You can import items into MYOB instead of entering them one item at a time. This is handy if you have a list of items you've exported from another program or if they're saved in a spreadsheet.

For the easiest import, we recommend using a sample file. It works like a template and ensures the required information is entered in a format that's accepted by MYOB.

We've provided a sample file below which contains all available fields needed for importing items. All you need to do is download the file, open it in a spreadsheet program like Excel, add your item information, then import it into MYOB.

Follow the import items steps in MYOB Business

Instead of following the steps below to download a sample file, you can open MYOB Business and follow the import items steps there if you prefer.

Go to the Items page in MYOB Business, click Import items and then follow the onscreen steps. After importing your items, you'll see a message on Import and export items page detailing what items were imported, imported with errors or skipped.

Already prepared an import file? Jump straight to task 2 to learn how to import it.

Let's step you through it.

You can only import inventoried items if you are using Premium Inventory. Find out how to add Premium Inventory.

1. Download and modify the sample file

Right-click the sample file, choose Save link as and save it to your Desktop: SampleItemsFile.txt. If you're warned about the file you're downloading, choose the option in the warning message to Keep the file and it'll download successfully.

Open a blank workbook in Excel.

Click and drag the downloaded sample file onto the the workbook. The file will open in Excel and the contents of the template will be displayed.

If you're on a Mac, right-click the downloaded sample file and choose Open with... and Excel.

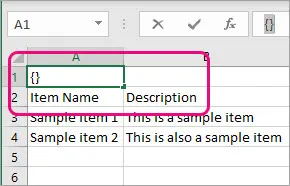

When looking at the file in Excel, note the following:the first cell (A1) contains parentheses (brackets) - these need to remain, as they indicate that the import file is for MYOB.

the second row (beneath the row with the brackets) is labeled so you can work out what type of information is displayed in each column.

Enter your data in each applicable column. See the FAQs below for details about how the columns in the sample file correspond to the fields in MYOB.

Remember:each column in the import file represents a field in MYOB

each row in the import file represents a different item

leave the brackets on the first row, and the headings on the second row.

When you're done, save the template as a text (.TXT) file. If you like, you can give the file a meaningful name, such as "Item Import" or similar.

If you're using Google Sheets, save the file as a Tab Separated Values (.TSV) file.

2. Import the file into MYOB

If you're not importing a prepared sample file, make sure your import file:

is a TXT file

is in tab-separated format

contains a header row for all mandatory fields (see the FAQs below)

contains brackets {} in cell A1

is under 25MB

To import items

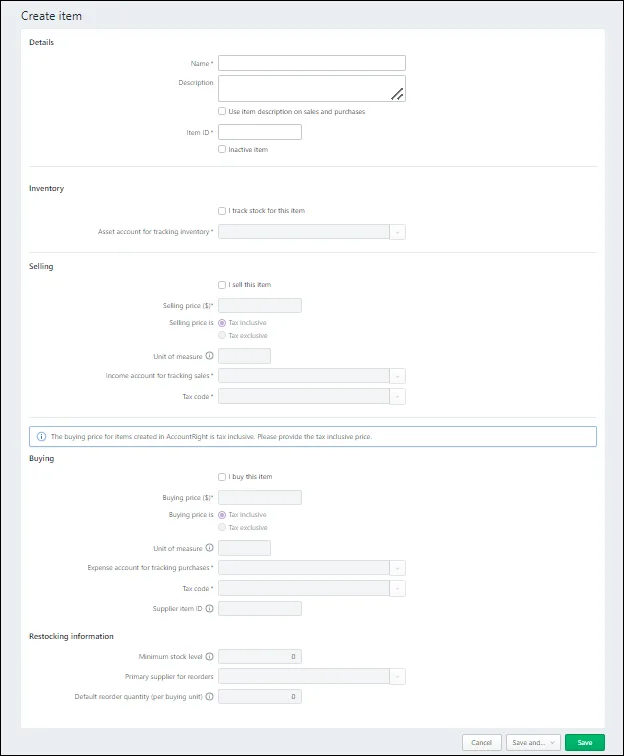

Click your business name and choose Import and export data.

