If an employee has been injured and can't work, you may be able to continue paying them and claim their wages on WorkCover. The setup described below is generic so might not be applicable in your circumstances.

The worker's compensation rules and obligations may vary from state to state, so it's best to check with your relevant authority for clarification. Also check with your accounting advisor regarding the potential implications of workers' compensation on tax, superannuation or leave obligations. The Fairwork website is a good place to start.

The tasks below describe one way of catering for workers' compensation payments, using the following generic example:

the employer pays the employee whilst they can't work

the employer claims the payments from their insurer, and

the insurer reimburses the employer.

If your scenario is different, you might need help from your accounting advisor about the best way to handle the payments in MYOB.

1. Create two expense accounts

We'll create one expense account to track the payments made to the employee, and another to track the insurer's reimbursement.

Go to the Accounting menu and choose Chart of accounts.

Click Create account.

Select the Detail account option.

For the Account type, choose Expense.

Enter a unique Account number.

Enter the Account name as Wages Paid on WorkCover or similar.

Choose the applicable Tax code for this account. If unsure, check with your accounting advisor.

Click Save.

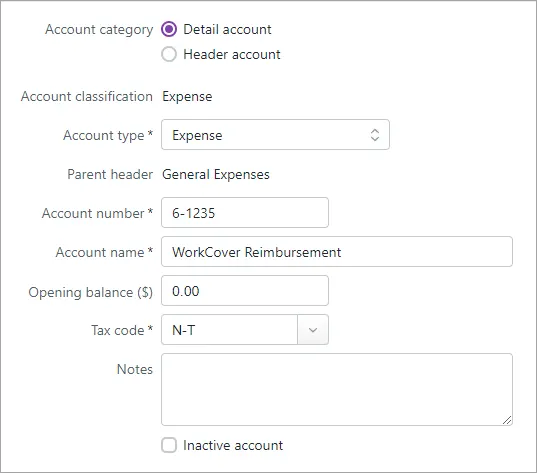

Repeat steps 2 - 8 to create another expense account called WorkCover Reimbursement.

Here are our examples:

2. Create a wage pay item

We'll create a wage pay item to allow payments to be made to the employee. What are pay items?

Go to Payroll menu and choose Pay items.

On the Wages and salary tab, click Create wage pay item.

Enter the Name as Wages Paid on WorkCover or similar.

Choose the applicable ATO Reporting Category. If unsure, check with your accounting advisor or the ATO. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

Set the Pay basis to Salary.

Select the option Override Employee's Wage Expense Account and choose the Wages Paid on WorkCover expense account created above.

Under Employees using this pay item, choose the employees who are receiving WorkCover payments.

Click Save.

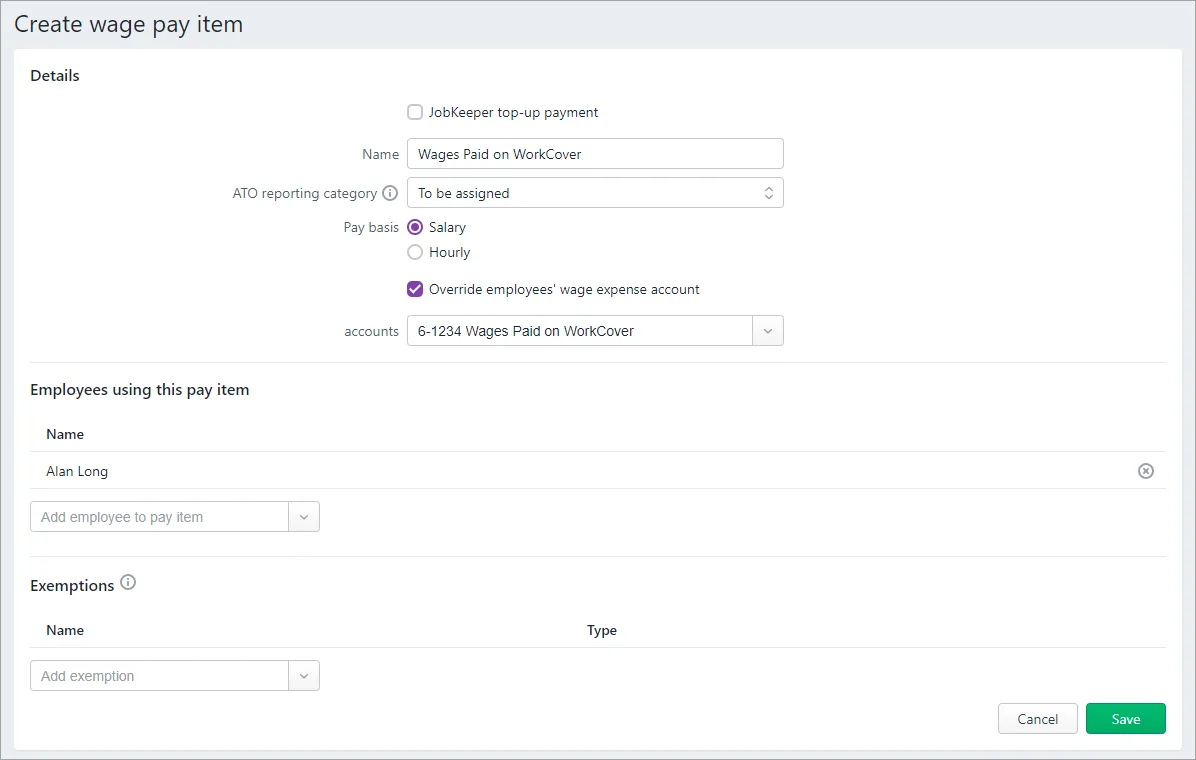

Here's our example pay item:

3. Pay the employee

When you pay the employee, you can now enter their regular wage against the Wages Paid on WorkCover pay item.

