A supplier deposit is a payment for goods or services that you haven't been billed for yet. This means if you make a payment against a purchase order, it's considered a deposit.

Once a purchase order is converted to a bill, payments you apply are just like regular supplier payments.

Setting up MYOB for supplier deposits

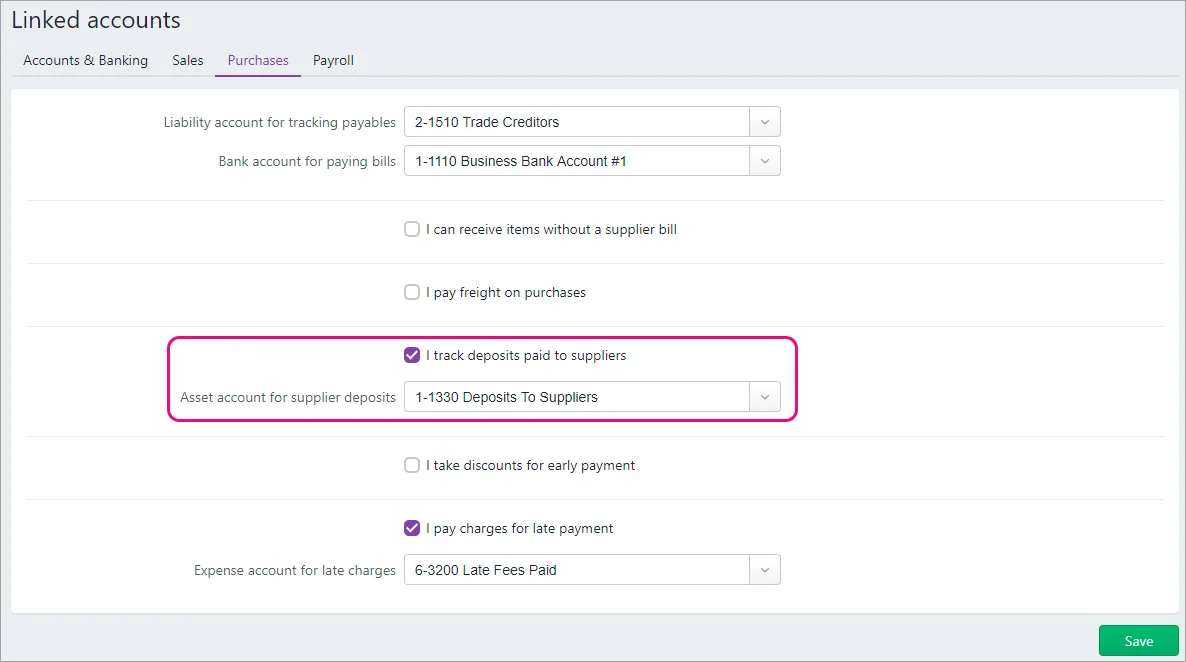

If you want to apply deposits to purchase orders, you'll need to activate an MYOB preference. You'll also need to specify the asset account you want to use to track your supplier deposits.

Why am I doing this?

From an accounting perspective, deposits are different to other supplier payments because you haven't been billed for the goods or services you've ordered. To account for this in MYOB, supplier deposits are posted to an asset account. When you're billed for the things you've ordered and you convert the purchase order into a bill, the deposit is transferred to your trade creditors account.

Activating the supplier deposit preference and specifying the linked asset account ensures this process happens behind the scenes.

Go to the Accounting menu and choose Manage linked accounts.

Click the Purchases tab.

Select the option I track deposits paid to suppliers.

Choose the Asset account for supplier deposits. If needed, you can create a new account for this purpose. Check with your accounting advisor if you're unsure.

Click Save.

Recording a deposit

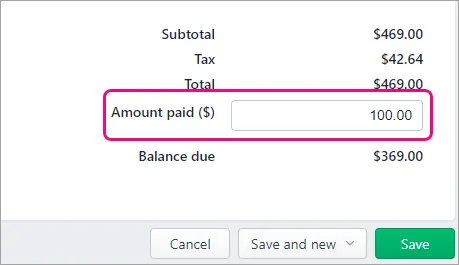

You can record a supplier deposit at the time you create the purchase order or after it's saved.

When creating a purchase order, enter the deposit amount in the Amount paid ($) field.

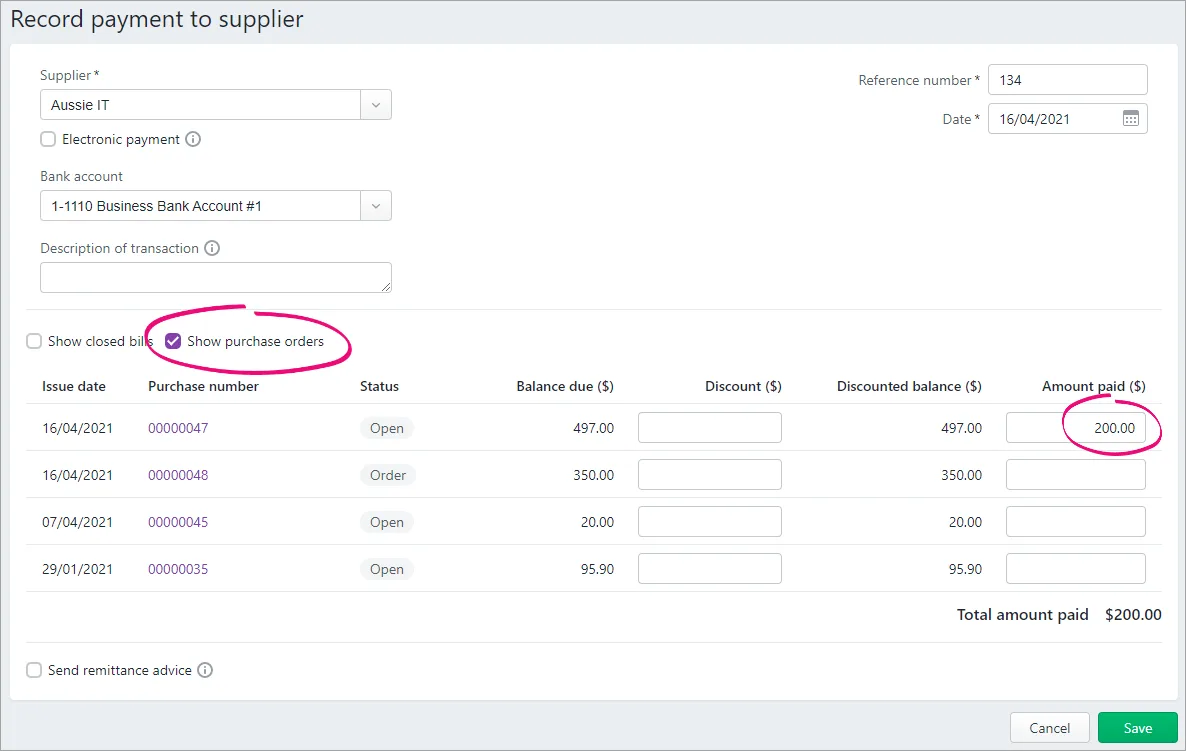

After you've saved a purchase order, and before it's converted to a bill, you can apply a deposit in a similar way to other supplier payments:

Go to the to Purchases menu and choose Create supplier payment.

Select the option Show purchase orders.

Enter the deposit amount against the applicable purchase order.

Click Save.

Deleting a deposit

Because of how a deposit is tracked in MYOB, you generally can't simply delete it. Instead, you'll need to "undo" it. How you do this depends on the purchase order the deposit was applied to.

If the purchase order has not been converted to a bill

Depending on whether or not the deposit is being refunded, here's how to proceed:

If the deposit is being refunded

To account for the refunded deposit, you'll need to create a supplier debit note.

Here's how:

From the Purchases menu, choose Purchase orders.

Click to open the purchase order which has the deposit which is being refunded. If needed, use the filters at the top to help find the order.

