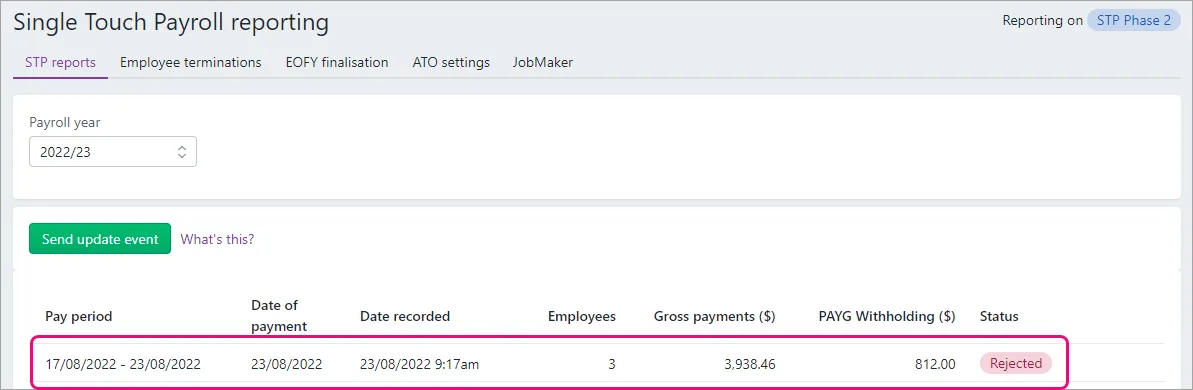

If a report you've submitted to the ATO has a Rejected status, view the error details to find the error code. Then check the list of errors below for a solution.

The Rejected status will remain for a rejected report. But once you've fixed the issue, updated payroll information will be sent to the ATO when you do the next pay run, or you can send an update event.

To view the error details

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the rejected report to see details of the error.

Find the error code - here's an example:

Check for a solution below.

Errors

CMN.ATO.GEN.XML03

This error means there's missing or invalid information in MYOB that you'll need to update. Do you use AccountRight? Your help is here.

To fix the error:

Check the error details in the STP reporting centre to find out which employee and field has an issue.

Find that field in MYOB.

Update the field with the required information in the correct format.

Field | Where to find it | Required information for this field |

|---|---|---|

Employee Tax file number | Payroll menu > Employees > click the employee > Payroll details tab > Taxes tab > Tax file number | Must be a valid tax file number with 9 digits between 0 and 9 |

Employee Postcode | Payroll menu > Employees > click the employee > Contact details tab > Postcode | Must be 4 digits between 0 and 9. If it's a 3 digit postcode, add a 0 at the start |

Allowance name | Payroll menu > Pay items > Wages and salary tab > check the name of each allowance Tip: Use the ATO reporting category column to see which pay items are allowances. | Only these characters are allowed: A-Z |

Employee Income type | Payroll menu > Employees > click the employee > Payroll details tab > Taxes tab > Income type | Choose the employee's Income Type from the dropdown list. If you choose Working holiday maker, also choose the employee's Home country (Country code) |

Employer ABN | Payroll menu > Single Touch Payroll reporting > ATO settings tab > Business details for the ATO section > ABN | Must be a valid ABN with 11 digits between 0 and 9 |

Employee Suburb/town/locality | Payroll menu > Employees > click the employee > Contact details tab > Suburb/town/locality | Only these characters are allowed: A-Z |

Employee Phone | Payroll menu > Employees > click the employee > Contact details tab > Phone | Only these characters are allowed: A-Z |

Employee Address | Payroll menu > Employees > click the employee > Contact details tab > Address | Only these characters are allowed: A-Z |

Employee First name | Payroll menu > Employees > click the employee > Contact details tab > First name | Only these characters are allowed: A-Z |

Employee State/territory | Payroll menu > Employees > click the employee > Contact details tab > State/territory | Choose the employee's state/territory from the dropdown list |

Employee Surname or family name* | Payroll menu > Employees > click the employee > Contact details tab > Surname or family name | Only these characters are allowed: A-Z |

Registered agent number (RAN) | Payroll menu > Single Touch Payroll reporting > ATO settings tab > Business ABN connected to the ATO section > Edit STP business details > follow the prompts to set up STP again and enter the correct RAN | Must be a valid RAN with 8 digits between 0 and 9 |