Record the employee's pay as normal (Payroll > Create pay run). Need a refresher?

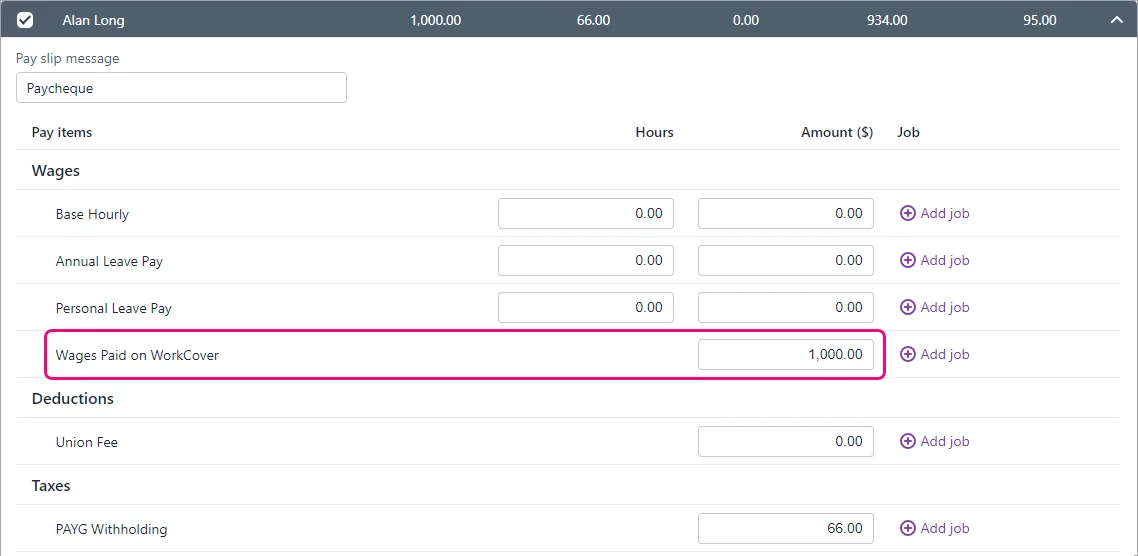

Enter the employee's pay amount against the Wages Paid on WorkCover pay item and ensure the Base hourly or Base salary amount is zero.

Here's our example:

4. Enter the WorkCover reimbursement

When you're reimbursed for the employee's WorkCover payments, you'll enter them using a receive money transaction.

Go to the Banking menu and choose Receive money.

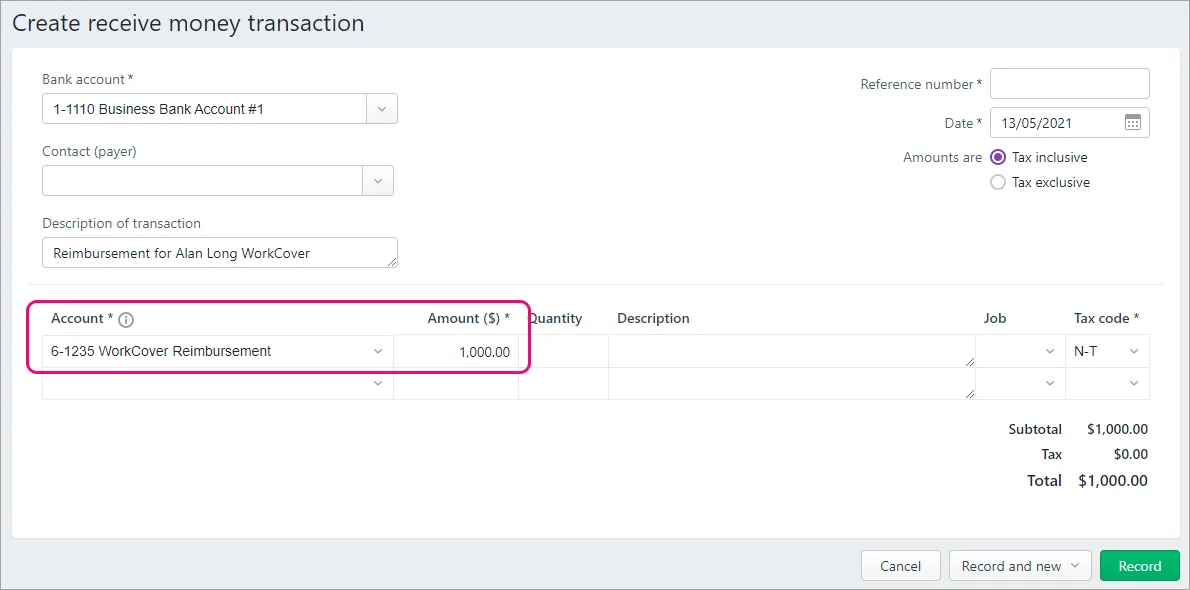

Allocate the amount received from WorkCover to the WorkCover Reimbursement expense account.

Enter an appropriate Description of transaction to explain what the payment is for.

Here's our example:

Click Record.

FAQs

Why do I have a negative balance after creating my expense account for reimbursement?

If you have a negative balance after creating the expense account for reimbursement, this balance will offset against the Wages Paid on WorkCover expense account. This way, you can clearly see how much in wages are paid to the employee and how much you have been reimbursed by WorkCover and easily identify any short fall.