Before you begin

Using MYOB Business Payroll Only?

You'll only be able to pay employees electronically, not suppliers.

Once you're set up, paying your suppliers or employees electronically is a two-stage process. Start by entering a payment transaction in MYOB, then process the electronic payment to transfer the funds.

1. Record the payment transaction in MYOB

When you enter a supplier payment transaction or do a pay run, you need to let MYOB know that you're going to process the payment electronically. Just make sure you've entered your suppliers' and employees' bank account details into MYOB.

No one receives any money yet—you'll process the actual payment later.

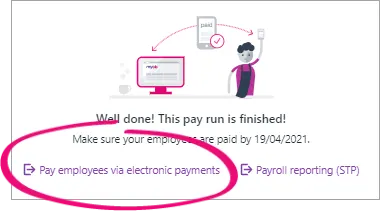

Paying employees

Do a pay run as you normally would. Need refresher?

At the end of the pay run, click the option to process employee payments electronically.

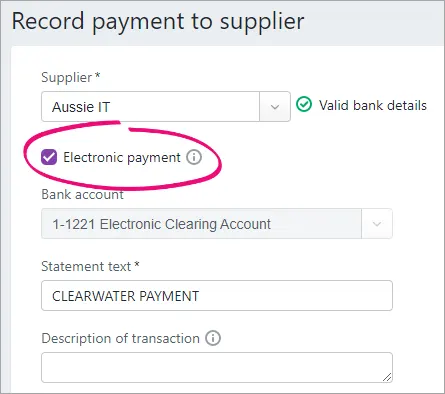

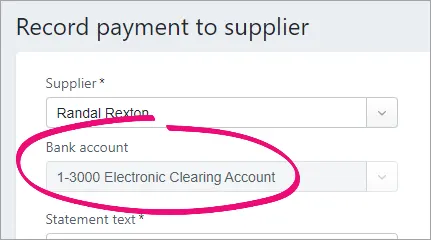

(Not available for MYOB Business Payroll Only) Paying suppliers

When you enter a supplier payment:

If you're in Australia, select the Electronic payment option.

If you're in New Zealand, select your Electronic Clearing Account as the Bank account.

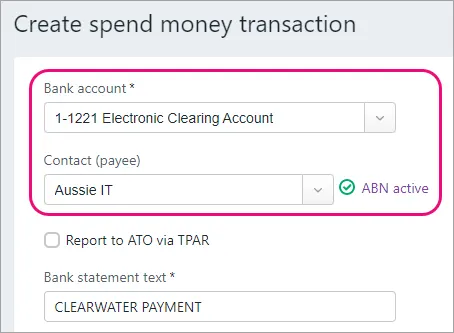

Spend money transactions

You can also pay a supplier when they haven't issued you a bill by recording a spend money transaction. Choose your electronic clearing account as the Bank account and the supplier as the Contact, to indicate you'll process the payment later electronically.

2. Process the electronic payment

Once you've recorded the payment transaction in MYOB, you need to deposit the actual payments into your suppliers' and employees' bank accounts. Depending on the electronic payment method you've set up, you can either:

make a direct payment, or

download a bank file for your bank to process.

Direct payments availability Only businesses that are currently set up for direct payments can use this feature. We're no longer taking new applications.

To process an electronic payment:

Go to the Banking menu and choose Prepare electronic payments. All the payments you've recorded in MYOB that you've chosen to pay electronically will be listed.

Optional:

Choose a Payment type if you'd like to group the electronic payment by payment type—for example, to pay bills or employees only.

Use the Transactions from and Transactions to fields to show transactions for a specific date range.

Choose the Account your payments will be paid from. This is the account you set up as part of setting up electronic payments.

If any details are missing from the chosen account:

Click Account details missing > Edit account details to see what's missing.

Add the missing details and click Save.

Enter a Description of transaction. This is just the description of the transaction as it'll appear in MYOB, not on any bank statements.

Confirm the Reference number is correct. If not, enter a new number.

Changing the numberingIf you change the reference number, you’ll change the automatic numbering. For example, if you change the number to 000081, the next time you create a bank file the new reference number will be 000082.

Enter the Date of payment. This is the payment date that'll be included in the bank file – it's not the date you recorded the supplier or employee payment.