Employer Phone | Payroll menu > Single Touch Payroll reporting > ATO settings tab > Business contact details for the ATO section > Phone | Only these characters are allowed: A-Z |

Employer Business Name | Payroll menu > Single Touch Payroll reporting > ATO settings tab > Business details for the ATO section > Business name | Only these characters are allowed: A-Z |

Employee date of birth | Payroll menu > Employees > click the employee > Payroll details tab > Employment details tab > Date of birth | Choose the date using the calendar selector or enter in the format dd/mm/yyyy |

ABN branch code | Payroll menu > Single Touch Payroll reporting > ATO settings tab > Business details for the ATO section > GST branch number | If your business doesn't report GST for multiple branches, your ABN branch number will typically be 1 or 2, but check with the ATO if you're unsure. |

Authorised sender | Payroll menu > Single Touch Payroll reporting > ATO settings tab > Business contact details for the ATO section or Agent contact details for the ATO section | Only these characters are allowed: A-Z |

Business contact first name/surname or family name | Payroll menu > Single Touch Payroll reporting > ATO settings tab > Business contact details for the ATO section | Only these characters are allowed: A-Z |

Once you've updated your payroll information, your employees' latest year-to-date payroll information will be sent to the ATO the next time you do a pay run. Or you can send an update event to the ATO at any time as described in the FAQs below.

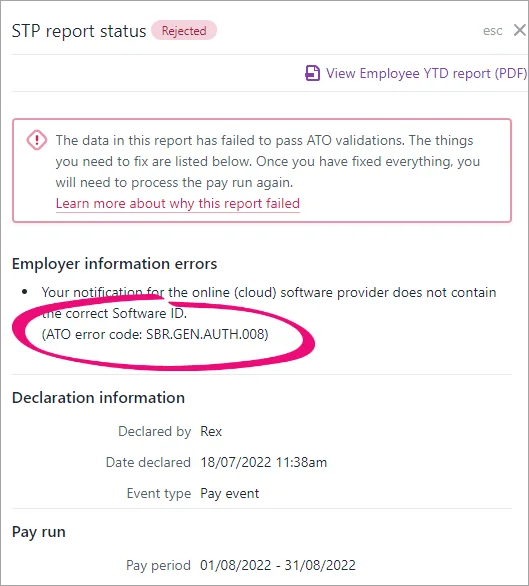

SBR.GEN.AUTH.008

You'll get this error if you've notified the ATO of the wrong Software ID. Do you use AccountRight? Your help is here .

To get your Software ID and notify the ATO:

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the ATO settings tab.

Note down your Software ID.

Notify the ATO you're using MYOB for payroll reporting by either:

phoning the ATO on 1300 852 232, or

using Access Manager to notify the ATO of a hosted SBR software service.

If the issue persists, get in touch with our support team.

CMN.ATO.AUTH.001

We found this information on the ATO website about this error:

This error means the registered agent number (RAN) used with your ABN or credential is not related.

If you're using a cloud-hosted software provider or Sending Service Provider (SSP), check the combination of the RAN and ABN.

If you're lodging directly, check the combination of RAN and the ABN linked to your credential, and then try again.

Attempt to correct in Access Manager. If you still need help, phone the ATO's Technical Help Desk on 1300 287 539, quoting error code CMN.ATO.AUTH.001.

CMN.ATO.AUTH.007

There are a couple of reasons why you might be getting this error. Usually, it's because there is a mismatch of data between the ATO and MYOB systems.

In Access Manager...

Sign in to Access Manager and make sure the tax or BAS agent has permission to lodge payroll reports.

Confirm you've notified the ATO that the business is using MYOB for payroll reporting.

In the tax or BAS agent portal...

Make sure the client is in your client list.

Confirm the client's details are correct (ABN, TFN and ABN branch number), and that they match what's in MYOB.

In MYOB...

Get in touch with our support team.

Once the error is fixed, the latest payroll information will be sent to the ATO when you report your next pay run to the ATO, or you can send an update event as described in the FAQs below.

CMN.ATO.AUTH.011

This error will only be for Tax or BAS agents. It means the client you reported is not associated with the Agent ABN or Registered Agent Number you supplied when you set up STP and can't be authorised.

This can happen if the client isn't in your client list – so you'll need to add them.

If the client is in your client list, you'll need to set up STP again and enter the correct Agent ABN and agent number.

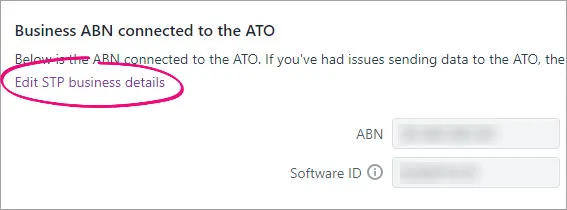

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the ATO settings tab.

Click the Edit STP business details link.

At the confirmation, click Edit STP business details.

Follow the prompts to set up Single Touch Payroll again, making sure to enter your correct agent ABN and agent number.

CMN.ATO.GEN.200001

We found the following information about this error on the ATO website:

"This error is often due to a timeout within our system. It is recommended that the user attempt the request again. If the issue persists, contact us quoting this error code to resolve any issues."

We recommend contacting the ATO about this one.

CMN.ATO.GEN.402043

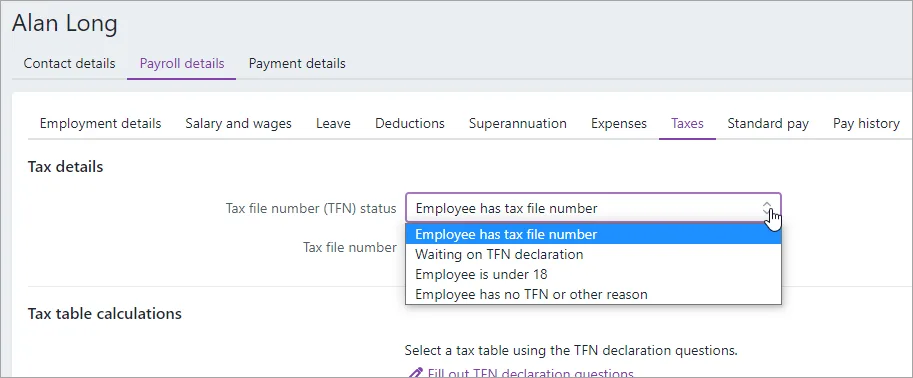

This error means the tax file number (TFN) you've recorded for an employee doesn't match the ATO's records.

To check the TFN you've recorded for an employee, go to the Payroll menu > Employees > click an employee > Payroll details tab > Taxes tab > Tax file number.

If the employee doesn't have a TFN, choose one of the available statuses to populate the Tax file number field.

Once you've updated an employee's TFN, their latest year-to-date payroll information will be sent to the ATO when you do their next pay run, or you can send an update event as described in the FAQs below.

CMN.ATO.GEN.500029

This error means an email address in MYOB contains an invalid text character. Email addresses must only contain these text characters: A to Z a to z 0 to 9 ! @ $ % & * ( ) - _ = [ ] ; : ' " , . ? / or a space character.'

To check an employee's email address, go to the Payroll menu > Employees > click an employee > Contact details tab > Email. Update as required and click Save.

To check the email address for each person who declares payroll information to the ATO for your business:

Sign into MYOB as the person who declares your payroll.

Go to the Payroll menu > Single Touch Payroll reporting.

Click the ATO settings tab.

Check the Email under Business contact details for the ATO section.

Update as required and click Update contact details.

Once you've updated the incorrect details, your employees' latest year-to-date payroll information will be sent to the ATO when you do the next pay run, or you can send an update event as described in the FAQs below.

CMN.ATO.GEN.XML04

This error means that some mandatory payroll information required by the ATO is missing from your MYOB business. This might be information relating to your business or one of your employees.

Here's a list of the mandatory information that you'll need to confirm has been entered and that it doesn't contain any invalid characters, including "[ ] ! # $ % * ; = @ <>\ _ { } ^~`"

Business information

Access your business information by clicking your business name > Business settings, then check these fields:

Business name

ABN

GST branch number (if you have one) what is this?

Address

Employee details

Access your employee's details via the Payroll menu > Employees > click an employee.

On the Contact details tab:

First name

Surname or family name

Country

Address

Suburb/town/locality

State/territory

Postcode

On the Payroll details tab > Employment details section:

Date of birth

Start date

Employment basis

On the Payroll details tab > Taxes section:

Tax file number

Income type

If you choose Working holiday maker as the Income type, you'll also need to choose the worker's Home country (Country code). Also check that the correct Tax table is assigned to working holiday makers based on your business's working holiday maker registration status.

Once you've updated your business or employees' details, your employees' latest year-to-date payroll information will be sent to the ATO when you do the next pay run, or you can send an update event as described in the FAQs below.

CMN.ATO.PAYEVNT.000212

This error has the description Branch code must be provided when an ABN is provided. This error means the GST branch number you have recorded for STP doesn't match the ATO's records.

GST branch numbers are used for businesses where part of the business accounts for GST separately from its parent entity. To learn more about GST branches, visit the ATO website.

Even if your business doesn't account for GST this way, if your business has an ABN you'll also have a GST branch number. If you don't have multiple branches, your GST branch number will typically be 1, but check with the ATO if you're unsure.

To check or update your GST branch number:

Open the STP reporting centre (Payroll menu > Single Touch Payroll reporting).

Click the ATO settings tab.

Check the GST branch number and update if required. This field cannot be empty and cannot be 0. Check with the ATO if you don't know your GST branch number.

Click Update business details to save any changes.

Once you've updated the incorrect details, your employees' latest year-to-date payroll information will be sent to the ATO when you do the next pay run, or you can send an update event as described in the FAQs below.

CMN.ATO.PAYEVNT.EM92168

This error means you're trying to finalise a payroll year for which you haven't submitted any payroll information to the ATO via STP. This can happen if you set up STP after the start of a new payroll year but you're trying to finalise the previous payroll year.

To finalise your previous year's payroll information, you'll need to complete manual payment summaries for your employees using forms available from the ATO.

If unsure about completing or submitting these forms, we recommend speaking to your accounting advisor or the ATO.

CMN.ATO.PAYEVNT.EM98452

This error means your ABN isn't active.

You'll need to contact the ATO to get their help to fix this issue.

CMN.ATO.PAYEVNT.EM99507

This error means there is an issue with the previous BMS ID that you transferred to the ATO when you set up STP in MYOB.

What's a previous BMS ID?

Each payroll software is identified using a Business Management Software (BMS) ID. If you previously reported via STP in the current payroll year using different payroll software, when you set up STP in MYOB you need to transfer the BMS ID of your previous payroll software.

This error will occur if:

you transferred the wrong previous BMS ID, or

you transferred a previous BMS ID when you didn't need to (you only need to transfer a previous BMS ID if you've reported via STP in the current payroll year in other payroll software, before moving to MYOB).

How you fix this error depends on whether you've reported via STP using other payroll software this year.

I have reported via STP in other payroll software this payroll year

OK, this means you'll need to find your correct previous BMS ID, then set up STP again in MYOB to enter this BMS ID.

To find your previous BMS ID

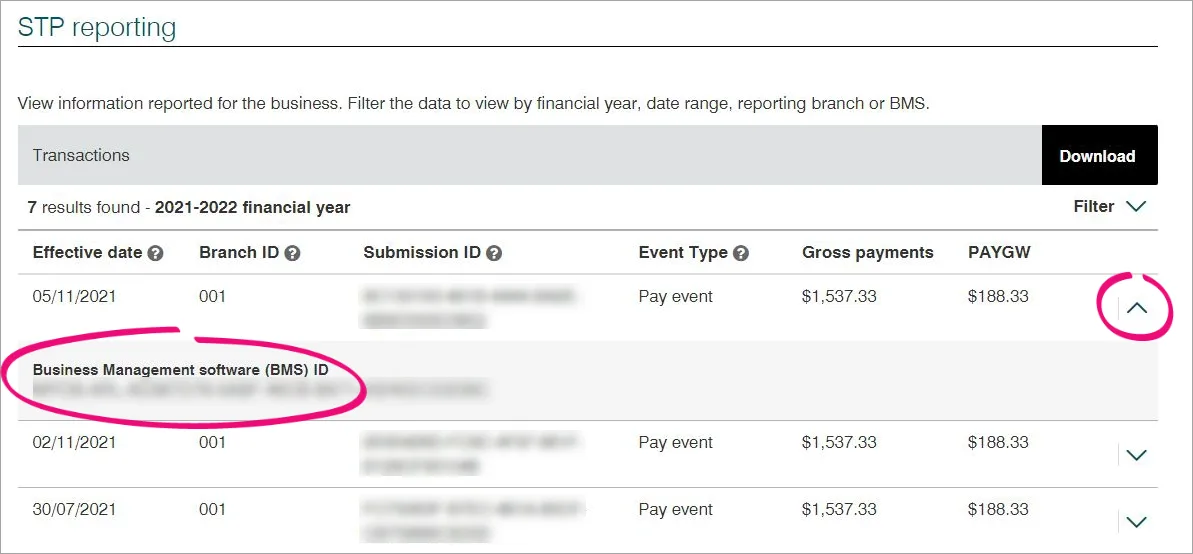

You or your tax/BAS agent can find your previous BMS ID via the ATO's online services.

Log into the ATO's online services.

Go to Employees > STP reporting (agents go to Business > STP reporting).

Click the dropdown arrow next to one of your STP reports.

Copy the Business Management software (BMS) ID so you can paste it into the Previous softwareBMS ID field in MYOB when prompted (see above).

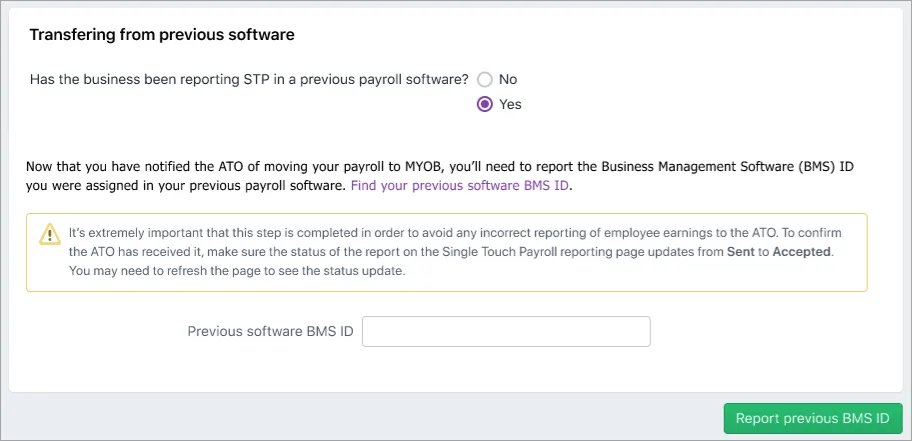

To set up STP again in MYOB

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the ATO settings tab.

Click Edit STP business details (near the bottom of the screen).

Follow the prompts to set up STP again.

At the Transferring BMS ID step, select Yes and enter the Previous software BMS ID.

Click Report previous BMS ID and complete the STP setup.

Once you've set up STP again, your employees' latest year-to-date payroll information will be sent to the ATO the next time you do a pay run. Or you can send updated information to the ATO at any time as described in the FAQs below.

I have NOT reported via STP in other payroll software this payroll year

OK, you just need to set up STP again in MYOB, and select No when prompted for a previous BMS ID.

Go to the Payroll menu and choose Single Touch Payroll reporting.

Click the ATO settings tab.

Click Edit STP business details (near the bottom of the screen).

Follow the prompts to set up STP again.

At the Transferring BMS ID step, select No and click Report previous BMS ID.

Once you've set up STP again, your employees' latest year-to-date payroll information will be sent to the ATO the next time you do a pay run. Or you can send updated information to the ATO at any time as described in the FAQs below.

CMN.ATO.PAYEVNTEMP.000239

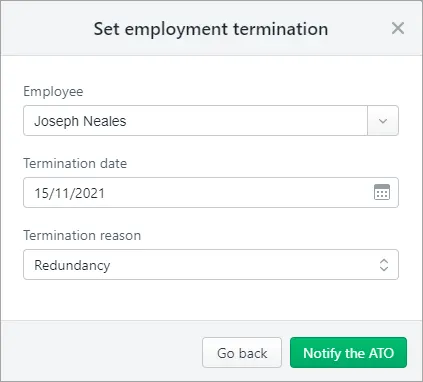

This error has the description Cessation Reason Code must be provided which means a terminated employee hasn't had their Termination reason reported to the ATO. This can happen if you terminated an employee in the current, or previous, payroll year before moving to STP Phase 2.

But it's easy to fix this in the STP reporting centre.

Open the STP reporting centre (Payroll menu > Single Touch Payroll reporting).

If you've finalised the terminated employee, undo their finalisation:

Click the EOFY finalisation tab.

Choose the Payroll year the terminated employee was finalised.

Select the terminated employee.

Click Remove finalisation and notify the ATO.

Enter your details and click Send.

Undo the employee's termination.

Click the Employee terminations tab.

Choose the Payroll year the employee was terminated.

Click Undo to remove the employee's termination.

Enter your details and click Send.

Redo the employee's termination.

Click Add termination.

Enter the termination details (including the Termination reason) and click Notify the ATO.

Enter your details and click Send.

If you removed the employee's finalisation at step 2, you can re-finalise them.

Click the EOFY finalisation tab.

Choose the Payroll year the terminated employee was finalised.

Select the terminated employee.

Click Finalise and notify the ATO.

Enter your details and click Send.

CMN.ATO.PAYEVNTEMP.000245

This ATO error indicates that one of your employee's has been assigned the Income type of Labour hire in their employee record, but that employee has a salary sacrifice on their pay.

To check an employee's income type, go to the Payroll menu > Employees > click the employee > Payroll details tab > Taxes tab > Income type.

According to the ATO, only contractors should be assigned the income type of labour hire, and contractors are not entitled to salary sacrifice. For more information about each income type, see this ATO information.

If you're not sure how your employees should be reported under STP, check with the ATO or your accounting advisor.

MYOB error code: 404

This error means the ABN you entered when you set up Single Touch Payroll is different to the ABN in your MYOB Business details.

To fix it:

Click your business name and choose Business details.

Check the ABN.

If it's the wrong ABN, update it and click Save.

If the ABN is correct, get in touch with our product support team.

My error code is different

Most rejection errors are generated by the ATO, so check the ATO website for more details.

Can't find your error? Get in touch with our support team.

FAQs

How do I resend a rejected report to the ATO?

You can't resend a rejected report and the Rejected status will remain for the report in the Payroll Reporting Centre.

Once you've fixed whatever caused the report to be rejected, the employee's latest year-to-date payroll information will be sent to the ATO after you process their next pay run. Or you can send updated information to the ATO at any time as described in the FAQ below.

How do I send an update event to the ATO?

You can sync your payroll totals in MYOB with the figures held by the ATO. This is a quick way of ensuring the ATO has the current year to date payroll figures for your employees.

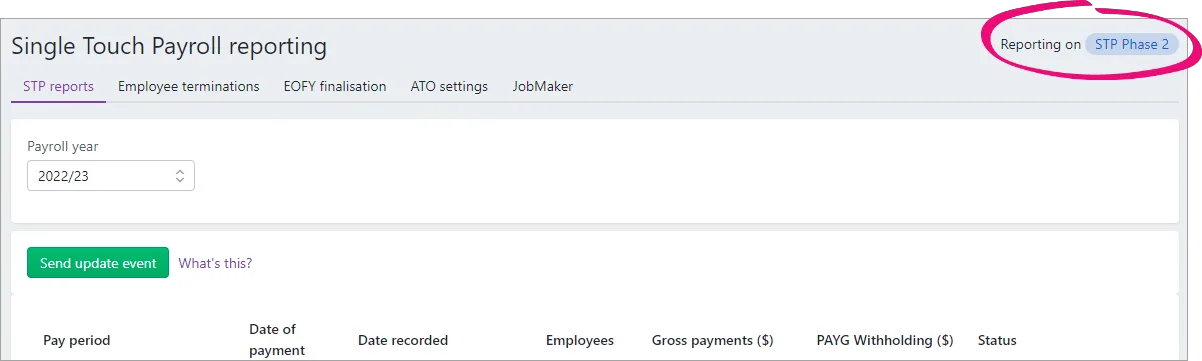

If you're reporting via STP Phase 2, you can send an update event from the STP reporting centre. Otherwise you'll need to record a zero dollar ($0) pay for each employee whose year to date payroll totals you want to send to the ATO.

Am I reporting via STP Phase 2?

You can check in the STP reporting centre (Payroll command centre > Payroll reporting > Payroll Reporting Centre). If you don't see this label, you're on STP Phase 1. How do I get ready for STP Phase 2?

Sending an update event for STP Phase 1

You can send an update event for an employee by recording a $0 pay. This type of pay is also called a void pay and it's like any other pay, but all hours and amounts will be zero.

When you record a $0 pay, the employee's latest year to date payroll totals will be sent to the ATO.

Start a new pay run (Payroll menu > Create pay run).

Set the Pay cycle to Unscheduled.

Ensure the Date of payment is in the payroll year you're sending the update event for.

Select only the employees you want to send an update event for.

Because you set the pay cycle to Unscheduled, you'll notice all hours and amounts are removed from each employee's pay (which is just what we want). Here's an example.

Complete the pay run as you normally do and declare it to the ATO. Need a refresher?

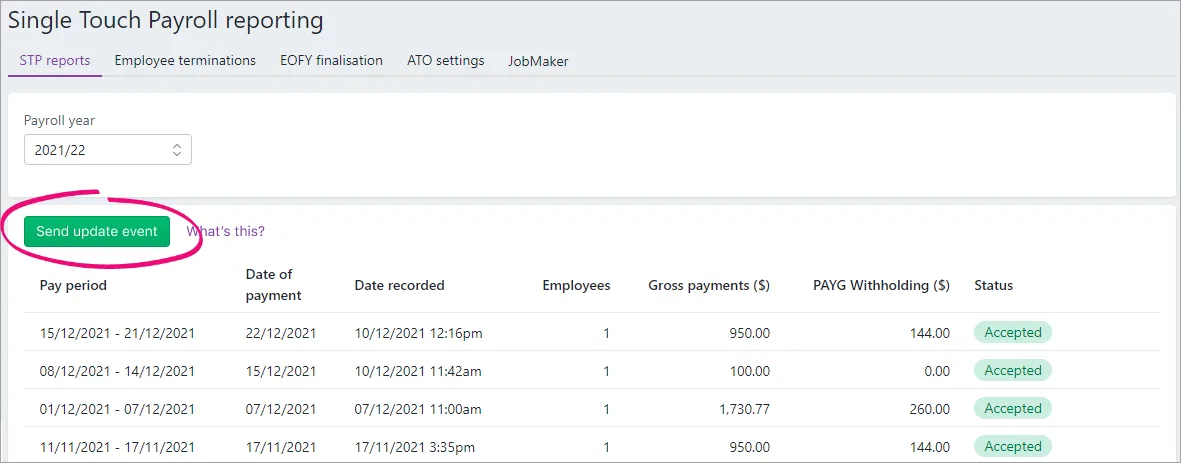

Sending an update event for STP Phase 2

Update events are listed in the Single Touch Payroll reporting centre with your other payroll submissions, but with zero (0.00) amounts

From the Payroll menu, choose Single Touch Payroll reporting.

Click the STP reports tab.

Choose the applicable Payroll year.

Click Send update event.

When prompted, enter your details and click Send.

Update events are listed in the Single Touch Payroll reporting centre with your other payroll submissions, but with zero (0.00) amounts

What information is sent to the ATO?

Your employees' year to date figures are sent to the ATO. This means each time you submit a pay run to the ATO, your employees' latest year to date figures are sent.

How do I fix or delete a report that's been sent to the ATO?

You can't delete or "undo" a report from the STP reporting centre. Instead, you can either reverse the incorrect pay and record it again, or wait until the next pay run and adjust it accordingly.

All submitted reports will remain listed in the payroll reporting centre, even if you change or delete a pay in MYOB.

What's the difference between a "pay event" and an "update event"?

Information submitted from MYOB will be received by the ATO as either a pay event or update event.

A pay event can only occur in the current payroll year, where both employee and employer year-to-date totals are submitted to the ATO. A regular pay run is considered a pay event.

An update event can occur in the current or a previous payroll year, and only the employee's year-to-date totals for the applicable payroll year are sent to the ATO. Recording a $0 pay is considered an update event.