Hire purchase arrangements are a common feature of small business operations. You'd use them in situations like this:

Example

You purchase a conveyor belt on a hire purchase basis over a period of 3 years (36 months). The price of the conveyor belt is $11,000 ($10,000 plus $1,000 GST) and the term charges are $3,600, so the total loan from the finance company is $14,600.

Note that the tax rates used in this topic are examples only. Ask your accounting advisor about the tax rates that apply to your circumstances.

This example is based on a GST accrual basis.

Here's what you need to do to set up a hire purchase arrangement for the example described above. For help with your hire purchase setup, ask the experts on the community forum.

1. Create a credit card account for the finance company

Go to the Accounting menu and choose Chart of accounts.

Click Create account. The Create account page appears.

Leave the Account category set to Detail account.

For the Account type, choose Credit card.

Choose the applicable Parent header.

Enter a unique 4-digit Account number after the dash. The prefix (the number before the dash) is based on the Account type and can't be changed.

Enter the Account name such as "Hire Purchase - Finance Co" or similar.

Choose the applicable Tax rate. This will depend on your circumstances - check with your accounting advisor if unsure.

Choose the applicable Classification for statement of cash flow. Check with your accounting advisor if unsure. Learn more about the Statement of cash flow report.

Click Save. The new account will be created and you can now create another new account as described in the next task.

2. Create an asset account for the Term Charges

If you're not already on the Accounts page, go to the Accounting menu and choose Chart of accounts.

Click Create account. The Create account page appears.

Leave the Account category set to Detail account.

For the Account type, choose Other current asset.

Choose the applicable Parent header.

Enter a unique 4-digit Account number after the dash. The prefix (the number before the dash) is based on the Account type and can't be changed.

Enter the Account name such as "Term Charges - Conveyor" or similar.

Select the applicable Tax Rate. This will depend on your circumstances - check with your accounting advisor if unsure.

Choose the applicable Classification for statement of cash flow. Check with your accounting advisor if unsure. Learn more about the Statement of cash flow report.

Click Save. The new account will be created and you can now create another new account as described in the next task.

3. Create an expense account for the Term Charges

If you're not already on the Accounts page, go to the Accounting menu and choose Chart of accounts.

Click Create account. The Create account page appears.

Leave the Account category set to Detail account.

For the Account type, choose Expense.

Choose the applicable Parent header.

Enter a unique 4-digit Account number after the dash. The prefix (the number before the dash) is based on the Account type and can't be changed.

Enter the Account name such as "Term Charges - Expense" or similar.

Select the applicable Tax Rate. This will depend on your circumstances - check with your accounting advisor if unsure.

Click Save.

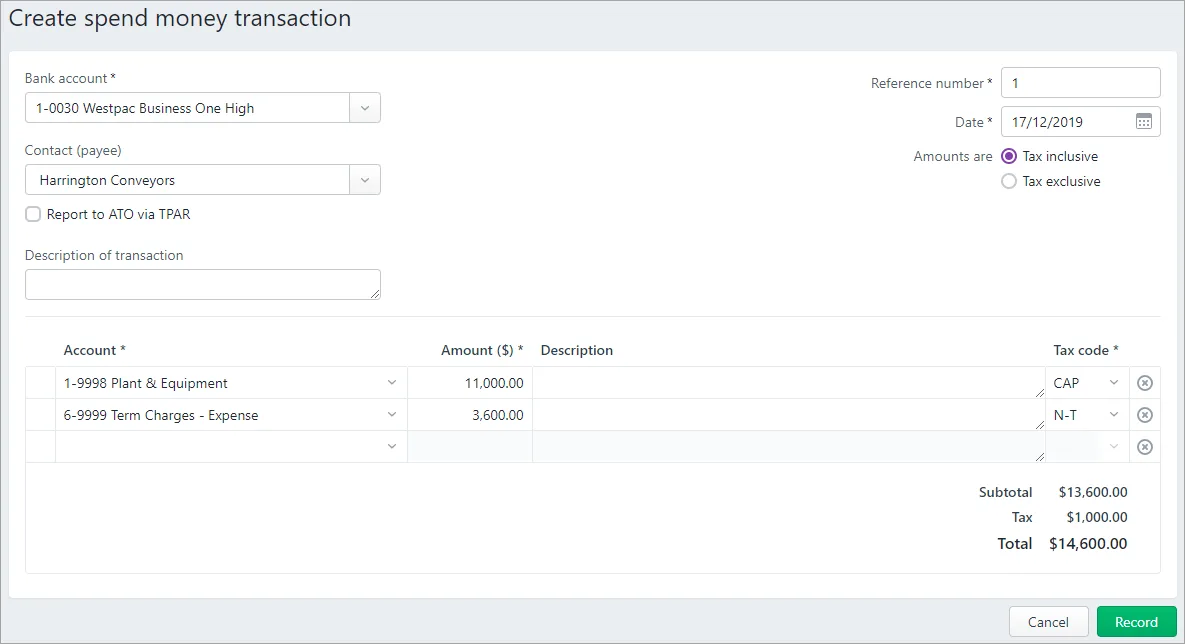

4. Record the initial purchase of the acquisition

On the Banking menu, click Spend money. The Spend Money page appears.

Enter the transaction as shown in the following example. Ensure you use the applicable accounts.

In our example below the equipment being purchased is entered against a 'Plant & equipment' asset account, created to hold the value of business assets. Accounts like this may exist in MYOB by default, or you can create a new one if you need to.

Click Record.

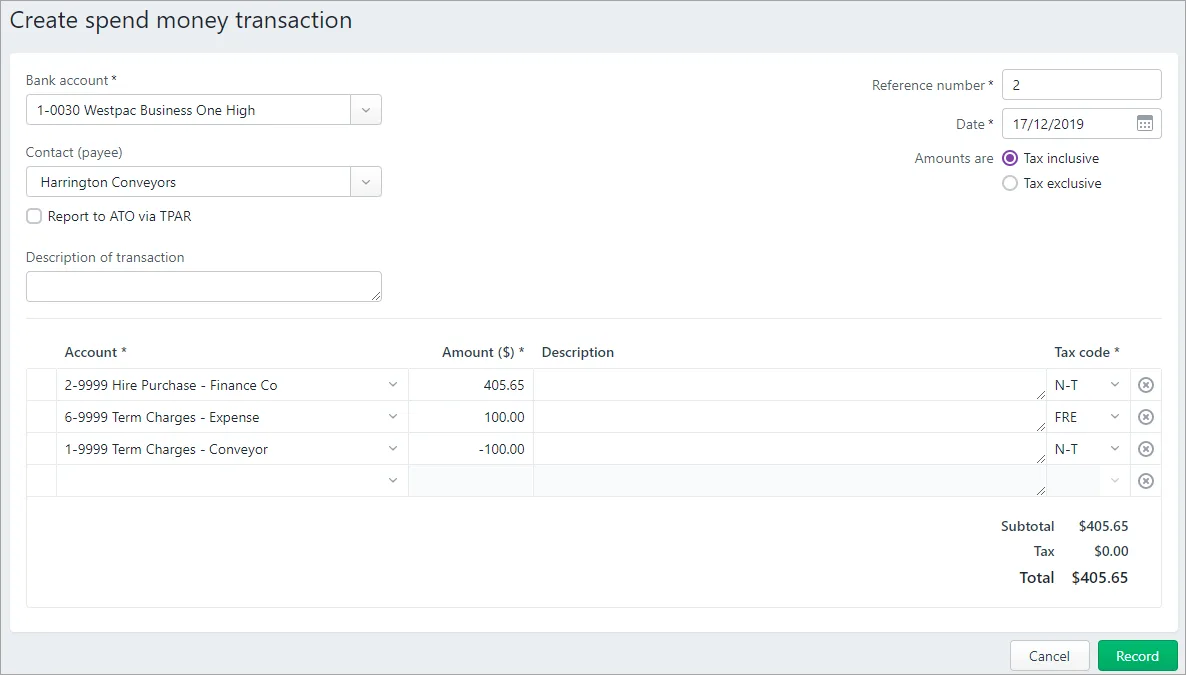

5. Record the periodical payments to the finance company

To determine the periodic amounts to be paid, divide the total purchase price by the total amount of periodical payments. In this example the payment periods are monthly so divide $14,600 by 36 to determine the monthly repayment amount - in this case $405.56.

On the Banking menu, click Spend money. The Spend Money page appears.

Enter the transaction as shown in the following example.

Click Record.