You can set all of your report preferences in the one place, so when you run a report it automatically displays just the way you like it.

When you save these preferences, they’ll be applied every time you run a report or export or print it.

Go to the Report settings page (click the settings menu (⚙️) and choose Report settings).

There's two groups of settings on this page:

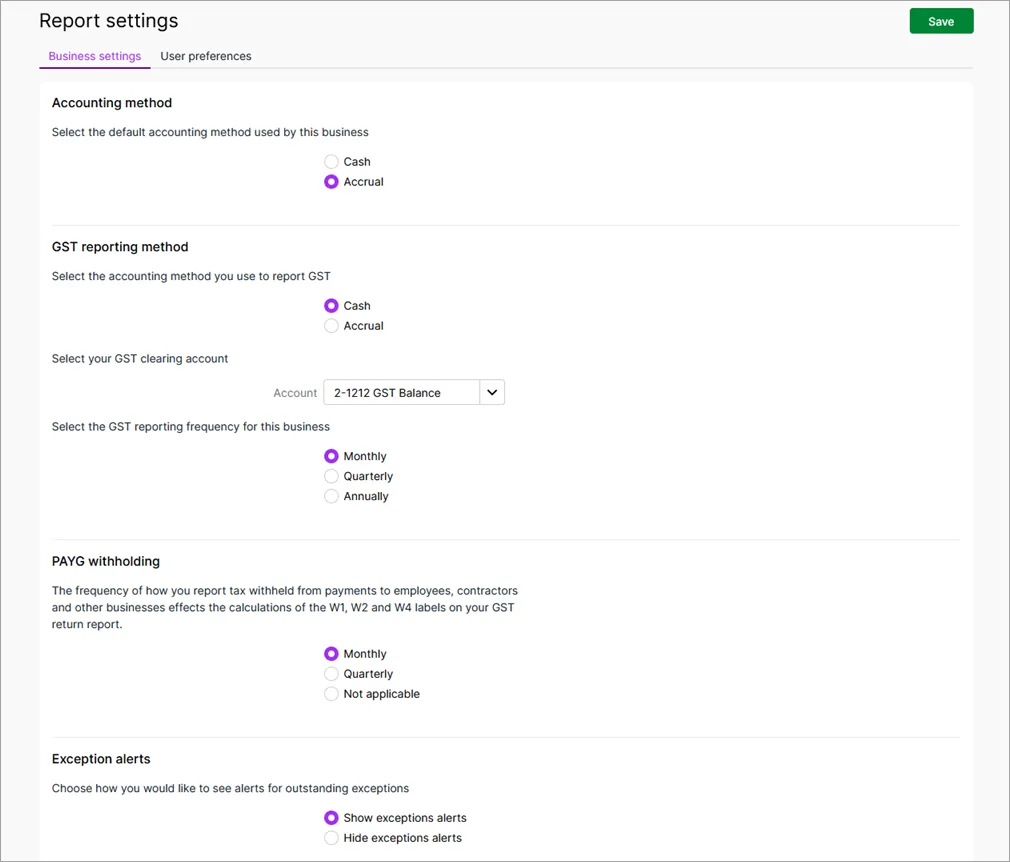

Business settings – select what accounting basis to report on. Any changes you save to these settings apply to all users in the business.

User preferences – select how to present reports. These preferences only apply to you – other users can set their own user preferences.

You can override these default settings when you run reports. To select your report settings

To select your report settings

Click the settings menu (⚙️) and choose Report settings.

Click Business settings and select whether you want to:

report on a cash or accrual basis. If you're not sure what to pick, consult your accounting advisor.

select your GST settings, including the accounting method, GST clearing account, reporting frequency and PAYG withholding frequency. The GST clearing account will be your liability account that temporarily holds funds to be disbursed to the ATO or to IR, such as a GST Balance account. If needed, you can create a separate account for this purpose.

Click Save. Any changes you've made will apply to all users of that business.

Click User preferences and select:

whether you want to include year-end adjustments

how you want to display amounts, accounts and currencies. For example, if you like to see cents included in report amounts, select Cents.

Choose PDF options:

PDF styling. Choose a PDF style template to determine what reports look like when you export them as PDFs

PDF export. Select whether you want reports to open in a new browser tab or whether they are to be downloaded

Report pack template. When you create a report pack, the report pack template you choose will be applied by default. This defines what information is going to be included in the report pack, how it's going to be organised and presented.

Click Save. Your preferences will be applied every time you sign in to this business and run reports.