When you terminate an employee, you record the payment in MYOB and notify the ATO about the employee's end date and termination reason in the Single Touch Payroll reporting centre.

But if you've reported an incorrect termination payment or chosen the wrong end date or termination reason for the employee, it's easy to fix.

Start by removing the termination from the Single Touch Payroll reporting centre, then fix whatever was wrong.

OK, let's step you through it.

Removing the termination from the Single Touch Payroll reporting centre

Go to the Payroll menu and choose Single Touch Payroll reporting.

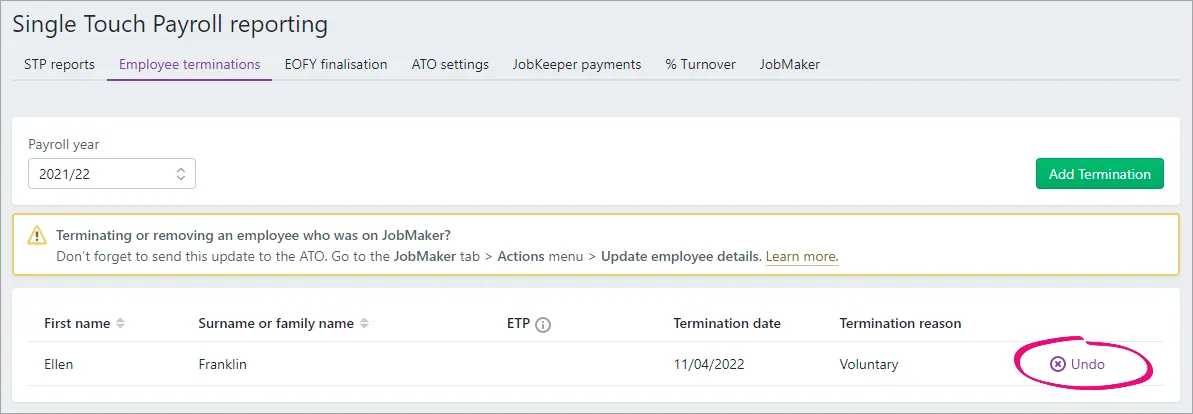

Click the Employee terminations tab.

Choose the Payroll year.

Click Undo for the employee.

When prompted to send your payroll information to the ATO, enter your details and click Send.

This notifies the ATO that the employee is no longer terminated, but doesn't change any termination payments you've reported for the employee. Keep reading to learn more...

What's next?

Simply fix whatever was wrong. For example, if you just need to change the employee's end date or termination reason, click Add Termination on the Employee terminations tab and report the termination again (with the correct details).

But if you need to change something in the termination payment you've recorded in MYOB and reported to the ATO (perhaps an amount was wrong or the wrong pay item was used), you'll need to reverse the incorrect pay, then process the final pay again. If the final pay included an Employment Termination Payment (ETP), learn about fixing an ETP.