Who doesn't like receiving a discount?

If a supplier offers you a discount (woo-hoo!) you can record it when paying the bill.

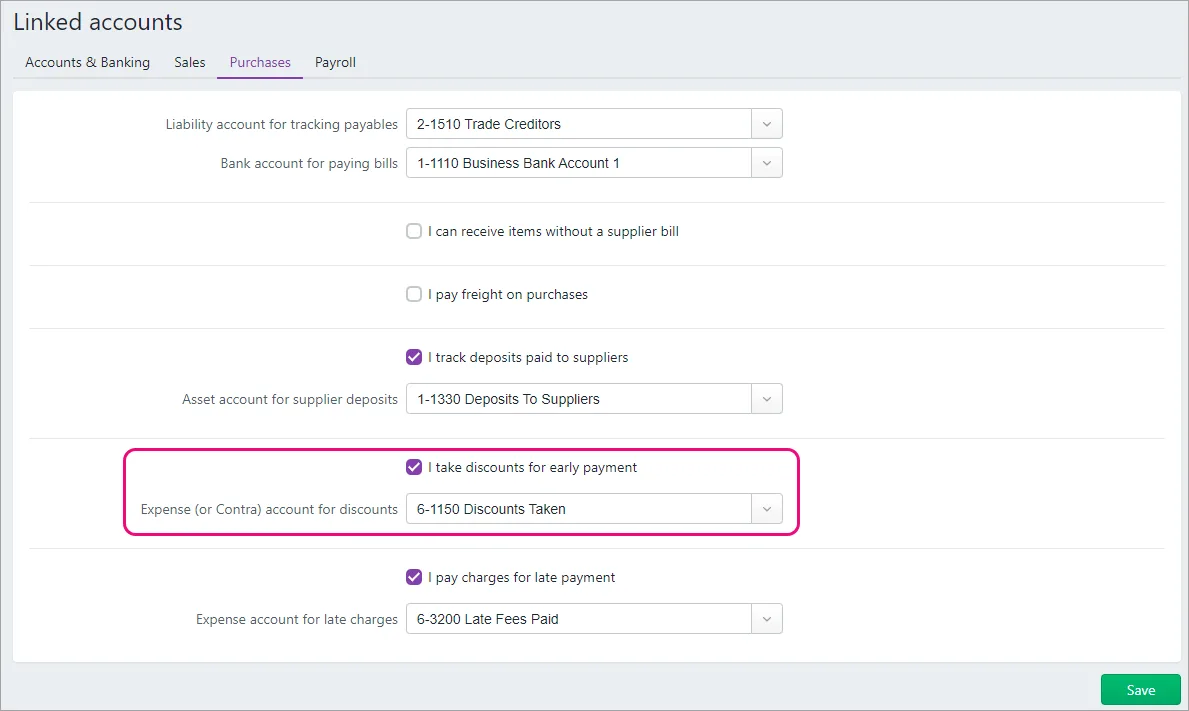

To be able to record discounts against your bills or supplier payments, you'll need to set an account in MYOB for tracking those discounts.

Set an account for supplier discounts

To add discounts to bills and supplier payments, you'll need to turn on a preference in MYOB. You'll also need to choose the linked account you want to use to keep track of your supplier discounts.

Go to the Accounting menu and choose Manage linked accounts.

Click the Purchases tab.

Select the option I take discounts for early payments.

Choose the Expense (or Contra) account for discounts. If needed, you can create an account for this purpose. If you need help choosing an account or setting one up, check with your accounting advisor.

Click Save.

Recording discounts

You can apply a discount when you're making a payment on a bill or when you're creating the bill.

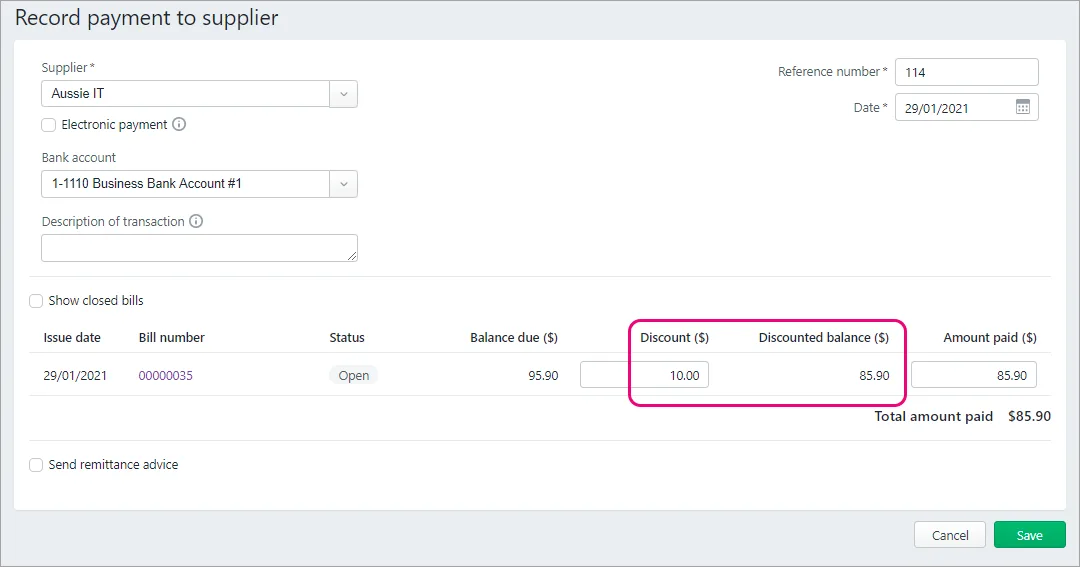

Add a discount when recording a supplier payment

If you've already created a bill, you can enter a discount when you're making a payment against that bill, such as a "pay on time" discount.

When you're entering the supplier payment (Purchases menu > Create bill payment), enter a Discount ($) amount. The Discounted balance ($) will update automatically.

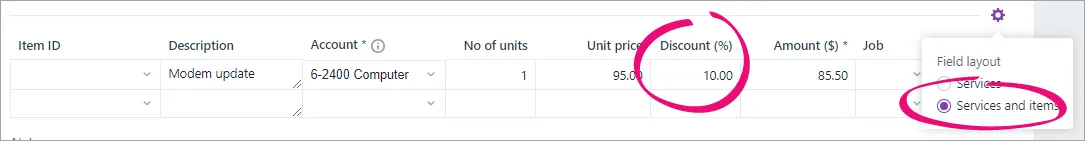

Add a discount % on a bill

When you're creating a bill (Purchases menu > Create bill), use the Services and Items layout on the bill. You can then add a Discount (%) to one or more lines in the bill.

You can use this method if you're buying items or services. If you're buying a service, you'll need to enter figures in the No of units and Unit price columns in order to generate the discount.

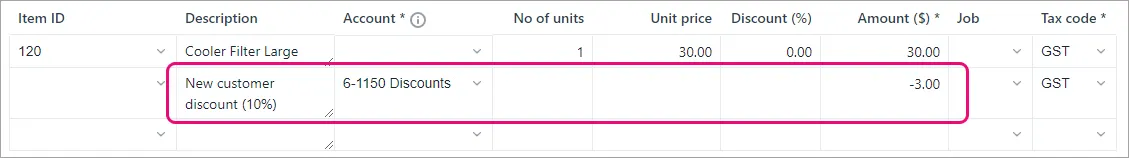

Add a separate discount line on a bill

When you're creating a bill (Purchases menu > Create bill), you can add a separate line to the bill for the discount.

Use the Description column to provide some details, and enter the discount as a negative amount. Allocate the discount to the applicable discounts taken account—this will likely be the same as the linked account you've set up for your supplier discounts (see above for details). Check with your accounting advisor if you're not sure which account to use.

FAQs

Why am I seeing the message "Set a linked account for taking discounts"?

You'll see this message when applying a discount if you haven't set an account to track you supplier discounts. See 'Set an account for supplier discounts' above for details.

Can I use an item with a negative value for supplier discounts?

No. You'll get an error if you try to use an item with a negative selling or buying price in a bill.

In older versions of MYOB Essentials, you could create an item with a negative price and use it to create discounts in bills.

To record a supplier discount on a bill in this version of MYOB, you can use the Discount (%) column (when you use the Services and items bill layout) or add a separate line with a negative figure in the Amount ($) column, as described above.