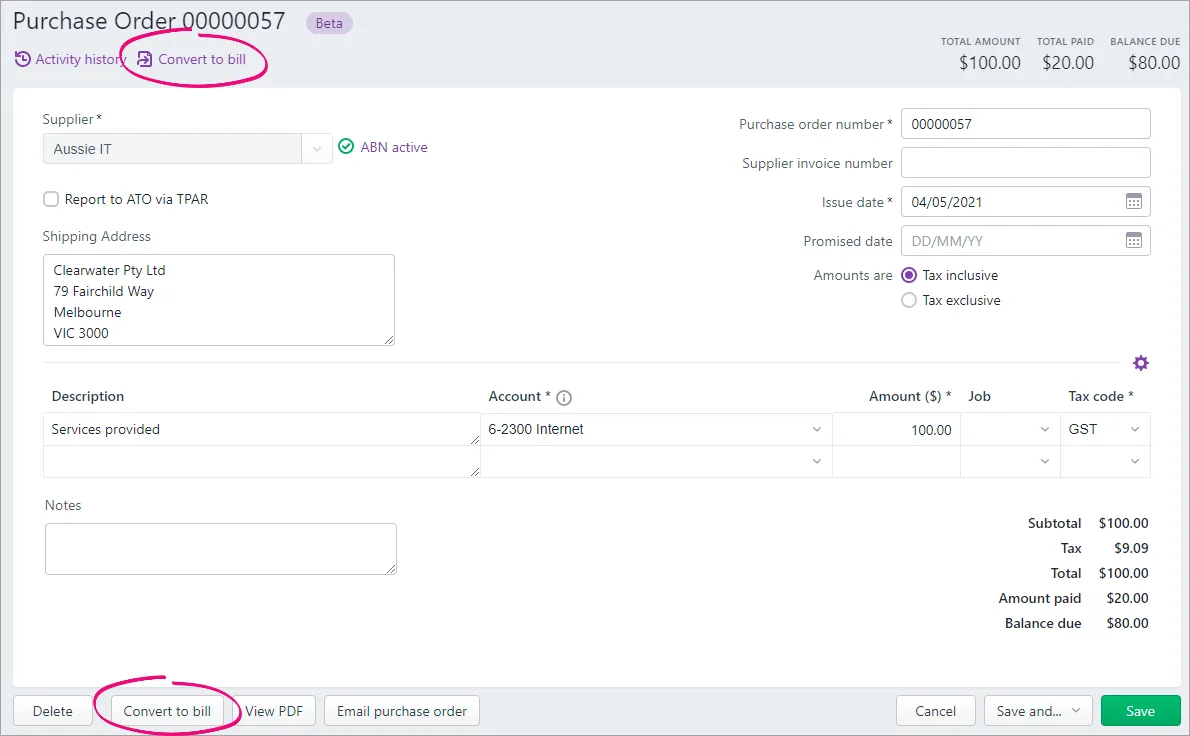

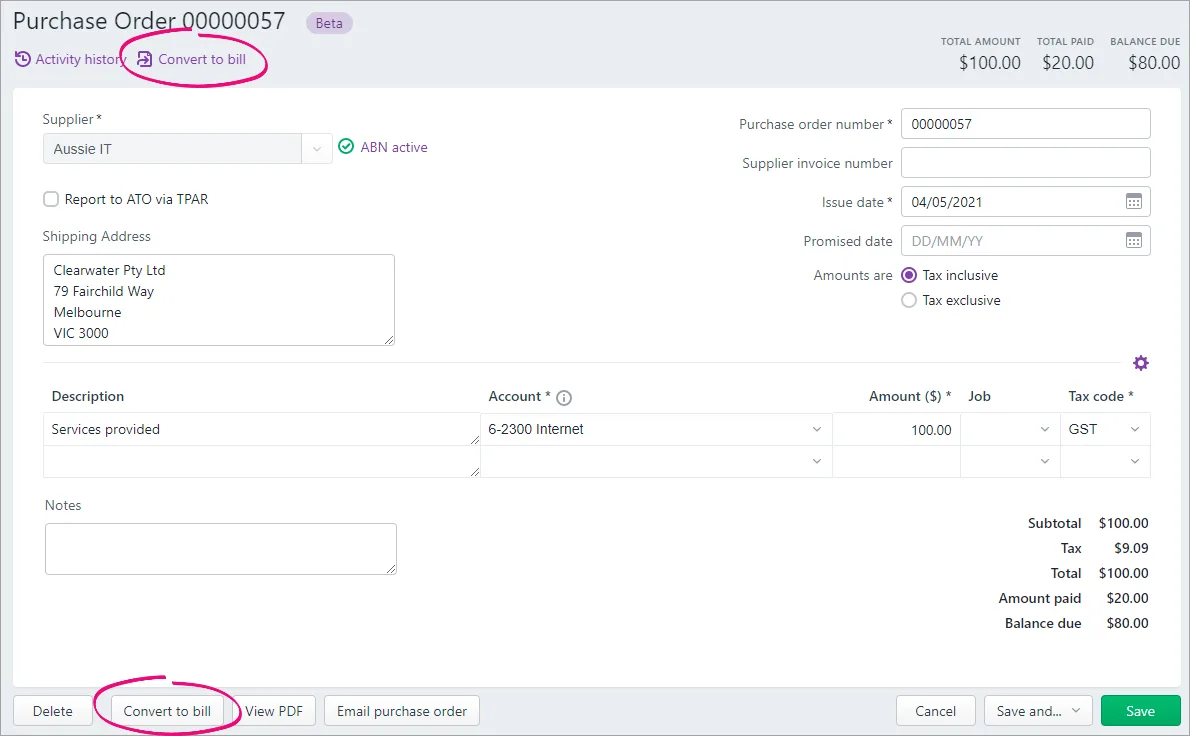

Click Convert to bill at the top or bottom of the order.

The details of the bill are displayed.

Change the bill Amount to zero (0.00).

Click Save.

This will create a supplier debit note (supplier return) for the refunded deposit that you can see via Purchases > Supplier returns. You can then process a refund for this amount or apply it to other bills from this supplier.

If the deposit is not being refunded

Here's how to account for the deposit you've paid so it's reflected as an expense to your business:

From the Purchases menu, choose Purchase orders.

Click to open the purchase order which has the deposit which is being refunded. If needed, use the filters at the top to help find the order.

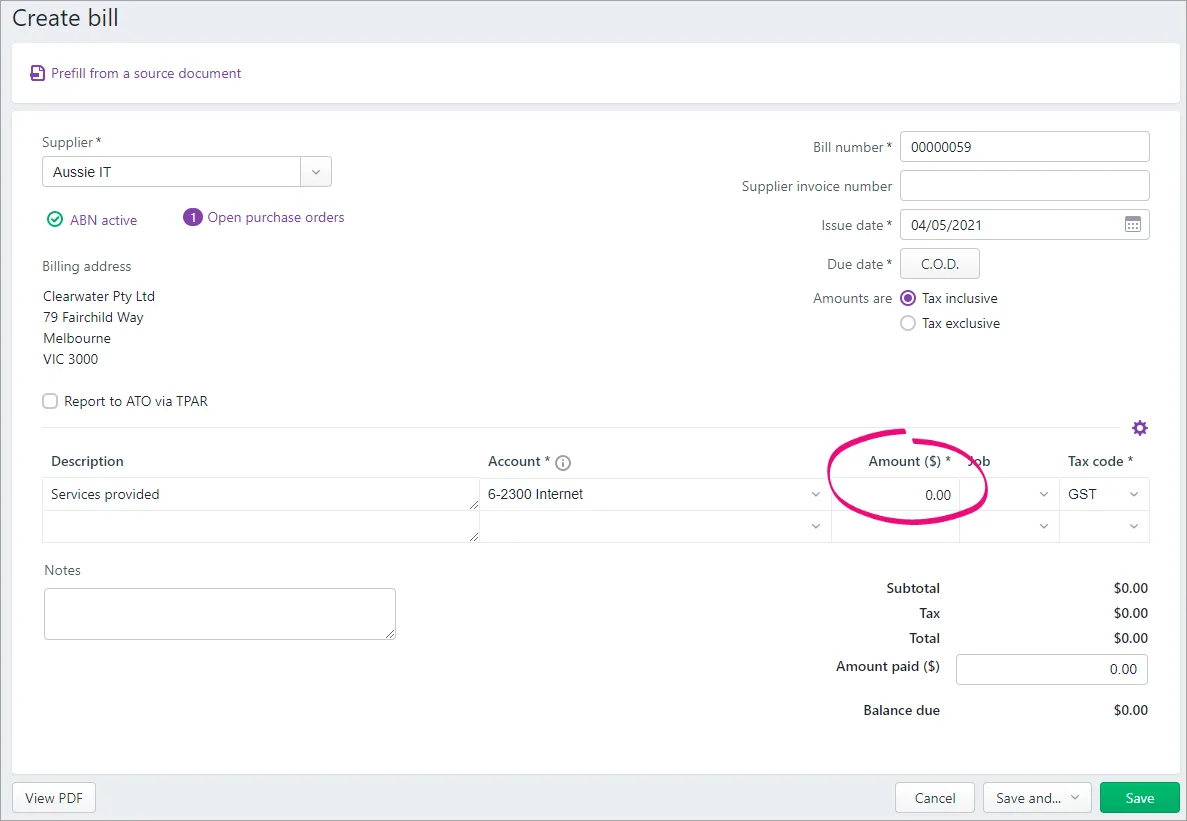

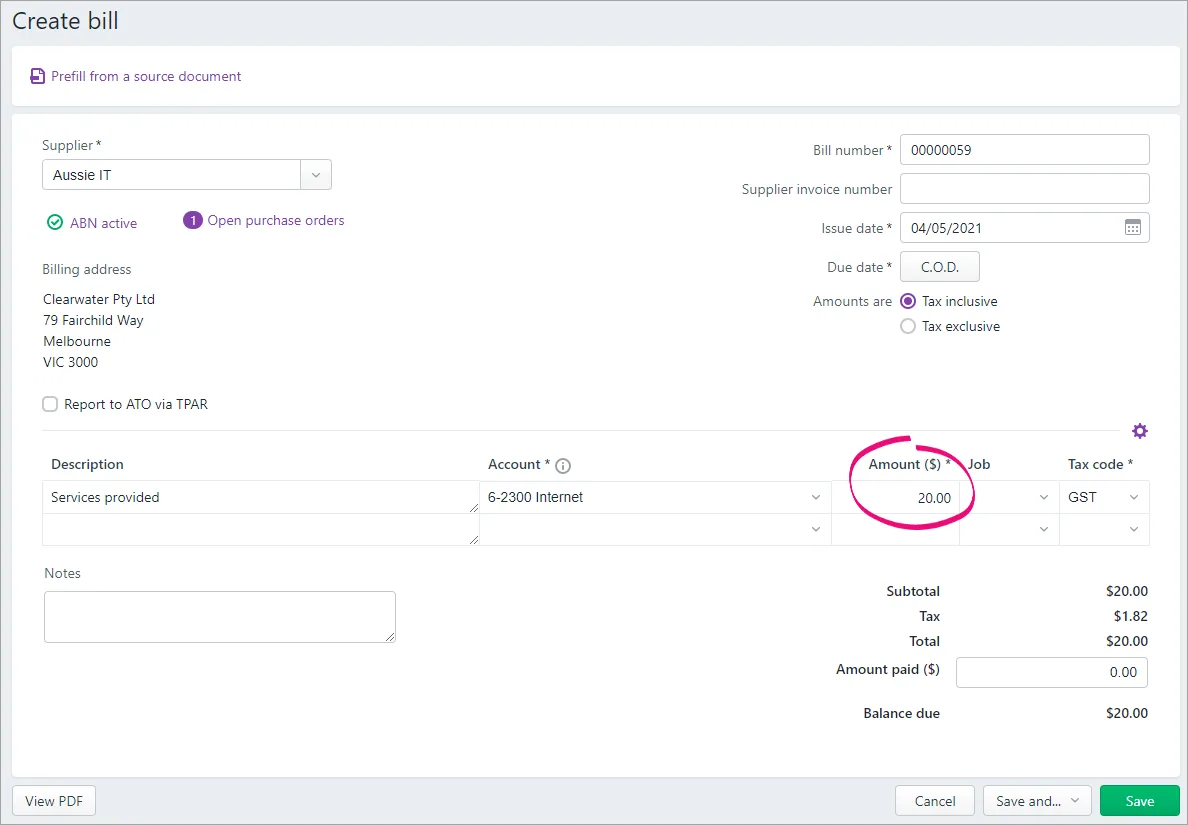

Click Convert to bill at the top or bottom of the order.

The details of the bill are displayed.

Change the bill Amount to the deposit amount. For example, if you paid a $20 deposit, change the bill amount to $20.00.

Click Save. The bill will be closed and the deposit is now recorded as an expense to your business.

If the purchase order has been converted to a bill

Let's say you apply a deposit to a purchase order, convert the order to a bill—then the order is cancelled. What about your deposit?

You'll first need to "undo" the bill by creating a supplier debit for the original bill. You can then settle that debit to close the bill and take care of the deposit.

This ensures:

the deposit can be refunded or forfeited

there's an audit trail of what happened

your MYOB account balances will be correct

your GST reporting will be accurate.

If you need to delete a deposit because the wrong amount has been applied, after completing the tasks below you'll need to create a new purchase order and apply the correct deposit amount.

1. Create a supplier debit for the original bill

By creating a supplier debit (sometimes called a debit note or supplier return) for the original bill, you'll be able to apply that debit to the bill to cancel it out—effectively undoing or reversing it.

From the Purchases menu, click Create bill.

Choose the same Supplier as the original bill.

Select whether the amounts in the original bill were Tax inclusive or Tax exclusive.

Enter a Description, for example "Supplier debit to reverse bill 000123".

Select the same Account as the original bill.

Enter the Amount of the original bill as a negative number. For example, if the original bill was $100, enter -100.00

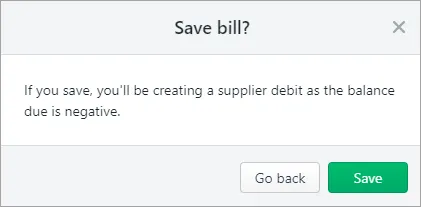

Click Save.

At the following confirmation, click Save.

Now, based on whether or not you're being refunded the deposit, you can settle this supplier debit against the original bill. See below for details.

2a. Settle the debit (if the deposit is being refunded)

You can use the supplier debit you've created to:

settle (close) the outstanding balance of the original bill (minus the deposit amount), and

record the deposit refund.

In this example, the original bill was for $100 and we paid a $20 deposit which is being refunded.

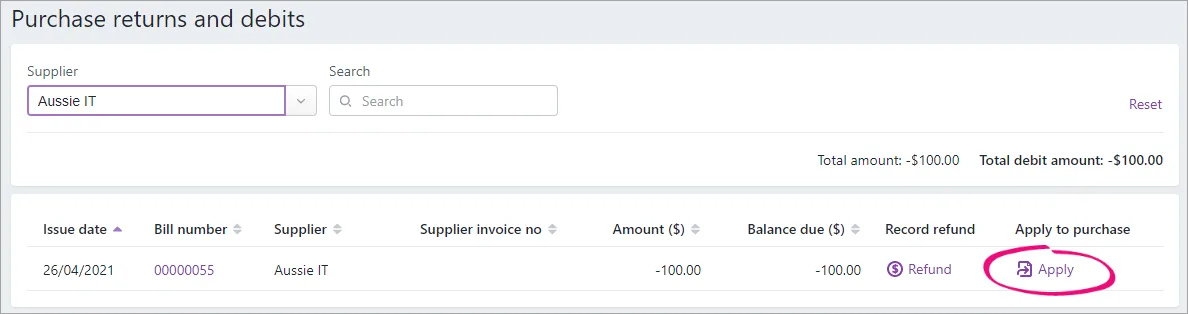

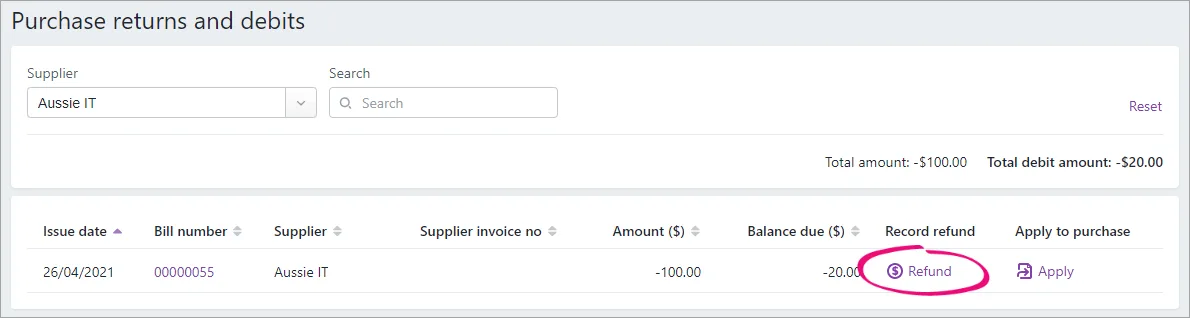

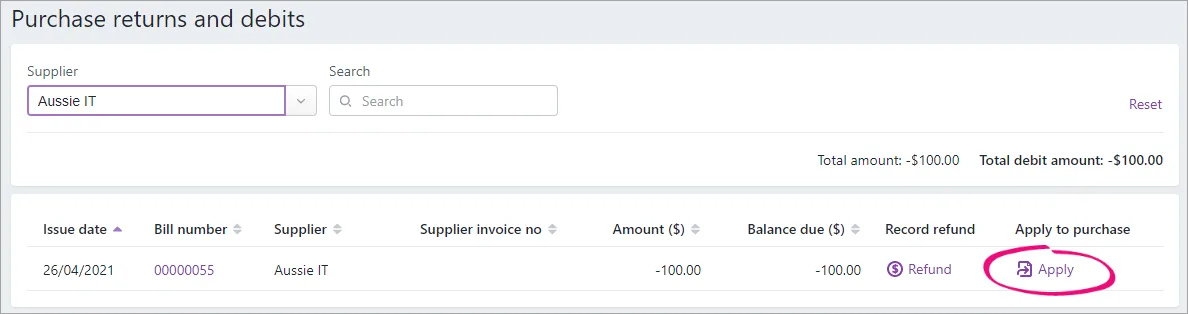

Go to the Purchases menu and choose Supplier returns.

Choose the Supplier you created the debit for.

Click Apply next to the debit to be settled.

In the list of displayed bills, find the original bill. The outstanding balance will be the amount of the original purchase order minus the deposit.

In the Amount applied field for the original bill, enter the amount left owing on the bill.

Click Record. This settles (closes) the bill and leaves a debit balance equal to the value of the deposit.

Click Refund next to the remaining debit amount.

Choose the Bank account the refund is being paid into.

Click Record. This refunds the deposit and settles the remaining balance of the supplier debit.

2b. Settle the debit (if the deposit is not being refunded)

If the deposit is non-refundable, you need to:

create a bill for the deposit amount (to account for the payment of this money to the supplier), then

apply the supplier credit you've created to:

close the deposit bill, and

settle the outstanding balance of the original bill (minus the deposit amount)

In this example, the original bill was for $100 and we paid a $20 deposit which is not being refunded.

Create a bill for the deposit amount

Record a new bill (need a refresher?) and use the following details:

Choose the same Supplier as the original bill.

If your business operates on a GST accrual/invoice basis, make sure the Date is in the same GST reporting period as when the purchase order was converted to a bill.

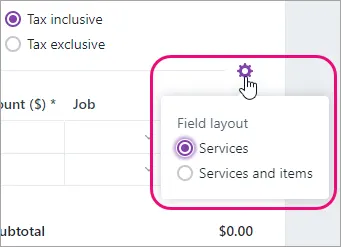

Use the Services field layout

Enter a Description which describes the transaction, such as Non-refundable deposit for order XXXX

For the Account, choose the original account number from the original order/bill.

For the Amount, enter the deposit amount.

Apply the supplier debit

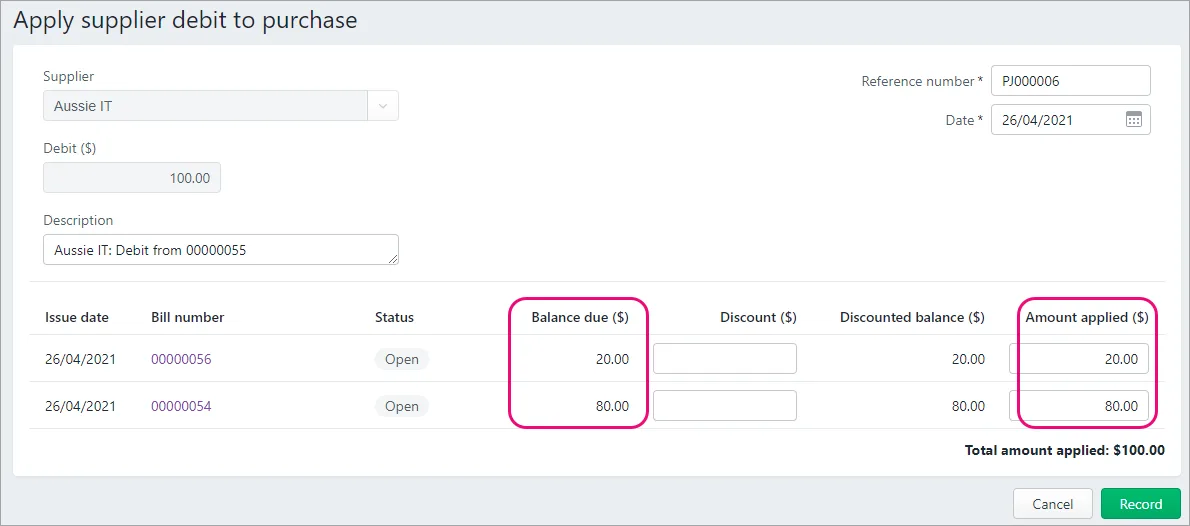

Go to the Purchases menu and choose Supplier returns.

Choose the Supplier you created the debit for.

Click Apply next to the debit to be settled.

In the list of displayed bills, find the bill you just created for the deposit amount, and the original bill.

In the Amount applied field for the deposit bill, enter the deposit amount. In our example this is $20.

In the Amount applied field for the original bill, enter the amount left owing on the bill. In our example this is $80.

Click Record. The debit is applied across the deposit bill and the original bill—closing them both.

FAQs

What happens to a deposit when the order is converted to a bill?

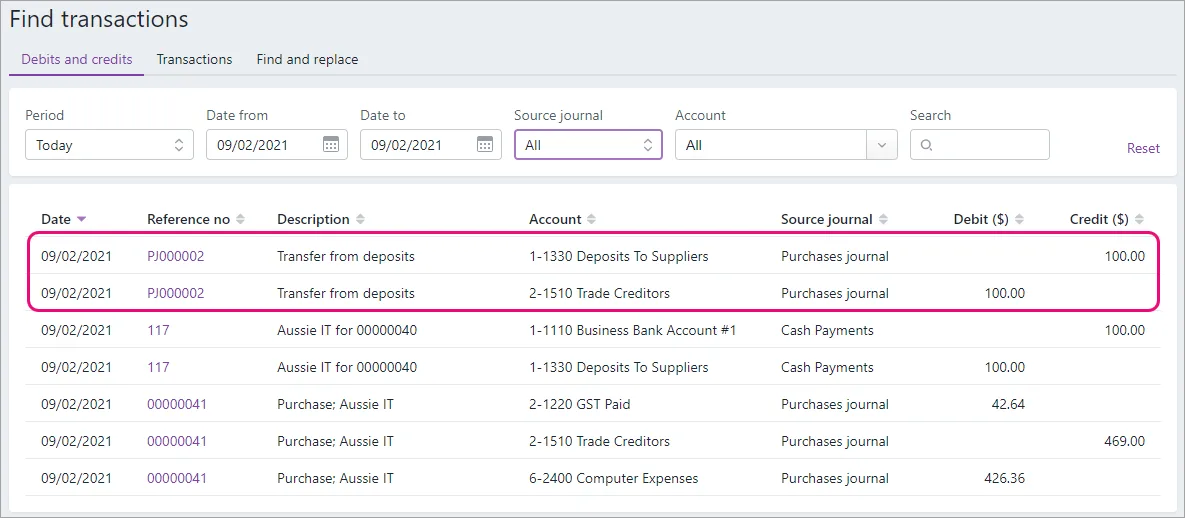

When a deposit is paid for a purchase order, the deposit amount is typically posted to an asset account. When the purchase order is converted to a bill, MYOB needs to transfer the deposit amount from the applicable account and post it to your trade creditors account. This will appear in your transaction journal as a Transfer from deposits.

This example shows what a $100 deposit looks like on the Find transactions page after the order has been converted to a bill: