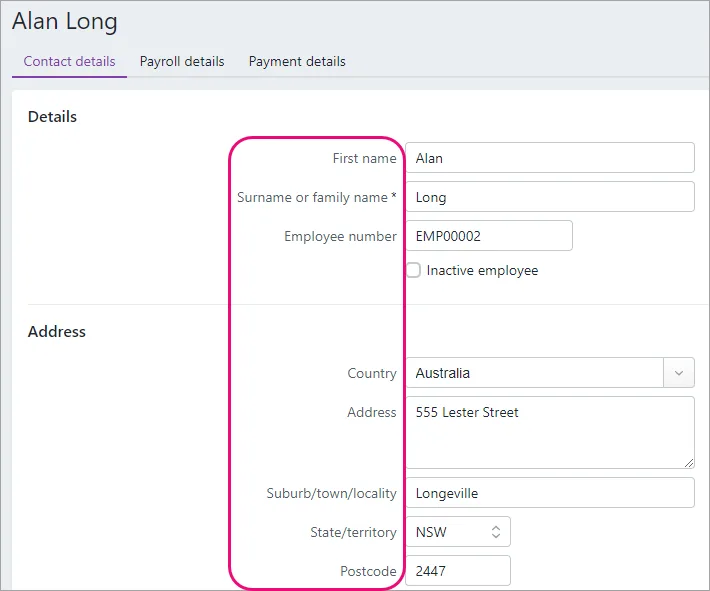

On the Contact details tab, enter details in these fields:

First name

Surname or family name

Country

Address

Suburb/town/locality

State/territory

Postcode

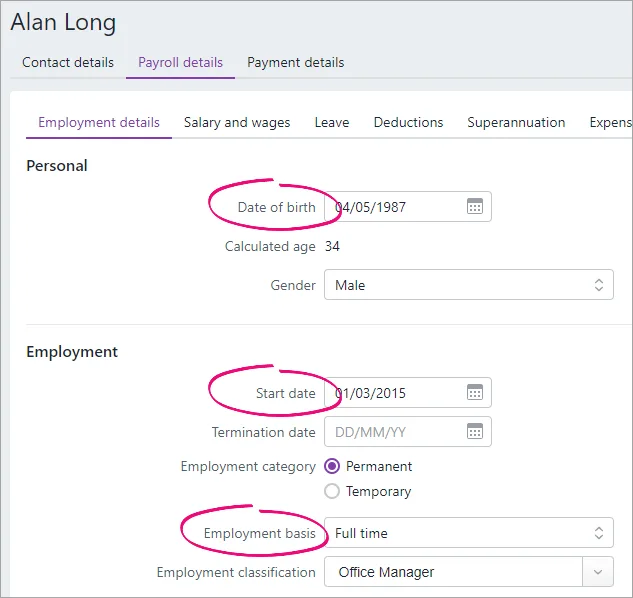

On the Payroll details tab > Employment details section, enter information in these fields:

Date of birth

Start date

Employment basis

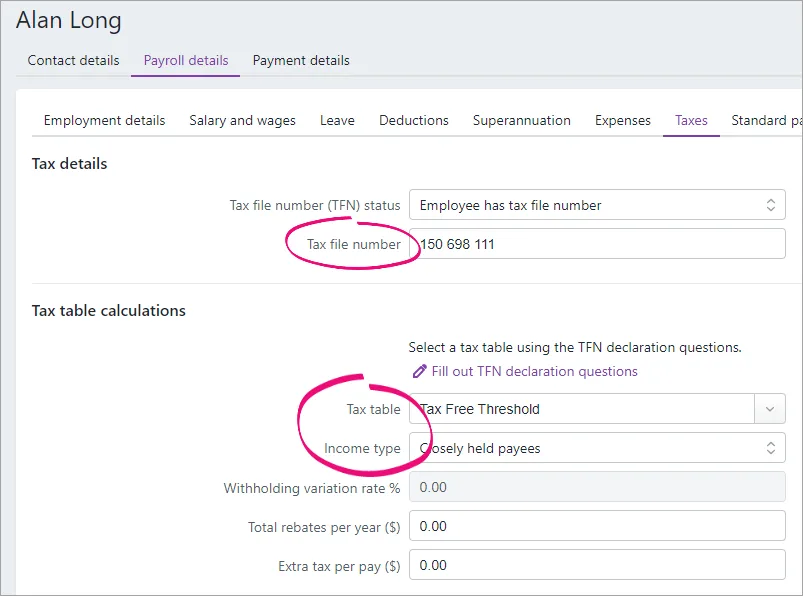

On the Payroll details tab > Taxes section, enter information in these fields:

Tax file number

Tax table

Income type (set to Closely held payees)

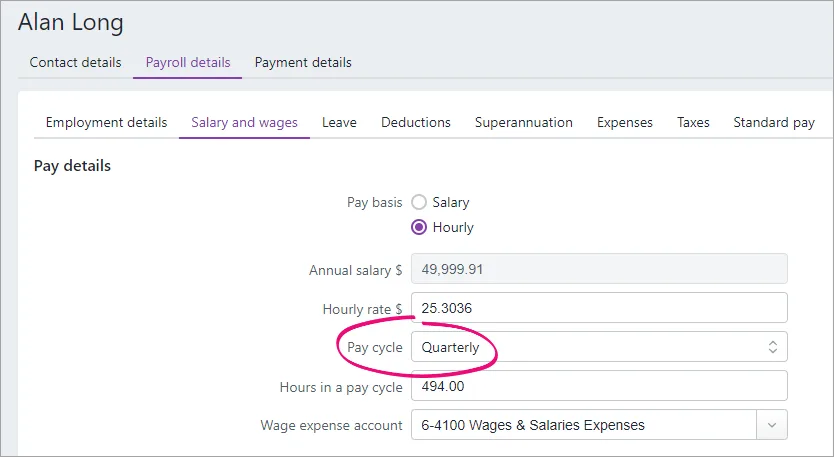

On the Payroll details tab > Salary and wages, set the Pay cycle to Quarterly.

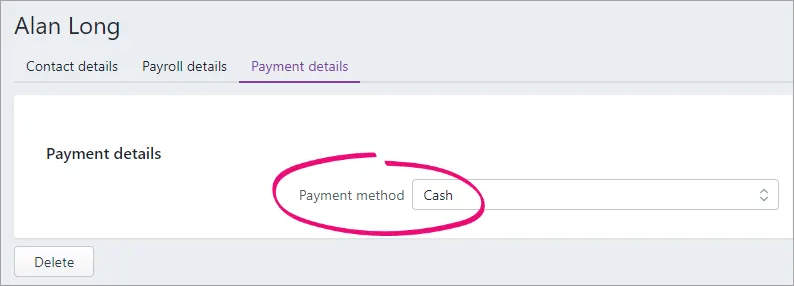

On the Payment details tab, set the Payment method to Cash.

If you need a refresher on setting up an employee or you've never done it before, learn all about adding employees.

Super payments

As you'll need to pay superannuation for closely held employees, make sure you've set up Pay Super.

2. Set up STP

If you haven't already, you'll need to set up STP. You'll then be able to report your closely held employees' payroll information to the ATO each quarter.

To get started, go to the Payroll menu and choose Single Touch Payroll reporting.

For all the details, see Setting up Single Touch Payroll reporting.

3. Process interim payments

Because you'll be reporting payroll information to the ATO once per quarter, you'll likely need to record interim payments to reflect the more regular payments you make to closely held employees.

Each business is different, so check with an accounting advisor about the best way track, record and reconcile these interim payments.

One suggestion would be:

Create a payroll clearing account to keep track of interim payments made to closely held employees.

Set the payroll clearing account as the linked account for payroll cash payments (Accounting > Manage linked accounts > Payroll tab > Bank account for cash payments).

Record interim payment as spend money transactions, allocated to the payroll clearing account. You can use your online banking software to deposit the money into the employee's account as you won't be able to create an ABA bank file for these payments.

4. Process and report a quarterly pay run

When you process a pay run for your closely help employees, you'll enter their pay amounts for the quarter (including earnings and deductions), then report it to the ATO.

Your accounting advisor will likely advise the amounts you'll need to enter into the pays.

If you've processed payroll before, this'll be easy. Here's a quick rundown—for more details see Do a pay run.

Go to the Payroll menu and choose Create pay run.

For the Pay cycle, choose Quarterly.

Choose the pay dates and click Next. All the employees you've set up with a quarterly pay cycle will be listed. Deselect any employees you don't want to include in this pay run.

Enter the pay amounts for each closely held employee:

Click the employee to open their pay.

Enter the hours and/or amounts for each applicable pay item,

Click Next and review the details of the pay.

When you're ready, click Record.

When prompted to send your payroll information to the ATO, enter your details and click Send.

When you're done, click Close.

Remember you've already paid the employee (see task 3 above) so no payment will be required when processing the pay run.

At the end of the year

Your accountant will work with you at the end of the payroll year to ensure your books are balanced. For example, you might need to allocate any remaining balance in the payroll clearing account which hasn't been processed through payroll.