On the Import tab, for the Data type choose Items.

Click Browse and locate the import file.

Click the import file then click Open.

Choose the method for handling duplicate data (data which is already in MYOB Business) – Update existing data or Reject duplicates.

Click Import.

What happens next

After importing, a message appears on the Import and export data page detailing what item records have been imported. This will also detail if any item records were skipped – see 'How do I resolve import warnings and errors' below for information about how to fix these. You can also view the imported items on the Items page and update any of their details.

3. (Optional) Make an inventory adjustment

When you import an inventoried item – and you already have stock of it on hand – you will need to make an inventory adjustment to update its on-hand quantity.

How the import fields work

The fields in the import file correspond to fields and options in items in MYOB Business. Some of these fields are mandatory – they must be included in the import file and be in the correct format or the item import won't work. Refer to the following for detailed information on import item fields.

Mandatory item import fields

This field is mandatory for all items:

Item Number

These fields are mandatory for items you sell:

Account for tracking sales

Tax Code When Sold

These fields are mandatory for items you buy:

Account for tracking purchases

Tax Code When Bought

These fields are mandatory for inventoried items:

Account for tacking inventory

Expense/COS Acct

(If the item is sold) No. Items/Sell Unit must have a value

(If the item is bought) No. Items/Buy Unit must have a value

This field is not mandatory, but is recommended for all items:

Item Name

How the columns in the sample file correspond to the fields in MYOB

All of the column headings in the sample file correspond to the fields in an MYOB Business item:

Refer to the following table to see what format they need to be in:

Sample file column heading | Item field name in MYOB Business | Description, character limit and format | Example |

|---|---|---|---|

Item Number | Item ID | A mandatory field for all items. A unique identifier for the item, up to 30 characters, alphanumeric. Using an existing item can lead to reject duplicate or replace the existing item. | 500 or SprWtr1L |

Item Name | Name | (Recommended but not mandatory) The name of the item, up to 30 characters, alphanumeric | Spring Water Beverage Maker |

Buy | I buy this item | Indicates whether you buy the item, 1 character, B for yes or blank for no | B |

Sell | I sell this item | Indicates whether you sell the item, 1 character, S for yes or blank for no | S |

Inventory | I inventory this item | Indicates that you inventory the item, 1 character, I for yes or blank for no | I |

Asset Acct | Asset account for tracking inventory | The linked asset account you use for tracking the value of the stock on hand of this item. Must be a valid, pre-existing account number (you can't add a new account as part of the import), 5 characters, numeric, using the exact account number as it appears on the Accounts page in MYOB Business. May have an optional non‑numeric separator between the first digit and the last 4 digits, for example: 1‑1140. | 11140, 1‑1140 |

Income Acct | Income account for tracking sales | The linked income account you use for tracking sales of this item. Must be a valid, pre-existing account number (you can't add a new account as part of the import), 5 characters, numeric, using the exact account number as it appears on the Accounts page in MYOB Business. May have an optional non‑numeric separator between the first digit and the last 4 digits, for example: 4‑1600. | 41600, 4‑1600 |

Expense/COS Acct | Expense account for tracking purchases | The linked expense or cost of sales account you use for tracking purchases of an item. Must be a valid, pre-existing account number (you can't add a new account as part of the import), 5 characters, numeric, using the exact account number as it appears on the Accounts page in MYOB Business. May have an optional non‑numeric separator between the first digit and the last 4 digits, for example: 5‑1100. | 51100, 5‑1100 |

Description | Description | The description of your item, up to 255 characters, alphanumeric. | Beverage Maker for use with Spring Water |

Use Desc. On Invoice | Use item description on sales and purchases | Display the description of your item on invoices, 1 character, Y for yes, N for no | X |

Primary Supplier | Primary supplier for reorders | The name of the primary supplier of the item, alphanumeric. Must match the name of a supplier contact in MYOB Business. (If the supplier is an individual, matches the name in this format: Lastname, Firstname.) | Clear & Bright Filters |

Supplier Item Number | Supplier Item Id | The supplier’s number for the item or SKU (Stock Keeping Unit), up to 30 characters, alphanumeric. | SBV05 |

Tax Code When Bought | Tax code (in the Buying section of an item) | The default tax to use when buying the item, 3 characters, alphanumeric. Must match a pre-existing Tax code in the Tax Code List. | N-T or GST |

Buy Unit Measure | Unit of measure (in the Buying section of an item) | The unit of measure you buy the item in, such as box or can, up to 5 characters, alphanumeric | box, can |

No. Items/Buy Unit | Items per buying unit | The number of items that comprise a single buying unit, up to 4 characters, numeric, the default figure in this field is 1If the item is inventoried (the Inventory field is set to 'I'), this field must have a value. | 1 or 12 |

Reorder Quantity | Default reorder quantity | The number of items to purchase when reordering it, numeric, no character limit, but a limit of up to 6 decimal places | 100000.011 |

Minimum Level | Minimum stock level | The minimum quantity you want to keep in stock, numeric, no character limit, but a limit of up to 6 decimal places | 600000.011 |

Selling Price | Selling price ($) | The selling price of 1 unit, up to 11 characters, numeric, including 4 decimal places | $300 |

Sell Unit Measure | Unit of measure (in the Selling section of an item) | The unit of measure you sell the item, such as box or can, up to 5 characters, alphanumeric. If you are updating an item then this field should match the existing value in this field if the item, or you'll get an error and the item row will be ignored. | box, kit, bag |

Tax Code When Sold | Tax code (in the Selling section of an item) | The default tax code when selling the item, 3 characters, alphanumeric. Must match a pre-existing Tax/GST code in the Tax/GST Code List. | N-T or GST |

Sell Price Inclusive | Selling price is | Indicates if the selling price includes tax, 1 character alphanumeric, X for yes, leave blank for no | X |

No. Items/Sell Unit | Items per selling unit | The number of items to be subtracted from inventory when you sell a single unit, up to 4 characters, numeric. If the item is inventoried (the Inventory field is set to 'I'), this field must have a value. | 1 |

Inactive Item | Inactive item | Indicates if this item is inactive, Y for yes and N for no | N |

Standard Cost | Buying price ($) | What it costs you to buy the item (Buying price), 10 characters, numeric including 4 decimal places | $200.2333 |

FAQs

How do I resolve import warnings and errors?

After you import your items, a message on the Import and export data page details what item records were imported successfully, imported with warnings and which were skipped due to errors.

Item records with warnings

If any item records have warnings, these items will have been imported but may have missing or altered information.

To check and fix these:

On the Import and export data page, view the details of which items were affected and why.

For a small number of items, you can view them on the Items page (Inventory menu > Items) and update their details.

For a large number of items:

Open your import file in Excel.

Complete or edit any information - refer to 'How the columns in the sample file correspond to the fields in MYOB' above for the correct format.

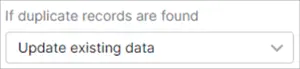

Import the file again, making sure 'If duplicate records are found' is set to 'Update existing data'.

Item records skipped due to errors

To check and fix these:

Open your import file in Excel.

Complete or edit any information - refer to 'How the columns in the sample file correspond to the fields in MYOB' above for the correct format.

Import the file again.

Other import troubleshooting tips

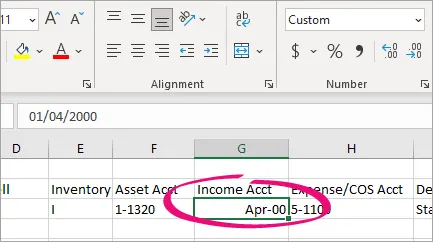

If you're importing a file that has been opened in Excel, check that Excel hasn't changed the format of some data. For example, check it hasn't changed an account number into date format:

To fix the example above, you would change the number format of the cell from Custom to General and retype the Income Acct number as 1-4200.