Future dates (bank files only)If you'll be downloading a bank file to make your payment, you can future date the Date of payment providing it's within the current financial year. This is the date you want your bank to process the payment, but not all banks adhere to future dating bank files. Check with your bank for clarification. If you'll be making a direct payment, the payment will be processed based on when it's authorised—see the FAQs below for details.

Confirm the Description and change if required. This is the description that'll appear on your bank statement.

Select the payments you want to pay electronically.

Choose how you want to process the electronic payment. Learn about these payment methods.

To process a direct payment (see note above about availability) | Click Direct payment. At the confirmation, click Record and submit. The payments will now need to be authorised before they can be paid into your suppliers' and employees' bank accounts. Find out how to authorise electronic payments. Something gone wrong? See Changing or fixing electronic payments or send an email to payments_support@myob.com |

To download a bank file | Click Download bank file. At the confirmation, click Download bank file. The file will be saved in your Downloads folder. Uploading bank files to your bankYou can now upload the bank file to your internet banking site. Most banks provide an online banking portal through which you can upload bank files. Check the help in your online banking software to learn more, or check with your bank for details. You can also search Google for your bank's instructions, e.g. search for "upload aba file ANZ" or "upload bank file westpac", etc.Once you've uploaded the bank file to your bank, they will distribute the payments into your suppliers' bank accounts (after your bank's clearance period). |

FAQs

When will my direct payments be disbursed?

Australia only

If the payment is authorised | At this time | Employee/supplier will receive the money | Employee/supplier will receive the money |

On a business day | Before 6:00pm | Next business day | Second business day after authorising the payment |

On a business day | After 6:00pm | Second business day after authorising the payment | Third business day after authorising the payment |

On a weekend | Anytime | Second business day after authorising the payment | Third business day after authorising the payment |

On a public holiday, special holiday, or bank holiday | Anytime | Second business day after authorising the payment | Third business day after authorising the payment |

Learn more about Authorising and reviewing direct payments

What are the fees for using direct payments?

Australia only

The fees per use are:

Debit card (Mastercard only)

0.1% of the total payment value

Example: if paying $10,000, the fee is $10

Credit card (Visa or Mastercard)

1.5% of the total payment value

Example: if paying $10,000, the fee is $150

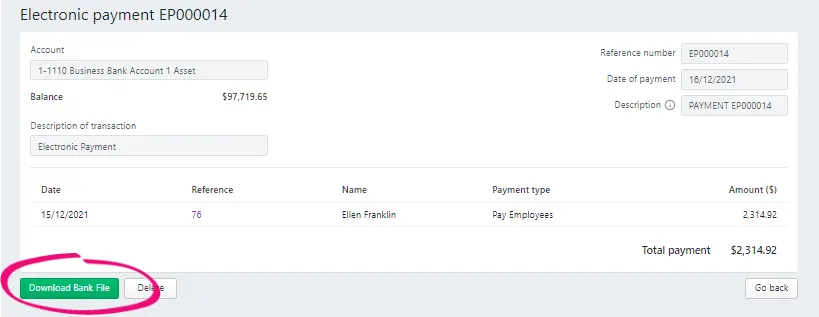

How do I recreate a bank file?

When you create a bank file, it's saved in your Downloads folder. But if you need to recreate it, you'll need to find and open the relevant electronic transaction, then download the bank file again.

Go to the Banking menu > Find transactions > Debits and credits tab.

Use the filters across the top of the Find transactions page to narrow your search. For example, if you're looking for employee payments, choose Payroll in the Source journal field.

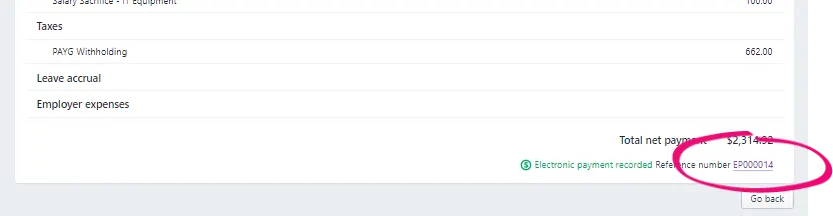

Click the Reference no. to open the transaction.

Within the transaction, click the Reference number again to open the electronic payment:

Click Download Bank File to download the bank file: